Types Of Gold Coins To Buy For Investment

Investing in gold coins can be a great way to diversify your portfolio and protect your wealth.

Gold coins come in many different sizes, designs, and grades, making it important for investors to understand the differences between them before investing. Each coin comes with its own set of advantages and disadvantages.

Be sure to read until the end of the article to find out our for the best 6 gold coins to buy for investment.

By providing an overview and understanding of the various types of investment grades, popular gold coins available, size considerations, premiums and storage, calculating value, and purchase options associated with each type of coin, you can make an informed decision that will best suit your investment needs.

Overview

Gold bullion coins provide investors with liquidity and flexibility as well as the potential for long-term gains. However, not all gold coins are suitable investments: some may have higher premiums due to additional minting costs or other factors. It’s important to consider the quality and rarity of each coin before investing.

As we will elaborate on later, some popular gold coins include the Gold American Eagle, American Gold Buffalo, South African Krugerrand, Canadian Gold Maple Leaf, Gold Britannia, Austrian Gold Philharmonic, Australian Gold Kangaroo, Chinese Gold Panda, Gold Somalian Elephant, and Gold Mexican Libertad.

Of these 10 popular coins for investment purposes, the one-ounce is the most common size among investors. Some investors prefer bars due to their larger size and lower premiums. However, if you’re working with a smaller budget or have limited storage space, then gold coins are often the better choice.

The value of any pure gold coin is calculated by multiplying its weight or gold content by the current price of gold in that currency at any given time. This makes it an easily trackable asset class.

When investing in physical gold, it’s also important to factor in additional costs such as premiums paid when purchasing the metal from dealers or online sources, storage charges, and insurance fees, which can add up quickly over time.

While physical gold does not offer a passive source of income like stocks or bonds do, it has proven itself to be a reliable long-term hedge against inflation during periods of economic uncertainty.

Investment Grades

Knowing the investment grade of gold coins is essential for making profitable investments. To ensure you’re buying quality gold coins, it’s important to consider their condition, weight, purity, and mintage.

Here’s a closer look at what makes up an investment-grade gold coin:

- Condition – Gold coins should be uncirculated or in near-perfect condition. Any signs of wear and tear can significantly reduce the value of a coin.

- Weight – The most popular size among gold coin investors is one ounce; however, there are other sizes available, such as half-ounce and quarter-ounce coins. Before investing in any size other than one ounce, be sure to do your research on its current market value.

- Purity – Most gold bullion coins have a purity level of .999 or higher, which means they are 99.9% pure gold. This ensures that your investment will maintain its value over time as purer forms of gold are more resistant to tarnishing or depreciation from natural elements and wear and tear over time.

- Be sure to also check the mintage year before investing. The newer the mintage year, the more likely you’ll see an increase in value over time due to rarity and uniqueness factors associated with modern minting processes compared to older ones. The popularity of certain designs can also affect their worth, so it pays to know which designs are trending in various markets before investing in them for long-term gains.

Popular Coins

There are several popular coins to choose from based on their uniqueness, rarity, design, and value. Popular gold coins include Gold American Eagle, American Gold Buffalo, South African Krugerrand, Canadian Gold Maple Leaf, Gold Britannia, Austrian Gold Philharmonic, Australian Gold Kangaroo, Chinese Gold Panda, Gold Somalian Elephant, and Gold Mexican Libertad. See our list below of our top 6 gold bullion coins to invest in.

One-ounce is the most popular size among gold coin investors due to its liquidity and flexibility. To re-iterate, gold bars are better for investors with larger budgets as they have lower premiums compared to gold coins. However, gold coins offer a more compact form of storage that could fit in safes or smaller boxes.

These coins can easily be purchased online or from local dealers and pawn shops at a good price depending on market conditions. It is important to note that short-term prices can be highly volatile which may lead to losses for investors, so it’s best approached as a long-term strategy rather than short-term gain.

Size Considerations

When it comes to gold coins, size matters: one ounce is the most popular among investors due to its liquidity and flexibility. A one-ounce coin can be easily stored in a safe or smaller box, while larger gold bars are better for investors with bigger budgets.

Gold coins also come with varying designs and sizes that add collectability and increase demand from buyers. However, potential investors should keep in mind that short-term prices of gold can be highly volatile, which may lead to losses if not done correctly.

Therefore, careful research into individual coins before investing is recommended, as certain bullion coins offer better returns than others based on rarity, popularity among collectors, etc.

There are also 1-gram sizes of gold coins and bullion that are available if you are looking to start investing more modestly.

Investors should also factor in additional costs associated with physical gold, such as storage charges, insurance fees, and premiums, when calculating their return on investment.

Ultimately, these factors will help determine whether a smaller one-ounce coin or a larger bar is the best choice for an investor’s budget and goals.

Premiums and Storage

Investing in gold coins comes with additional costs, such as premiums and storage charges, so it’s important to consider these factors when deciding which type of coin is right for you.

A premium is a markup charged by the dealer over the spot price of gold. The size of the premium depends on the rarity and condition of the coin.

Storage charges can also add up if you don’t store your coins securely, so it’s important to choose a secure storage option such as a safe or bank deposit box. Here are three things to keep in mind when considering premiums and storage:

- Popular one-ounce gold coins typically have higher premiums than other sizes because they are more widely traded and easier to liquidate quickly.

- Gold bars usually have lower premiums than gold coins due to their larger size but require more secure storage options and may not be suitable for smaller investors with limited budgets.

- When choosing a secure storage option, make sure that it meets insurance requirements for theft or fire protection and has adequate security measures in place.

It’s important to understand how premiums and storage fees affect your investment before purchasing any gold coins or bars, so that you can make an informed decision about what type of investment is best suited for your needs and budget.

To address these concerns, working with a reputable gold investment company that deals in volume and can provide the most competitive prices and lower fees is key.

Gold IRAs, more specifically, provide a tax-advantaged means of owning physical gold and address these concerns without eroding the gains from your investment.

To learn more about how gold investing can protect your long-term wealth and the advantages of tax-deferred gold IRAs, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Calculating Value

Again, the value of a gold coin is determined by multiplying its weight or gold content by the current market price, making it an attractive asset with the potential for high liquidity.

Although there is no guarantee of profits when investing in physical gold, its scarcity and high demand make it a popular investment choice for those looking for a long-term hedge against inflation.

Additionally, since prices of gold can be volatile over short periods of time, investors should research the historical performance of any asset before investing and understand that there is always risk involved, regardless of what type of investment they choose.

Due to its flexibility and potential for high liquidity, investing in gold coins can be an attractive option for many investors; however, it’s important that they understand the risks associated with investing in physical gold as well as calculate the value based on current market prices before making any investments.

With careful research and due diligence on the part of the investor, buying gold bullion can potentially lead to positive returns over time.

Best 6 Gold Coins To Buy For Investment

Which gold coin should I invest in?

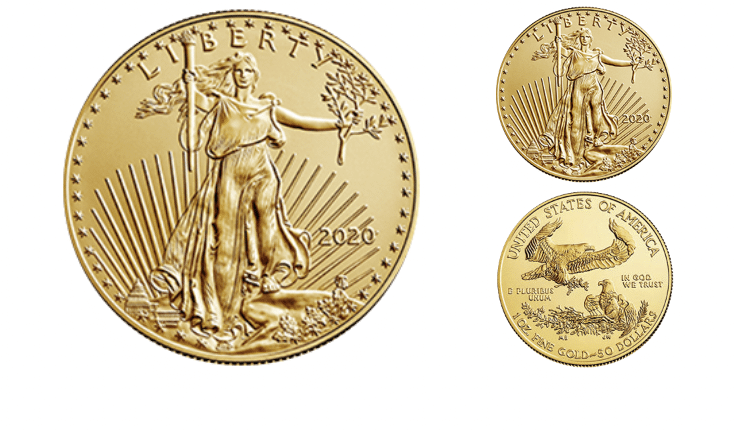

- American Gold Eagle: The American Gold Eagle is one of the most recognized gold coins worldwide. It contains 1 troy ounce of gold and is backed by the United States government. These coins are highly liquid and easily traded.

- Canadian Gold Maple Leaf: The Canadian Gold Maple Leaf is another popular choice among investors. Produced by the Royal Canadian Mint, these coins are known for their purity and fine craftsmanship. They also come in various denominations, including 1 ounce, ½ ounce, ¼ ounce, and 1/10 ounce.

- South African Krugerrand: The South African Krugerrand was the first modern gold bullion coin introduced in 1967. It contains exactly one troy ounce of gold and is alloyed with copper for added durability. Krugerrands are widely recognized and traded internationally.

- Australian Gold Kangaroo/Nugget: Produced by the Perth Mint, the Australian Gold Kangaroo (previously known as the Gold Nugget) is a popular choice for investors. These coins feature iconic Australian wildlife designs and come in various sizes, including 1 ounce, ½ ounce, ¼ ounce, 1/10 ounce, and 1/20 ounce.

- Chinese Gold Panda: The Chinese Gold Panda is issued by the People’s Republic of China and is known for its annually changing designs featuring pandas. These coins come in different sizes, ranging from 1 ounce to 1/20 ounce. Note that prior to 2016, the Chinese Gold Panda coins followed the metric system (e.g., 1/20 ounce, 1/10 ounce, etc.) rather than troy ounces.

- British Gold Britannia: The British Gold Britannia is a popular choice for investors due to its historical significance and beautiful design. These coins are produced by the Royal Mint and contain 1 troy ounce of gold. They are also legal tender in the United Kingdom.

Purchase Options

When investing in gold coins, you clearly want a trusted source. Options range from a dealer or pawn shop, online store, or through a gold IRA from an established company such as Augusta Precious Metals, Birch Gold Group, American Hartford Gold, or Noble Gold Investments. These companies provide competitive prices, buyback guarantees, dedicated customer service, and secure storage options.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Conclusion

You’ve done your research and now know the types of gold coins that are available for purchase, their advantages and disadvantages, and how to calculate their value.

Investing in gold coins can protect against inflation and is a great way to diversify your portfolio. Whether you choose to invest in bars, coins, or rounds, make sure you understand all the risks associated with it before making your purchase.

With careful consideration of premiums, storage options, size specifications, and quality standards, you’ll be able to select the right gold coin for your investment needs. Don’t forget to compare prices between different dealers to ensure you get the best deal possible!

Historically, precious metals have served as wealth insurance during turbulent economic times. To learn more about silver and gold investing, see the links below to access the free investment guides from the best gold IRA and precious metals investment companies that we have thoroughly researched.

To reiterate, as an investor, you want the most trusted source possible as well as the best prices. You will be building a long-term relationship with whatever gold investment company you choose.

For this reason, we have also detailed each company’s culture and core values. See our list of the top gold IRA companies and find the right company for your needs.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect and want to take advantage of the best prices, attend a gold educational webinar hosted by Augusta Precious Metals. Tap the button below:

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com