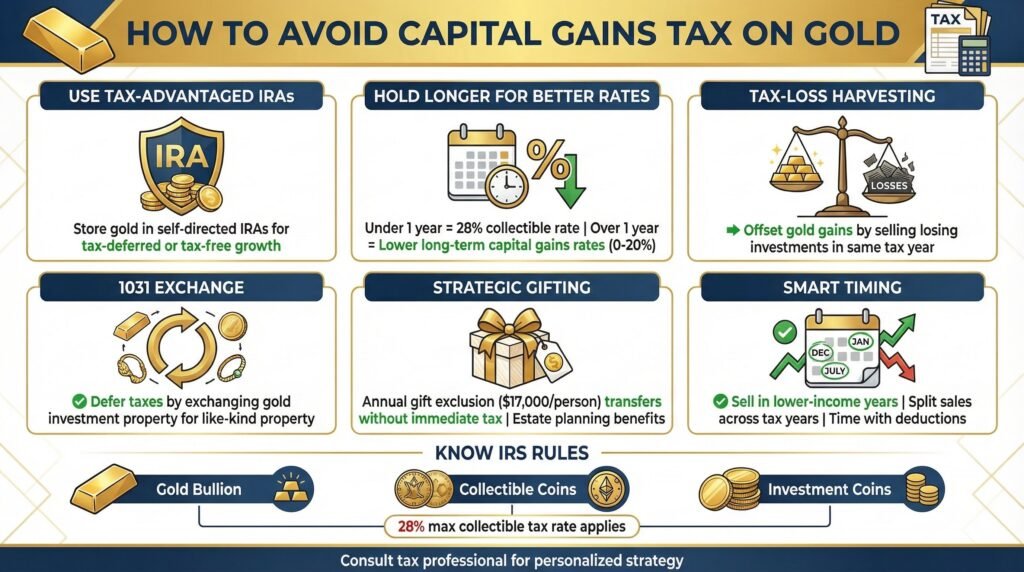

How to Avoid Capital Gains Tax on Gold

Investing in gold has long been a preferred strategy for preserving wealth, hedging against inflation, and securing financial stability. However, many investors face the challenge of capital gains tax when they sell their gold for a profit.

There are many gold investment instruments that can enable an investor to avoid capital gains taxes such as tax-deferred IRAs, 1031 exchanges, ETFs and much more. Capital gains taxes can significantly reduce the returns on your investment, making it essential to explore legal strategies to minimize or eliminate these taxes.

This article will guide you through various ways to avoid capital gains tax on gold, ensuring you keep more of your hard-earned wealth.

Understanding Capital Gains Tax on Gold

Before delving into ways to avoid capital gains tax, it is crucial to understand how it is applied to gold investments.

In many countries, including the United States, gold is considered a collectible, which means it is taxed at a higher rate than other types of investments such as stocks or bonds.

However, state taxes on gold will vary from state to state, and in many states gold is not taxed.

Tax Rates on Gold Investments

-

- In the United States, long-term capital gains on gold (held for more than a year) are taxed at a maximum rate of 28%.

- Short-term capital gains (assets held for less than a year) are taxed as ordinary income, which could be higher depending on your tax bracket.

- Some countries apply Value Added Tax (VAT) or Goods and Services Tax (GST) on gold purchases, adding another layer of taxation.

With these high tax rates, it becomes crucial to consider strategies that can help reduce or eliminate the capital gains tax on gold.

1. Use a Gold IRA

A Gold IRA (Individual Retirement Account) is one of the most effective ways to legally avoid capital gains tax on gold. A Gold IRA allows investors to hold physical gold in a tax-advantaged retirement account.

Types of Gold IRAs

- Traditional Gold IRA: Contributions are tax-deductible, and the gains grow tax-deferred until withdrawal in retirement.

- Roth Gold IRA: Contributions are made with after-tax income, but withdrawals (including profits) are entirely tax-free.

By investing in gold through an IRA, you defer tax payments until retirement, when your tax rate may be lower, or avoid them entirely if using a Roth IRA. If you’re interested in setting up a Gold IRA, consider speaking with a trusted Gold IRA provider today.

To learn more about how gold investing can protect your long-term wealth and the advantages of tax-deferred gold IRAs, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

2. Take Advantage of the 1031 Exchange

The 1031 exchange allows investors to defer capital gains tax by exchanging one investment for another of “like-kind” without realizing a taxable gain. While this strategy was more common for real estate transactions, some investors have successfully applied it to gold.

How It Works

- If you sell gold and immediately reinvest in another gold asset of a similar nature, you may qualify for deferred taxation under the 1031 exchange.

- The IRS has tightened regulations around 1031 exchanges, so it is advisable to consult a tax professional to ensure compliance.

Want to learn more about 1031 exchanges? Check out financial planning services that specialize in tax-efficient investment strategies.

3. Gift Gold Instead of Selling

Gifting gold to family members or loved ones can help avoid capital gains tax while transferring wealth efficiently.

Annual Gift Tax Exclusion

- In the U.S., you can gift up to $17,000 per recipient (as of 2023) without triggering a gift tax.

- If you gift gold, the recipient assumes your cost basis, and they will be responsible for any capital gains tax upon selling.

If your recipient is in a lower tax bracket, they may pay a lower capital gains tax than you would. Looking for trusted gold storage and gifting solutions? Explore secure vault services to keep your assets protected.

Best Gold IRA for Low Minimum Investment. Click the banner below to Get Started

4. Pass Gold Through Estate Planning

If you plan to leave gold as part of your estate, your heirs can benefit from the “step-up in basis” rule.

How It Benefits Heirs

- When gold is inherited, the cost basis resets to its fair market value at the time of inheritance.

- If your heirs sell the gold immediately, they may owe little to no capital gains tax.

Estate planning tools such as trusts can help optimize tax efficiency and ensure smooth wealth transfer. To set up an estate plan that includes gold, consider consulting an estate planning attorney.

5. Invest in Gold ETFs and Mining Stocks

Instead of investing in physical gold, consider gold ETFs (Exchange-Traded Funds) or gold mining stocks. These investments typically receive more favorable tax treatment than physical gold.

Tax Advantages of ETFs and Mining Stocks

- Gold ETFs are taxed at the standard long-term capital gains rate of 15% or 20%, rather than the 28% collectible rate.

- Mining stocks qualify as standard equity investments and can offer tax benefits such as lower dividend tax rates.

If you want exposure to gold while reducing tax burdens, ETFs and mining stocks offer a smart alternative. Start investing today by exploring top-rated gold ETFs and mining stock platforms.

Final Thoughts

Avoiding capital gains tax on gold requires strategic planning, but it is entirely possible through legal means. Whether by investing through a Gold IRA, gifting, estate planning, ETFs, or trusts, the right approach depends on your financial goals.

If you’re serious about reducing taxes on gold investments, consider consulting with a financial advisor or tax professional to explore the best options for your situation. By implementing these strategies, you can maximize your wealth while minimizing tax obligations. Ready to take the next step? Explore tax-advantaged gold investment options today!

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com