Which States Do Not Tax Gold and Silver?

Gold and silver have been valued for centuries, not only as precious metals but also as a means of preserving wealth. Many investors turn to these metals as a hedge against inflation, economic uncertainty, and currency devaluation.

One of the biggest concerns for potential gold buyers is taxation. Some states impose sales tax on gold and silver purchases, while others have exempted these metals from taxation to promote investment and financial security. Presently, 32 states do not apply a sales tax to gold and silver sales.

This article explores how precious metals are taxed, why many states are removing sales taxes on gold and silver, and provides a breakdown of sales tax policies by state.

We will also discuss how you can invest in gold and silver using a tax-advantaged IRA to maximize your wealth. If you’re considering a purchase, make sure you understand the tax implications and shop with a reputable dealer to get the best value.

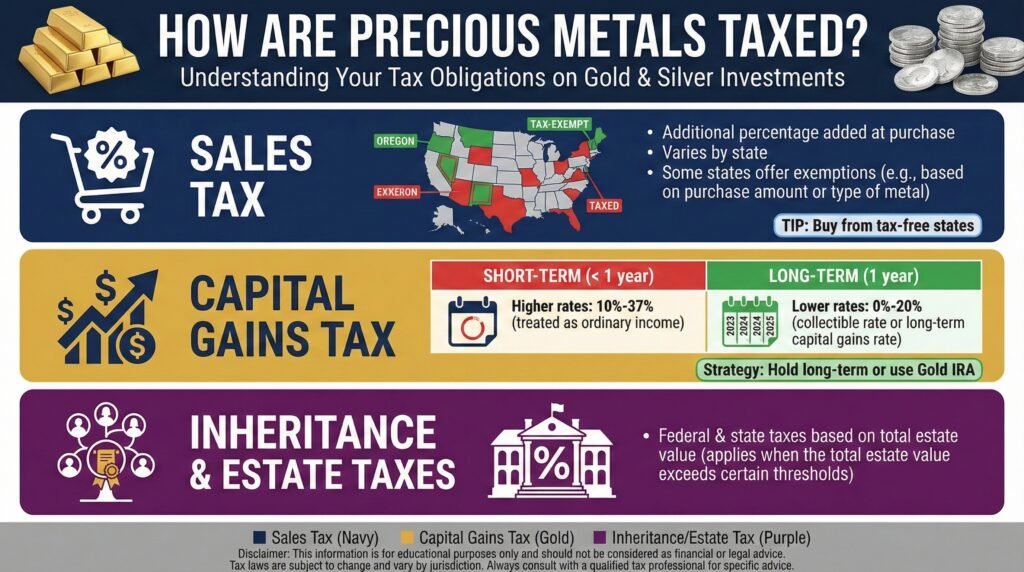

How Are Precious Metals Taxed?

Understanding how gold and silver are taxed is crucial for investors. Depending on where you live, purchasing and selling precious metals can incur different types of taxation, affecting your overall returns. Here are the primary ways precious metals are taxed:

Sales Tax

Many states impose a sales tax on goods, including precious metals. When purchasing gold or silver, buyers in these states may be required to pay an additional percentage on top of the purchase price. However, some states have chosen to exempt these metals from sales tax to encourage investment.

If you’re looking to buy gold and silver without unnecessary taxes, check if your state offers exemptions or consider purchasing from an online dealer that ships from a tax-free state. You can find trusted gold and silver dealers here.

Capital Gains Tax

When you sell gold and silver for a profit, the IRS considers it a taxable event. Capital gains tax applies to any increase in value from the time of purchase to the time of sale. This tax rate depends on how long you have held the asset:

- Short-term capital gains tax (for assets held less than a year) is taxed at regular income tax rates.

- Long-term capital gains tax (for assets held over a year) is typically taxed at a lower rate, ranging from 0% to 20%, depending on income level.

To minimize capital gains taxes, consider holding your investments long-term or using a tax-advantaged account like a Gold IRA.

Inheritance and Estate Taxes

If gold or silver is part of an inheritance, it may be subject to estate taxes. The federal government and some states impose estate taxes based on the total value of the estate.

Why Many States Are Removing Gold and Silver Sales Tax

Over the past decade, there has been a growing movement to remove sales tax on gold and silver. States recognize that taxing these metals creates an unnecessary financial burden on investors and discourages economic growth. Here’s why many states are eliminating sales taxes on precious metals:

Promoting Sound Money Policies

Many states view gold and silver as real money rather than just commodities. By removing sales tax, they align with the principle that money should not be taxed when exchanged for another form of money.

Encouraging Investment

Precious metals serve as a safe haven during times of economic uncertainty. Eliminating sales tax makes investing in gold and silver more attractive, helping individuals diversify their portfolios and protect their wealth.

If you’re considering diversifying your investments, purchasing tax-free gold and silver is a smart way to preserve your wealth. Research tax-friendly states and buy from reliable sources. Compare the best gold and silver dealers here.

Boosting Local Economies

States that remove sales tax on gold and silver often see an increase in business activity, particularly in the precious metals industry. More investors buy and sell within the state, boosting revenue for local dealers.

Competing with Neighboring States

When one state removes sales tax, investors often cross state lines to purchase tax-free gold and silver. As a result, other states follow suit to remain competitive.

Sales Tax on Gold And Silver by State

The taxation of precious metals varies widely across the United States. Below is a breakdown of which states do not tax gold and silver and which still impose sales tax on these metals.

States That Do NOT Tax Gold and Silver

The following states have fully exempted gold and silver purchases from sales tax:

- Alaska

- Arizona

- Arkansas

- Colorado

- Florida

- Idaho

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Michigan

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- West Virginia

- Wisconsin

- Wyoming

If you live in one of these states, you can buy gold and silver without worrying about sales tax. Take advantage of these tax benefits by purchasing from a local or online dealer based in a tax-free state.

In addition to choosing the best state to maximize your gold investment, another tax-advantaged means of owning physical gold without the need or liability of storing the precious metal in your residence is a gold IRA.

Gold IRA companies provide investors with competitive pricing, a reasonable buyback guarantee, lifetime customer support, and secure storage of their gold and silver.

To learn more about how gold investing can protect your long-term wealth and the advantages of tax-deferred gold IRAs, click the banner below to access and download American Hartford Gold’s free gold IRA guide to make sure you are aware of all aspects of the gold IRA process:

States That Still Tax Gold and Silver

Some states still impose sales tax on gold and silver purchases. The tax rate and exemptions may vary, but generally, these states include:

- California (Exempts purchases over $1,500)

- Connecticut

- Georgia

- Hawaii

- Illinois

- Indiana

- Maryland

- Massachusetts

- Minnesota

- New Jersey

- New Mexico

- New York

- Rhode Island

- Vermont

- Washington

If you’re in a state that taxes gold and silver, consider making your purchases from a tax-exempt state or online to avoid unnecessary costs.

Invest in Gold and Silver Using a Tax-Advantaged IRA

One of the most effective ways to invest in gold and silver while minimizing taxes is through a Precious Metals IRA. This type of retirement account allows you to purchase physical gold and silver while enjoying tax benefits similar to traditional IRAs.

Benefits of a Precious Metals IRA

- Tax Deferral – With a traditional IRA, you defer taxes on gains until you take distributions.

- Tax-Free Growth – A Roth IRA allows tax-free withdrawals if eligibility requirements are met.

- Wealth Preservation – Gold and silver help protect against inflation and economic downturns.

How to Set Up a Gold or Silver IRA

- Choose a Custodian– Not all IRA providers offer precious metals investments. Look for a custodian that specializes in self-directed IRAs.

- Fund Your Account– You can roll over an existing retirement account or make new contributions.

- Select Your Metals– The IRS requires IRA-approved gold and silver to meet specific purity standards.

- Secure Storage– Your metals must be stored in an IRS-approved depository for compliance.

Finding the right gold and silver IRA company for your individual needs is critical. For example, if you require a low investment minimum to start a or silver IRA, Birch Gold Group or American Hartford Gold would be two choices to consider.

However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive silver prices as well as life-time customer support, then Augusta Precious Metals would be a good fit.

For a highly personalized experience, National Gold Group is a family-owned gold and silver IRA company that offers a low minimum investment, no-fee buyback policy, and great educational resources for its clients.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Final Thoughts

With more states eliminating sales tax on gold and silver, investing in these metals has become more accessible and cost-effective. If you’re looking to buy, make sure you research reputable dealers and take advantage of tax-friendly options. Consider opening a Gold IRA for additional tax benefits and long-term wealth preservation.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Click the button below:

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com