Gold Retirement Account for Retirees

A Gold Retirement Account is a smart option for retirees seeking a hedge against inflation and a tool for wealth preservation. Such accounts allow you to invest in various forms of gold, including coins meeting IRS purity standards, exchange-traded funds (ETFs), stocks of gold mining companies, et cetera. To better understand this subject:

-Gold Individual Retirement Accounts

-Gold Exchange-Traded Funds

-Gold Stocks

-Gold Mutual Funds

-Gold Futures and Options

-Considerations Before Rollover

-Gold Bars and Coins

It’s important to remember that higher administrative fees and storage costs can apply, but the potential growth in gold’s value is tax-deferred until distribution.

As your interest is piqued, I’ll subtly mention there’s plenty more to explore about this golden opportunity for retirement security.

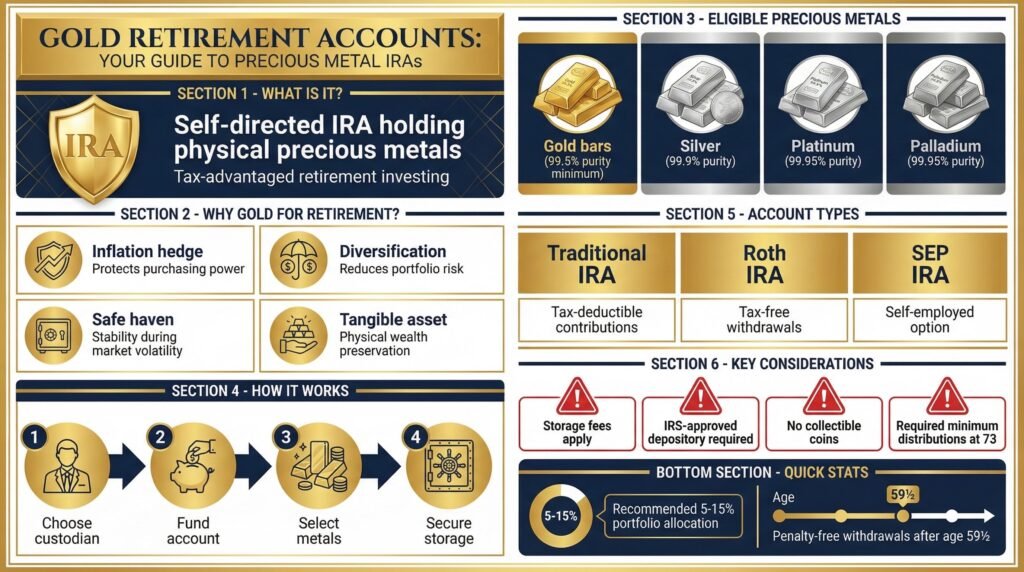

Gold Individual Retirement Accounts

When it comes to investing in gold during your retirement years, a Gold Individual Retirement Account (IRA) can be a practical choice.

This tax-advantaged, self-directed IRA permits you to hold physical gold, such as bullion or coins, directly within your retirement account. This sets it apart from traditional IRAs which typically limit you to conventional assets like stocks and bonds.

However, it’s important to keep in mind that gold within an IRA must meet specific purity standards established by the IRS; this generally means the gold must be 99.5% pure. This is where a credible custodian comes into play.

Such a custodian, approved by the IRS, not only guarantees the gold meets the required purity but also takes care of its secure storage. This, though, could incur additional costs.

Admittedly, Gold IRAs may involve higher administrative fees than traditional ones, and they might have stricter rules about the type of gold investments allowed. But these are often offset by the potential tax benefits they offer. Any growth in the value of the gold held within the IRA is tax-deferred until you decide to take a distribution.

Gold Exchange-Traded Funds

If you’re searching for a convenient, hassle-free way to invest in gold during retirement, you might want to reflect on Gold Exchange-Traded Funds (ETFs).

These funds offer a smart alternative to investing in physical gold, as they issue shares that track the price of gold, without the need for you to physically own it.

Gold ETFs are traded just like stocks on exchanges, making them highly liquid and easy to buy or sell, a perk that can be particularly beneficial as your financial needs change throughout retirement.

Furthermore, they generally have lower management fees than other gold investment products, which can help preserve more of your retirement savings for the future.

But as with any investment, there are a few caveats to be aware of. While Gold ETFs do hold physical gold, as an investor, you don’t have direct ownership of the underlying gold. This difference doesn’t pose a problem for most investors, but if you’re someone who prefers the security of physically owning your investments, it’s something to ponder.

Additionally, the performance of a gold ETF can be influenced by more than just the price of gold. Market sentiment, economic indicators, and other external factors can all affect the price of a Gold ETF.

Gold Stocks

Diversifying your retirement portfolio with gold doesn’t always mean buying physical gold or ETFs. Investing in gold stocks, which are shares in gold mining companies, can give you indirect exposure to this precious metal.

As gold prices rise, these companies often reap higher profits, which can potentially increase their stock prices.

However, investing in gold stocks isn’t without its challenges. These stocks are subject to various risks, including operational difficulties, regulatory changes, and fluctuations in production costs.

It’s not just about tracking the price of gold; the company’s management, reserves, and overall financial health also play significant roles in its performance.

Despite these risks, gold stocks can be a relatively safe investment during your retirement. Often, the returns can be more rewarding than with other types of gold investments. But, like any investment, you must do your homework.

Research the company thoroughly, and understand what you’re buying into before adding the gold stock to your portfolio.

Gold Mutual Funds

For investors seeking a diversified approach to gold investment, gold mutual funds present an attractive option. These funds are designed to invest in a varied portfolio of gold-related assets, such as gold mining stocks, gold ETFs, and even physical gold.

This diversity makes them generally safer than some other gold investments, minimizing the risk that can come from putting all your eggs in one basket.

Now, you may be asking, why opt for a gold mutual fund? Well, these funds are managed by professional investment managers.

This means you get the benefit of their expertise and experience, which can be a major advantage, especially if you’re new to the gold market. They do all the research and select the investments, freeing you from the time-consuming task of doing it yourself.

But, like all investments, gold mutual funds come with their own set of considerations. For instance, they typically have higher management fees than gold ETFs.

So, while you’re benefiting from professional management, it’s important to factor in these costs when calculating potential returns.

Another point to be aware of is that the performance of gold mutual funds may not perfectly track the price of gold. This is due to the fund’s diversification, which includes assets other than just physical gold.

But, despite these considerations, gold mutual funds remain a smart, safe way to invest in gold during retirement. They offer a convenient method to gain exposure to the gold market while mitigating some of the risks associated with other types of gold investments.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

See the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

Gold Futures and Options

While gold mutual funds offer a more diversified and managed approach to investing in gold, another avenue to contemplate is gold futures and options.

For the seasoned investors among us, these instruments can provide leverage and the potential for higher returns during retirement. However, before diving in, it is crucial to understand the complexities and risks associated with them.

Gold futures contracts allow you to speculate on the future price of gold. By buying a futures contract, you’re agreeing to buy a specific amount of gold at a predetermined price on a set date in the future.

If the market price of gold is higher than your contract price when it expires, you make a profit. Conversely, if the market price is lower, you face losses.

Similarly, gold options give you the right, but not the obligation, to buy or sell gold at a predetermined price within a specific timeframe.

If the market price moves in your favor, you can exercise the option and profit from the difference. However, if it doesn’t, your loss is limited to the premium you paid for the option.

However, remember that these instruments carry significant risks. The market can move against your position, leading to substantial losses. It’s also worth noting that futures and options require a deep understanding of market trends and a keen eye for risk management.

So, if you’re confident in your market knowledge and risk tolerance, gold futures and options could be a lucrative addition to your gold retirement account. But, approach with caution and consider seeking professional advice before proceeding.

Considerations Before Rollover

Before you decide to roll over your traditional IRA or 401(k) into a gold IRA, it’s vital to understand the specifics. A gold IRA rollover isn’t a decision to be made lightly.

It’s important to weigh the benefits and drawbacks, considering the impact on your retirement savings and your overall financial plan.

Firstly, consider the costs involved. Unlike traditional retirement accounts, gold IRAs come with additional fees. These include storage and insurance costs for the physical gold you’ll hold in your account.

You’ll also need to factor in custodian fees and any premium you might pay for the gold itself. These expenses can add up and will directly impact your bottom line.

Next, consider how a gold IRA fits into your broader investment strategy. Gold can be an excellent hedge against inflation and market volatility, but it’s not without risks.

The price of gold can fluctuate, just like any other investment. If you’re overly reliant on gold for your retirement savings, a significant drop in gold prices could hurt your financial security.

Lastly, it’s important to consult with a financial advisor before making any major investment decisions. An advisor can help you assess your financial situation, consider your retirement goals, and determine if a gold IRA rollover is the right move for you.

Setting up a gold IRA rollover involves a few crucial steps. Here, I’ll walk you through the process. It’s not as intimidating as it may seem, and it can provide a substantial boost to your retirement savings.

Firstly, you’ll need to choose a reputable IRA custodian specializing in gold IRAs. It’s important to choose someone reputable, with a solid track record, fair fees, and positive customer feedback. Research thoroughly before making a decision. After all, this custodian will be handling your retirement savings.

Once you’ve chosen a custodian, you must open a self-directed IRA. This is an account that allows you to make investments in a variety of assets, including precious metals like gold. Your custodian will guide you through the process.

Next, you’ll initiate a rollover from your traditional IRA or 401(k). The funds will be transferred directly to your new self-directed gold IRA. This is known as a direct rollover, and it’s generally the most straightforward method.

Once the funds are in your new gold IRA, you can start investing in gold. You’ll have the option to invest in physical gold, like bars and coins. Work with your custodian to purchase IRS-approved gold or other precious metals.

The gold must be stored in an approved depository. Home storage is not allowed for Gold IRAs, and attempting to do so could result in severe penalties from the IRS.

Benefits of Choosing a Reputable Gold IRA Company

It is crucial to remember that investing in a Gold IRA involves unique considerations. These include understanding the storage requirements of physical gold and the fees associated with these accounts.

Additionally, like all investments, Gold IRAs come with risks, including the potential for loss if the price of gold decreases.

Finding the right gold IRA company for your individual needs is critical. For example, if you require a low investment minimum to start a gold IRA company, Birch Gold Group would be a great choice to consider.

However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive gold prices, then Augusta Precious Metals would be a good fit. Decide based on your individual needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Gold Bars and Coins

In relation to tangible assets, investing in gold bars and coins offers the most direct form of gold ownership during retirement. When you buy physical gold bullion, which refers to gold bars or ingots, or coins minted by government agencies, you’re making a choice that many retirees find reassuring.

The primary advantage of owning physical gold is the direct possession of the asset. This provides a sense of security and control that you don’t get with other types of investments.

The value of gold bars and coins tends to stay stable or even grow over time, which can make them less risky than other gold investments.

However, it’s important to be aware of the costs and challenges associated with owning physical gold.

Storing and insuring your gold can be expensive. If you’re living on a fixed income during your retirement, you need to evaluate whether these additional costs are worth the benefits.

Another factor to assess is the potential difficulty in selling your gold quickly if you need cash. While gold is a liquid asset, it can take time to find a buyer and complete a sale. This could be a problem if you need money in a hurry.

Conclusion

So, there you have it! Gold Retirement Accounts offer a compelling and secure way to diversify your retirement portfolio. From gold IRAs to gold stocks, the options are varied and many.

Remember, it’s not just about safeguarding your finances; it’s about making smart decisions that could potentially bring growth. I hope this guide has demystified Gold Retirement Accounts for you. Here’s to a golden, prosperous retirement!

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Click the button below:

Find the right gold IRA conpany for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com