Real Interest Rate vs Gold

Have you ever wondered why the glimmer of gold seems to fade when interest rates rise? It’s a curious dance between these two financial elements, where one’s rise often heralds the other’s fall.

This intriguing connection, steeped in economic theories and market dynamics, might just transform your investment strategies if you understand it well.

What is more intriguing is that this long-held correlation may now be broken due to the present US national debt situation. Be sure to read to the very end to learn about this new economic paradigm.

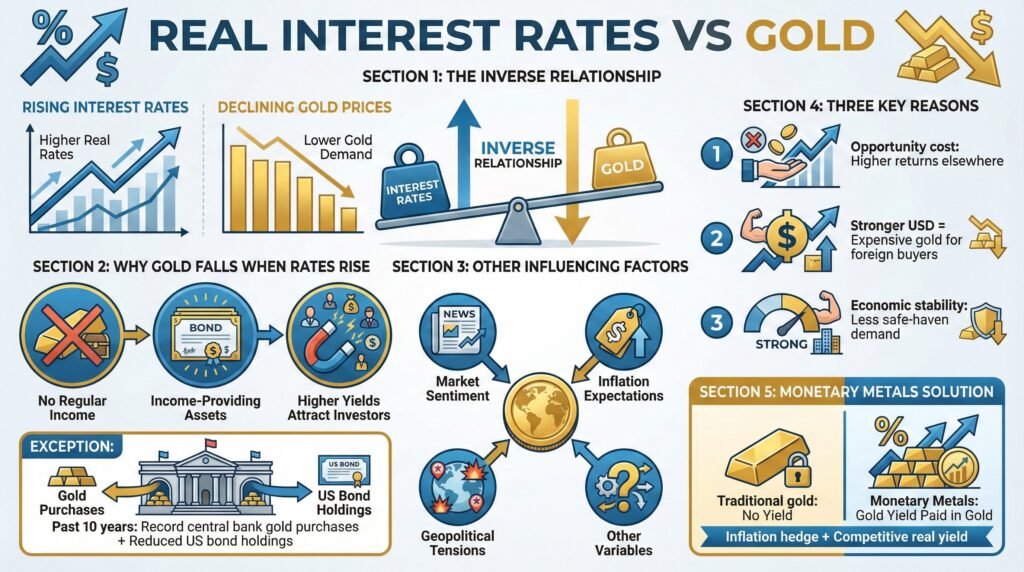

Generally, there is an inverse relationship between real interest rates and the rise in gold’s value. To gain a greater understanding of the relationship between real interest rates and gold, we will explore the following: investing in precious metals, the impact of rising interest rates on gold, the influence of falling interest rates on gold, factors affecting the gold price, correlation between gold and interest rates

It’s more than just a random oscillation; it’s a rhythm that reflects the state of the global economy. So, buckle up and get ready to navigate this complex financial landscape. Why? Because grasping this relation could be your golden ticket to making smarter, more informed investment decisions.

Investing in Precious Metals: A Guide

Diving into the world of precious metals investing requires a clear understanding of the market dynamics, your investment goals, and the various factors that can significantly impact the value of gold and silver. Precious metals, particularly gold and silver, have been a trusted store of wealth for centuries, offering a hedge against inflation and currency fluctuations.

Analyzing data from the past decades, it’s evident that gold prices often inversely correlate with real interest rates.

When interest rates rise, the allure of holding gold, which doesn’t offer an interest yield, diminishes. Conversely, when interest rates fall, gold’s appeal increases, driving up its price.

Moreover, market supply and demand significantly sway gold and silver prices. For instance, increased industrial use or investment demand can push prices up, while high levels of mining can pull them down.

Geopolitical tensions and economic uncertainties also tend to boost demand for these metals as safe-haven assets.

As you step into precious metals investing, it’s important to establish your risk tolerance and investment goals. Are you looking for a long-term hedge against inflation, or are you seeking to profit from short-term price fluctuations? Your answer will shape your investment strategy.

Finding a reputable dealer is crucial. Be wary of dealers charging high premiums or those unwilling to guarantee the purity of their metals.

Remember, investing in precious metals isn’t risk-free; it’s subject to market volatility and potential dealer fraud. Stay informed and monitor the market regularly to make sound investment decisions.

Impact of Rising Interest Rates on Gold

When interest rates start to climb, you’ll likely notice a corresponding decrease in gold prices due to investors’ shifting focus towards assets with higher annual yields.

This is because gold doesn’t offer any regular income, unlike bonds and stocks, and hence, in a higher interest rate environment, these income-providing assets often seem more attractive.

However, it’s important to note that while there’s a general inverse relationship between interest rates and gold prices, it’s not a hard-and-fast rule. Market sentiment, inflation expectations, and geopolitical tensions, among other factors, can influence gold prices.

Analyzing historical data, one can identify a trend where gold prices tend to fall when real interest rates rise. This phenomenon can be attributed to:

- The increased opportunity cost of holding gold: Higher interest rates mean that you’re potentially missing out on higher returns from other investments.

- The strengthening of the currency, particularly the US dollar: Gold is priced in dollars, so a stronger dollar makes gold more expensive for foreign investors, reducing its demand.However, we have seen an exception to this trend due to the mass amounts of foreign central banks buying record amounts of gold in the past 10 years. This has also coincided with a reduction in the holding of US bonds by these same central banks.

- The perception of economic stability: When interest rates rise, it often signals a robust economy, which reduces gold’s appeal as a “safe-haven” asset.\

- To address the opportunity cost of holding gold, as opposed to the classic government bond. Monetary Metals is a gold investment company that offers a yield on gold, paid in gold through the company’s fixed-income investment products.

The company’s gold lease programs offer investors an opportunity to take advantage of all the inflation-hedging upside of holding gold as well as earn a real yield competitive with real interest rates set by the Federal Reserve.

To learn more about Monetary Metals’ yield-bearing gold investment products, click the banner below to get started earning a gold yield, paid in gold.

Influence of Falling Interest Rates on Gold

In contrast to rising interest rates, a drop in these rates often sets the stage for an upswing in gold prices. Why is that? Well, when interest rates fall, the cost of holding non-yielding assets like gold decreases. At the same time, lower rates can lead to inflation, which erodes the value of paper currency and makes gold more attractive.

Historical data support this correlation. Take, for example, the period between 2000 and 2001. The Federal Reserve cut interest rates from 6.5% to 1.75%, and during that time, gold prices rose by approximately 13%. Similarly, during the 2008 financial crisis, when rates were slashed to near-zero, gold prices doubled over the next three years.

Lower interest rates often coincide with economic uncertainty, which also boosts the appeal of gold as a safe-haven asset. When you’re worried about the stock market’s volatility or the stability of your currency, you might find solace in gold’s enduring value.

Factors Affecting Gold Price

So, what influences the price of gold apart from interest rates? Many factors come into play. These factors can be broadly categorized into demand and supply factors, geopolitical tensions, and inflation expectations.

- Demand and Supply Factors: As with any commodity, gold’s price is largely determined by the dynamics of demand and supply. When demand for gold increases, whether for industrial use, jewelry, or as an investment, and supply is limited, prices tend to soar. Conversely, an excess supply with limited demand can lead to a drop in gold prices.

- Geopolitical Tensions: Gold is often considered a ‘safe haven’ during times of political and economic instability. Investors flock to gold during such periods, driving up its price. For instance, during the 2008 financial crisis, the price of gold surged as investors sought safety in the precious metal.

- Inflation Expectations: Gold is widely viewed as a hedge against inflation. During periods of high inflation, when the value of currency declines, investors often turn to gold. As a result, higher inflation can lead to higher gold prices.

While these factors certainly play a role, it’s important to remember that the gold market is complex and influenced by many interconnected variables.

As an investor, it’s crucial to keep a close eye on these factors to make informed decisions about your gold investments. Remember, investing in gold is not without risks, and it’s always wise to diversify your investment portfolio.

Correlation Between Gold and Interest Rates. Pre-2022 Model

While understanding the myriad factors that influence gold prices is vital, it’s equally important to examine the historically inverse relationship between gold and interest rates.

Analysis of historical trends shows a clear negative correlation between these two variables. When interest rates rise, the price of gold typically falls, and vice versa.

In times of high interest rates, investments that yield an income, such as bonds and savings accounts, become more appealing. You’re likely to see a shift away from gold, which doesn’t provide an annual return, leading to a decrease in demand and, subsequently, a drop in gold prices.

Conversely, when interest rates are low, gold becomes a more attractive investment. This is because the opportunity cost of holding gold, a non-interest-bearing asset, decreases. Therefore, during periods of low-interest rates, demand for gold tends to spike, driving up its price.

Moreover, the correlation between gold and interest rates is influenced by expectations of future inflation. If you expect inflation to rise, you might invest in gold as a way to preserve your wealth, anticipating that gold prices will increase in response to inflation.

One of the most notable historical exceptions to the standard inverse correlation was the stagflation era of the 1970s, where the Federal Reserve hiked rates at an extremely aggressive pace. From 1971 to 1980, gold’s value increased 2,200% over those 9 years. To reiterate, the inverse correlation is not a hard-and-fast rule.

Gold Price and Real Rates Now. 2022 Broken Correlation

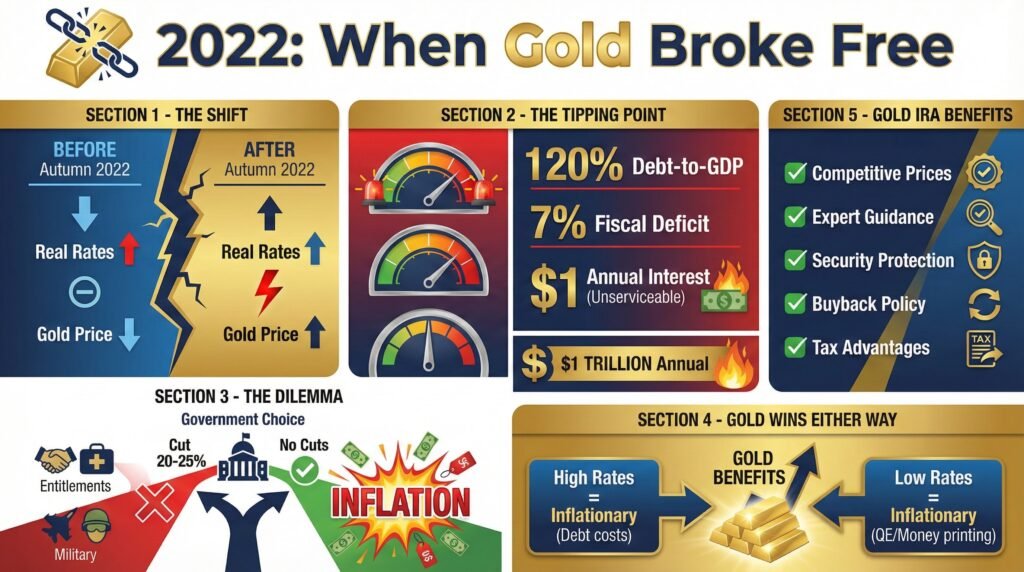

Before the autumn of 2022, the rise of real interest rates and gold prices typically had a negative correlation. This correlation has now been challenged concerning the present economic milieu.

What changed exactly? According to macroeconomic expert Luke Gromen, as well as others, the US debt and fiscal position is beyond the tipping point where the interest on the US national debt alone, nearly $1 trillion, is unserviceable.

According to Gromen, once the US fiscal accounting hit 120% debt-to-GDP threshold and 7% fiscal GDP deficits, the negative correlation between real 10-year interest rates and the price of gold broke.

Unless the US government cuts the largest parts of the federal budget, either entitlement programs or military spending by 20 – 25%, the end effect of this ever-expanding debt is inflationary.

The US government indicates no intent to cut either expense, resulting in the negative correlation between real rates and gold prices becoming effectively decoupled.

In this era of fiscal dominance, the present high interest rates on the US National debt are inflationary, as well as the scenario of lower rates with the increase in the money supply due to the inevitable quantitative easing. Both situations are now effectively good for the dollar price of gold.

Benefits of Working with a Reputable Gold Investment Company

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key. Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and hassle.

Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital.

Gold IRAs provide additional advantages to merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one’s unique investing needs.

Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a tax-deferred gold IRA or owning the physical gold in your place of residence, make the choice that best suits your needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Conclusion

In summary, understanding the relationship between real interest rates and gold prices is key to successful investing. But more importantly, understanding that the classic correlations do not always apply. Factors like inflation, geopolitical events, market speculation and the present decoupling of this inverse correlation due to the massive amount of US national debt hold sway.

Keep exploring, keep learning, and keep investing wisely.

Best Gold IRA for Low Minimum Investment.

Click the Link Below to Visit Birch Gold Group’s Official Site to Get Started.

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Take Advantage of the Best Prices. Attend a Gold Investment Webinar for Investors with 100k or More to Protect Hosted by Augusta Precious Metals

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com