How to Choose an IRA Custodian

Choosing the right IRA custodian can be a critical decision in your retirement planning process. Whether you’re considering a Traditional, Roth, or Self-directed IRA, you must carefully evaluate potential custodians based on several factors. To fully understand this subject, we will review the following points:

- Understanding IRAs

- What are the 3 types of IRA?

- Who Can Be an IRA Custodian

- IRA Investment Options

- IRA Custodian Rules

- Loan Lender Considerations

Look at their range of investment options, fees, customer service quality, and any specific restrictions they may have.

Remember that certain custodians might offer more diverse options than others due to differences in charters and IRS regulations.

In this article, we’ll delve into what IRAs are and their types, highlight the characteristics of different custodians, and provide insight into picking one that best suits your needs.

We’ll also discuss investment options and potential restrictions for each type of IRA. By the end of it all, you’ll have the knowledge needed to make an informed choice about your IRA custodian.

Understanding IRAs

Now that you’ve got a handle on the different types of IRAs and their unique tax benefits, let’s dive into understanding these retirement savings accounts better and how to choose the right custodian to manage your investments.

Remember, an IRA is a long-term savings plan with tax advantages designed specifically for retirement planning. The type of IRA you choose – Traditional, Roth, or Self-Directed – determines your tax breaks and investment options.

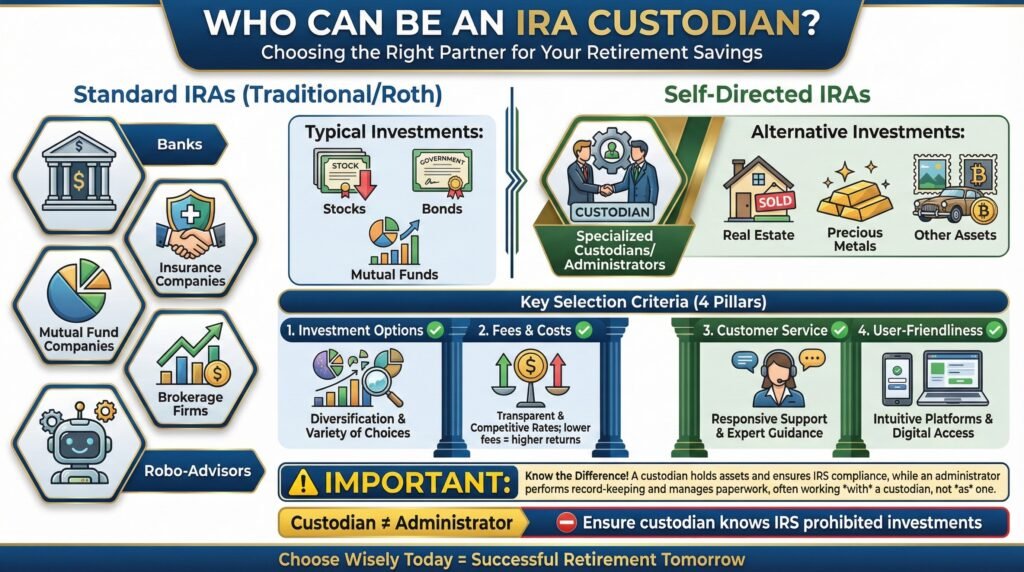

When it comes to selecting an IRA custodian, there are many factors to consider. If you’re opting for a traditional or Roth IRA, banks, insurance companies, mutual fund companies, brokerage firms, and robo-advisors can all serve as standard custodians.

For self-directed IRAs with expanded investment options such as real estate or precious metals, you’ll need specialized custodians or administrators.

However, not all custodians are created equal. Some may limit your investment choices based on their charter. Others might charge hefty fees for certain transactions. So take some time to research thoroughly before choosing your custodian. Look out for ones offering a wide range of investments at low fees with good customer service.

What are the 3 types of IRA?

Imagine the freedom of being able to decide how your retirement funds are invested, whether in traditional stocks and bonds or alternative assets like real estate or precious metals!

This is possible with different types of Individual Retirement Accounts (IRAs), each offering unique benefits based on your financial goals.

- Traditional IRAs give a tax break on contributions, but you’ll owe taxes when you withdraw. They’re ideal if you expect to be in a lower tax bracket during retirement.

- Roth IRAs don’t offer a tax break on contributions but allow for tax-free withdrawals. These work best if you anticipate being in a higher tax bracket when retiring.

- Self-directed IRAs expand your investment options beyond the stock market into areas such as real estate or private mortgages. Gold IRAs are a type of self-directed IRA that provides tax-deferred benefits that greatly enhance their specific appeal.

Selecting the right type of IRA depends heavily on your future income expectations and preferred investment avenues.

Regardless of your choice, remember that it’s crucial to pick an IRA custodian who offers a broad array of investment options, low fees, quality customer service, and user-friendly digital platforms.

Keep these factors in mind as you map out your retirement strategy for maximum peace-of-mind and financial security.

Working with a Reputable and Trusted Gold IRA Company

When starting on the path of gold investing, working with a credible and trustworthy precious metals IRA company is key. Also, these companies have a long-term relationship with trusted custodians.

Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one’s unique investing needs. Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a tax-deferred gold IRA, owning the physical gold in your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Who Can Be an IRA Custodian

You’ve got your retirement plans laid out, but did you know the type of custodian managing those funds can make a huge difference in how well they grow? It’s true.

Not all custodians are created equal; they vary significantly in their services, fees, and investment options. Also, many confuse gold IRA administrators and custodians as interchangeable. They are not.

For standard IRAs like Traditional or Roth accounts, you can choose from banks, insurance companies, mutual fund companies, brokerage firms, or robo-advisors as your custodians. These typically offer a narrower range of investments primarily focused on stocks, bonds, and mutual funds.

If you’re considering more unconventional investments such as real estate or precious metals for your IRA portfolio, you might need to look into self-directed IRAs managed by specific types of custodians – administrators or facilitators who specialize in these complex transactions.

Remember, though, that even within this category, there are variations: some may restrict certain investment options based on their charte,r while others might be more lenient.

Moreover, always ensure that any potential custodian is aware of prohibited IRA investments to avoid inadvertently violating IRS rules.

So take your time when choosing an IRA custodian. You want a partner with the right mix of investment options, low fees, and excellent customer service to manage your hard-earned retirement savings effectively.

When it comes to handling your retirement savings, the characteristics of your financial custodian play a crucial role in determining success. It’s not simply about choosing an institution that handles IRAs – you need to ensure they’re the right fit for your unique needs and goals.

Firstly, consider the range of investment options offered. For instance, if you’re interested in alternative investments like real estate or precious metals, you’ll require a self-directed IRA custodian who can facilitate these types of transactions. However, keep in mind that some custodians may restrict certain investments based on their charter.

Next, assess the fees associated with the custodian. Lower fees equate to higher returns over time. This includes both account maintenance fees and transaction costs.

Customer service is another important factor. You want a responsive team that can help navigate complex issues or questions about your IRA.

Lastly, don’t forget user-friendliness, especially where digital platforms are involved. An intuitive, easy-to-navigate website or app can make managing your account much simpler.

A common misconception is the role of a custodian and an administrator. Knowing what is the difference between an IRA custodian and an administrator is also key to making the right decision.

Remember – choosing wisely now will save headaches later on and set you up for a more successful retirement future!

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

Click the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

IRA Investment Options

Diving into the world of investment options can feel thrilling and overwhelming at the same time, as it opens up a realm of possibilities for growing your hard-earned money. As you dissect which IRA custodian to use, it’s critical to evaluate the variety of investments they offer.

Here are some key points to consider:

- Investment Type: Ensure your custodian supports all types of assets you’re interested in – stocks, bonds, mutual funds, ETFs or even alternative assets like real estate or precious metals.

- Restrictions: Some custodians may restrict certain types of investments based on their charter; ensure these don’t limit your financial strategy.

- Expanding Options: Consider if the institution offers self-directed IRAs for expanded investment choices.

- Consolidation: If you have multiple accounts, look for a custodian that allows account consolidation for easier management.

- Risk Diversification: A good mix of various asset classes is key to mitigating risks; ensure your chosen custodian allows this.

Remember that choosing an IRA custodian isn’t just about today but also about how well they can accommodate changes in your financial goals over time. Make sure they provide ample flexibility and adaptability to match your evolving investment

IRA Custodian Rules

Navigating the various restrictions tied to Individual Retirement Accounts can be quite a maze, but it’s crucial for optimizing your retirement savings and staying within legal boundaries.

Understanding these limitations can also guide you when choosing an IRA custodian that best fits your investment strategy.

The restrictions set by IRA custodians may differ from those imposed by tax laws or IRS regulations.

These are often based on the charter of the financial institution serving as your custodian. For instance, some custodians restrict certain types of investments, such as real estate or precious metals, especially in self-directed IRAs.

While you’re exploring potential custodians for your IRA, make sure to investigate their specific restrictions.

Some might limit contribution amounts more stringently than IRS rules do. Others could have stricter rules about early withdrawals or loans against your IRA assets.

Understanding each custodian’s unique restrictions helps avoid unpleasant surprises down the line.

It enables you to choose a partner that aligns with your personal investment goals and risk tolerance level. Remember that being well-informed is key to making sound financial decisions for your future retirement security.

Best Gold IRA for Low Investment Minimums. Click the Banner Below to Visit National Gold Group and Receive a Free Guide Today

Loan Lender Considerations

Carefully choosing the right loan lender for your 401(k) rollover can help you secure greater financial security and peace of mind. When looking for a trustworthy loan lender, there are several factors to consider:

- Reputation: Look up reviews and ratings from previous customers to determine the validity of the loan lender.

- Fees: Compare rates and fees from multiple lenders to find an option that fits your budget.

- Investment options: Make sure the lender offers gold investments in coins, bullion, or ETFs that are eligible for inclusion in a Gold IRA account.

- Customer service: It’s important to work with a knowledgeable custodian who can advise you on which products are allowed and provide guidance throughout the process.

It’s essential to read the commenting policy, corrections policy, privacy policy, your privacy choices, and terms of service provided by any potential loan lenders before making a decision.

Doing research ahead of time will ensure you make an informed choice when selecting a Gold IRA custodian for your 401k rollover.

This way, you can rest assured knowing your investment is secure and protected against inflationary risk and market volatility, tax-free or tax-deferred, with potential growth opportunities

Final Considerations

It’s essential to remember that the journey towards a comfortable retirement isn’t just about growing your savings-it’s about making thoughtful decisions that will impact your financial future. Choosing an IRA custodian is one of these crucial choices.

To make this decision, consider the following:

- Investment Options: Evaluate if the custodian offers a wide range of investment options that align with your financial goals.

- Fees: Understand the fee structure and ensure it doesn’t eat into your returns significantly.

- Customer Service: Look for a custodian who provides excellent customer service and responsiveness.

- Online Tools & Resources: Check for easy-to-use online tools, user-friendly interfaces, and educational resources on the platform.

- Consolidation Options: Find out if the custodian allows you to consolidate different accounts into one place.

Remember, this decision isn’t set in stone-you can switch custodians if you find another provider better suited to your needs later on. Therefore, take time to research thoroughly before finalizing any choice.

This diligence will help safeguard your retirement savings and contribute towards a secure financial future.

Choosing an IRA custodian isn’t a decision to take lightly. You need to consider the type of IRA, available investment options, associated fees, and quality of customer service.

Remember that restrictions may apply based on the custodian’s charter and IRS tax laws. Be cautious about potential fraud with self-directed IRAs.

Ultimately, your choice should align with your retirement planning strategy. Do thorough research and make an informed decision for your financial future.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com