How Much Do I Need to Start Investing in Gold? Ask Successful Investors – Part 1

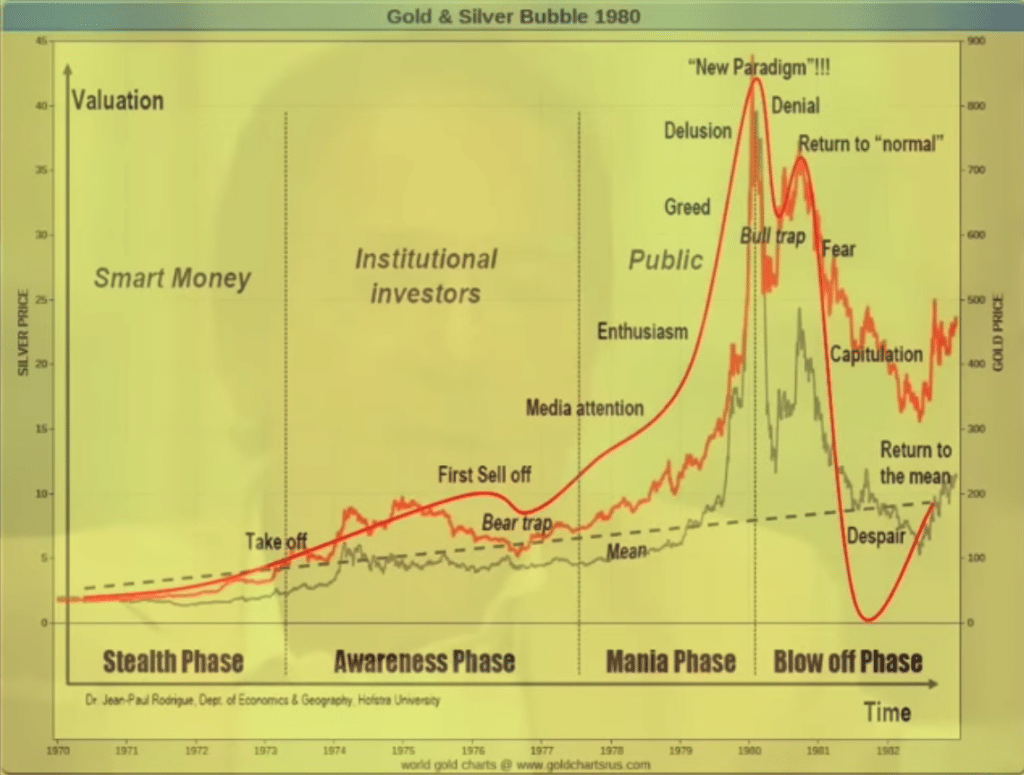

Chart and information available courtesy of Bloomberg and Tavi Costa and Crescat Capital

A constant question when investing in gold is ‘How much do I need to allocate to start investing in gold’. The general rule for inflation hedging and asset loss is an allocation of 10% of one’s investments should be allocated to gold and precious metals.

However, this gold allocation amount can vary depending on who you ask. Also, the larger economic milieu will also dictate how much, at any one time, a person should be allocating to gold, as a percentage of their investment portfolio.

In this article, we will discuss some gold allocation examples from popular and successful investors. As the adage goes, ‘success leaves clues’.

Kyle Bass

Kyle Bass is an American investor and founder of Conservation Equity Management and Hayman Capital Management, has publicly stated that he has allocated around 10% of his portfolio to gold as a hedge against currency debasement and political risk.

Nicknamed the prophet of Wall Street Doom, Bass is best known for successfully predicting and effectively betting against the U.S. subprime mortgage crisis of 2008, by purchasing credit default swaps on subprime securities which, in turn, increased in value when the real estate bubble burst.

When asked by Michael Lewis, the author of The Big Short and Moneyball, “What do you tell your mother, when she asks you where to put her money?”, Bass simply said “Guns and gold”.

Gold is considered Kyle Bass’ favorite investment. And given his aptitude for making market predictions, it may be wise to follow his lead.

John Paulson

The billionaire investor is known for making a fortune by betting against subprime mortgages during the 2008 financial crisis. He has been a vocal supporter of gold,as a defensive investment and has allocated up to 30%, of his funds to gold in the past.

Paulson states that gold has the potential to go ‘parabolic’ due to its limited supply and increased demand when quantitative easing re-starts.

It is worth noting that when the Federal Reserve has pivoted in the past, as they do when there is a systematic break in the economy, this does not coincide with a re-emergence of a bull market. History has repeatedly shown that the equity market is in a major downturn, or correction to be kind when this takes place. Short-term to long bond yields are in rapid flux. This is where gold comes in as a portfolio stabilizer.

Gold is easy to buy and sell, has a track record for returns over the long term, and is valued by investors all over the world. Precious metals act as a great way of balancing out the risk that comes with your portfolio of other investments.

Ray Dalio

American billionaire investor, hedge fund manager, and founder of Bridgewater Associates, has 8% of his portfolio invested in gold, or at least that’s what his “All-Weather Portfolio, elaborated with Tony Robbins, is allocated into.

Bridgewater’s Pure Alpha fund avoided much of the 2008 stock market implosion for its investors. He went long on Treasury bonds, shorted the dollar, and bought gold and other commodities.

As a massive proponent of diversification outside the standard, publicly traded assets, Dalio states that buying gold in 2023 is a key factor in minimizing risk. He considers other hedges, like bitcoin, to be too volatile and prefers gold as a safe haven and risk mitigation asset.

Ray Dalio doesn’t like losing his billions, but he knows he can and, most likely, will in the approaching economic downturn. He avoids that by holding on to gold. During an economic downturn, he sells gold because he knows the value will hold up. As the economy recovers, Dalio returns to his traditional assets and resumes stocking up on gold until the next downturn.

As quoted on Chris Williamson’s podcast, “I don’t understand why people are more inclined to go to bitcoin than gold. If you look internationally, gold is, for central banks, the third highest reserve asset,” the Bridgewater Associates founder said. First is dollars, then euros, then gold, and Japanese yen. And central bankers are buying gold, and they’re not buying bonds. And it’s timeless and universal.”

Dalio sees gold as a non-debt-based form of currency. Unlike cash and bonds, which are susceptible to devaluation due to counterparty default risks or inflation, gold, by contrast, remains supported by risks related to debt defaults and inflation.

It is worth noting that many of the famous and wealthy investors on this list were able to strategically position themselves and their clients’ capital to benefit from the Great Recession crisis of 2008.

The ability to see ‘where the puck is headed,’ as Wayne Gretzky would put it, is key in minimizing risk as well as profiting from it. Not coincidentally, the majority of these successful and forward-looking investors are advocates of gold ownership.

Rick Rule

The president and CEO of Sprott US Holdings is a legendary resource investor. He has recommended that investors hold up to 10% of their portfolio in gold and other precious metals. He has also stated that he personally holds up to 20% of his portfolio in physical gold.

Rule recently told Kitco, “It’s important to consider how far gold can go,” Rule said. “Precious metals-related investments comprise less than one-half of one percent of all savings in investment asset classes in the United States. The four-decade mean market share is two percent.”

He states that the combination of negative real interest rates, quantitative easing, waning dollar confidence, federal liabilities like the national debt, and deficits will propel gold’s investment market share to the four-decade mean at a minimum. “If that’s correct, demand for precious metals-related assets will increase fourfold, which is precisely what I think is going to happen.”

Commodities experts like Rick Rule understand that education is key and that relying on the accumulated knowledge of experts saves time and financial setbacks.

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key.

Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and hassle.

Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital

Gold IRAs provide additional advantages over merely buying gold from a local dealer.

Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

If you are a serious investor and have 100K in savings. Attend Augusta Precious Metals’ free educational web conference hosted by Harvard-trained economic analyst Devyln Steele. Click the Banner below to get started today.

Notable Mentions

Paul Tudor Jones

The billionaire hedge fund manager and founder of his hedge fund, Tudor Investment Corporation has publicly stated that he has invested around 5% of his portfolio in gold as a hedge against inflation and currency devaluation. He also owns other hedges such as Bitcoin as well.

Peter Thiel

Characteristic of forward-looking investors and seeing, as Wayne Gretzky would put it, ‘where the puck is going’, in August of 2021, Palantir Technologies, co-founded by the technology billionaire Peter Thiel and CEO Alex Karp, stockpiled $50.7 million in gold bars.

Stated that year, the software company would accept precious metals as well as Bitcoin as a form of payment for its services.

Palantir COO, Shyam Sankar, stated that accepting nontraditional forms of payment “reflects more of a worldview,” adding: “you have to be prepared for a future with more black swan events.”

Palantir’s 100-ounce gold bars are expected to be stored in an undisclosed vault in the US Northeast.

Read more about other famous and seasoned investors and their portfolio allocations to learn how much is needed to get started investing in gold.

To get started with your specific portfolio gold and silver investment allocation, see the links below to access the free investment guides from the best gold IRA companies that we have personally researched and vetted.

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com