What Is the Difference Between IRA Administrator and Custodian?

When it comes to planning your retirement, understanding the various roles involved in managing your Individual Retirement Account (IRA) is crucial.

Two key players are the IRA administrator and custodian. But what distinguishes these two?

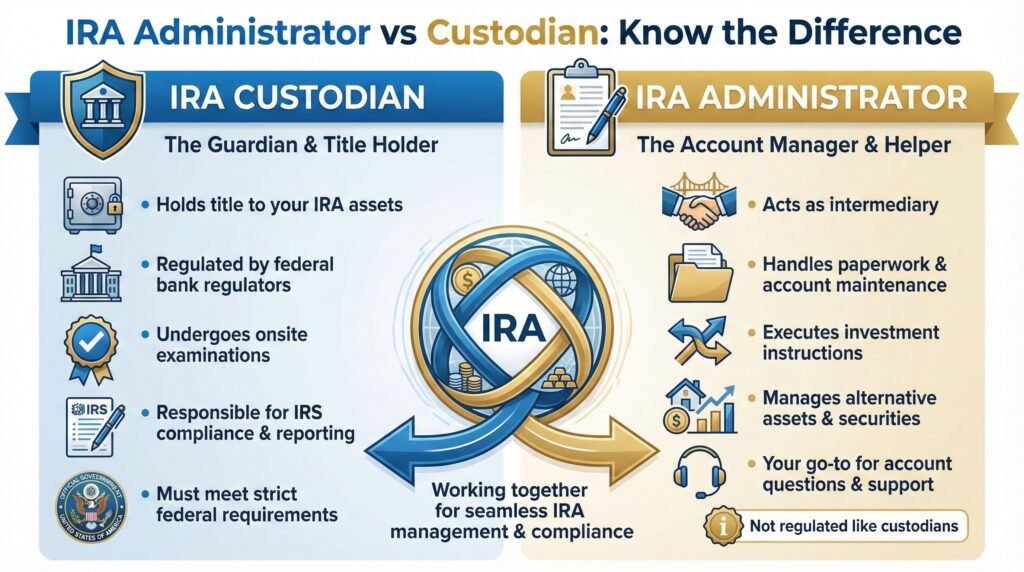

In simple terms, an IRA custodian holds the title to assets and ensures compliance with IRS reporting. They’re overseen by bank regulators and must meet certain federal requirements.

Meanwhile, an IRA administrator handles account maintenance and paperwork administration while acting as an intermediary. However, they aren’t regulated like custodians.

To truly understand the difference between an IRA administrator and a custodian, we will review the following points:

- IRA Custodians

- Do IRAs Require a Custodian?

- IRA Administrators

- Finding a Trusted Gold IRA Company

- IRA Administrator Job Description

- IRA Custodian Rules

- How To Choose IRA Custodians or Administrators

This article will delve deeper into their distinct responsibilities and regulations, and how you can choose between them for your needs. We’ll also suggest IRA companies that work with qualified custodians as well as administrators.

So let’s clear up any confusion about these critical roles in managing your retirement savings.

To learn more about the process of gold IRAs right now and make sure you are choosing the right company for you, tap the banner below to be taken to Augusta Precious Metals’ official site to receive their free gold IRA checklist

IRA Custodians

When it comes to understanding custodians, they’re the ones who’ve got to meet all those pesky IRS requirements and are kept in check by state or federal bank regulators – pretty hefty responsibility, right? They’re not just your average bear.

Custodians hold custody of assets, ensuring their safety and security. These aren’t just any old assets either; these can range from traditional stocks and bonds to alternative investments like real estate or precious metals.

Being a custodian means undergoing onsite examinations by bank regulators. They need to be on their A-game – always. So you can bet that they keep their operations in line with strict regulations.

They hold title to your IRA’s assets, too, which makes them responsible for accurate IRS reporting.

Let’s not forget about how important due diligence is when selecting a custodian for your IRA. You want someone reliable who knows what they’re doing because let’s face it – this isn’t chump change we’re talking about here! Choosing a reputable company could offer you extra security and protection while self-directing your IRA.

But remember, while custodians play a crucial role in holding and safeguarding your IRA assets, there’s another player on the stage: administrators.

Do IRAs Require a Custodian?

What is the role of the IRA custodian?

As an investor, it’s important that you’re aware of the responsibility and regulations surrounding custodians. These professionals hold a critical role in managing your IRA by holding title to assets in trust for the benefit of account holders, ensuring adequate protection and security.

Custodians are subject to stringent IRS requirements and are regulated by state or federal bank regulators. This level of oversight means they undergo regular on-site examinations to ensure compliance with banking standards, adding another layer of security for your investment.

One key responsibility of custodians is IRS reporting. They handle tasks such as detailing distributions and contributions, ensuring accurate tax documentation is provided.

It’s also worth noting that, unlike administrators who mainly handle paperwork and execute investments as per instructions, custodians can actually hold custody of assets.

Remember, though, while custodians offer a high level of protection due to their regulations and responsibilities, it doesn’t negate your need for due diligence when choosing one. Ensure you select a reputable company that offers both traditional and alternative investment options along with expert guidance through its team of specialists.

IRA Administrators

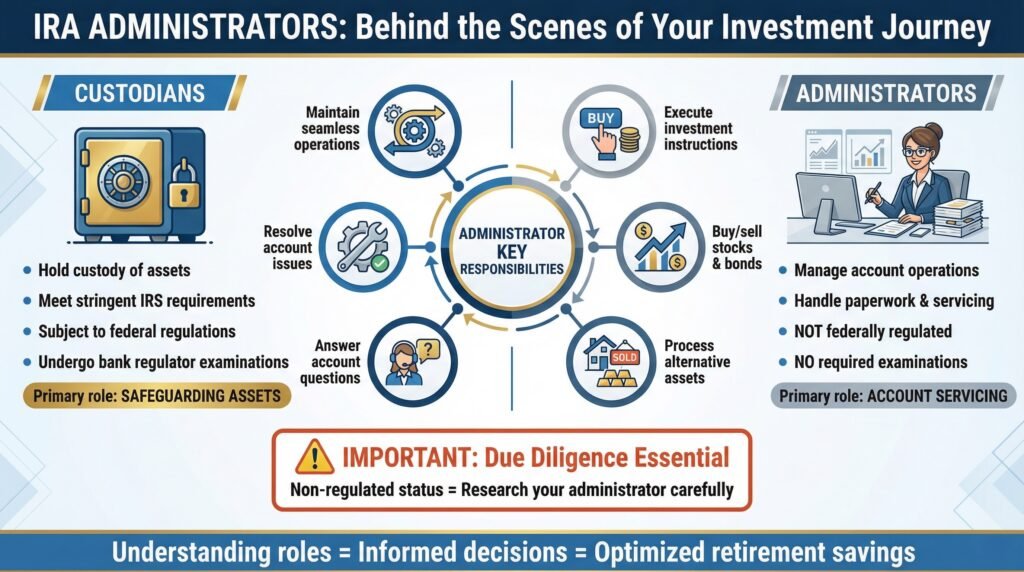

Peeling back the layers of your investment journey, you’ll find administrators working diligently behind the scenes, keeping your accounts running smoothly and handling all the necessary paperwork.

While custodians hold custody of assets and must meet stringent IRS requirements, administrators are there to ensure that everything runs seamlessly.

Administrators play a vital role in IRA management. They’re responsible for executing investments according to specific instructions, which could include buying or selling stocks or bonds, investing in alternative assets like real estate or precious metals, and much more.

If you’ve ever had a question about your account or needed help with an issue, chances are it was an administrator who came to your rescue.

Unlike custodians, though, administrators aren’t subject to federal regulations and don’t need to undergo onsite examinations by bank regulators. Their primary role is in account servicing rather than safeguarding of assets – even if they work closely with custodians who do have these responsibilities. It’s this non-regulated status that makes proper due diligence essential when selecting an IRA administrator.

By understanding their distinct roles and responsibilities in managing your IRA investments, you can make informed decisions and optimize your retirement savings strategy.

Tap the banner below to visit American Hartford Gold to receive their free gold IRA kit

Best Gold IRA for Low Minimum Investment

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

Click the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

Finding a Trusted Gold IRA Company

Navigating the maze of retirement planning, you’ll find that a lot’s riding on your administrator’s shoulders. As an IRA account holder, it’s critical to understand the tasks and oversight involved in an administrator’s role.

An IRA administrator is essentially the middleman handling your account maintenance and administration.

This includes everything from processing transactions and executing investments according to your instructions to managing paperwork and maintaining accurate records. They are responsible for ensuring sthe mooth operation of your account on a day-to-day basis.

However, administrators aren’t regulated like custodians. While they work closely with custodians who are subject to federal regulations, administrators themselves don’t have such stringent rules governing their operations. They aren’t required by law to implement specific policies or provide training for their employees.

Given this lack of regulation, it becomes all the more important for you as an investor to perform due diligence when choosing an IRA administrator. Make sure they follow best practices in terms of transparency, reliability, and efficiency in handling administrative tasks related to your IRA account.

Augusta Precious Metals works with qualified custodians, Equity Trust, GoldStar Trust Company, or Kingdom Trust.

National Gold Group works with custodians’ GoldStar Trust and Delaware Depository.

Birch Gold Group is a partner with custodian companies Brink’s Global Services, Delaware Depository, International Depository Services (IDS), and Texas Precious Metals Depository.

American Hartford Gold utilizes Equity Trust Company for custodian services.

Noble Gold works with the qualified custodian’s Equity Institutional and International Depository Services (IDS).

IRA Custodian Rules

When it comes to regulations and responsibilities, don’t you want someone who’s under strict scrutiny handling your hard-earned money? That’s exactly what an IRA custodian does.

They’re overseen by state or federal bank regulators and are regulated through onsite examinations. They hold title to your assets, ensuring they’re safe and secure.

In addition, they keep track of all transactions and report them to the IRS, making sure everything is above board.

On the other hand, IRA administrators act as a bridge between you and the custodian. Their main role is account maintenance and administration of paperwork associated with your investments.

However, unlike custodians, administrators aren’t regulated by bank authorities nor required to implement policies or provide training according to regulatory standards.

While both roles are crucial for managing your IRA smoothly, this distinction in regulations manifests itself in their responsibilities, too. Custodians bear weighty legal obligations because they have custody of assets, while administrators primarily handle administrative tasks without bearing such stringent accountability.

This difference underscores why due diligence should be exercised when selecting a custodian or administrator for your IRA – after all, it’s about safeguarding your investment future!

How To Choose IRA Custodians or Administrators

Selecting the right entity to manage your retirement assets is a crucial decision, requiring a careful evaluation of their credibility, reliability, and track record. You need to conduct thorough due diligence before choosing an IRA custodian or administrator.

When considering these entities for your individual retirement account (IRA), remember:

– Administrators handle routine account maintenance tasks, whereas custodians hold legal authority over your assets.

– Custodians are regulated by federal or state bank regulators, while administrators aren’t subject to regulatory oversight.

– The IRS requires all IRAs to have a custodian; administrators are optional.

– While both can execute investment transactions, only custodians can report directly to the IRS.

This distinction is more than academic-it affects how secure your investments will be. A well-regulated custodian provides additional layers of protection for your IRA. They offer traditional investments as well as alternative ones such as real estate or private equity.

With specialists ready to assist you in managing your retirement savings, they represent a reliable option for self-directing an IRA. Remember that who manages your retirement savings impacts its growth and security.

In sum, both custodians and administrators play vital roles in managing your IRA. Custodians, regulated by state or federal bodies, ensure IRS compliance and safeguard your assets.

See our list below of the four best gold IRA administrator companies that we have thoroughly reviewed, along with details of their respective IRA custodians.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Find the right gold IRA conpany for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com