Does Rolling Over A 401k to an IRA Count As a Contribution?

Are you considering rolling over your 401(k) into an IRA? It could be a great way to access different investment options and potentially pay less in management fees. But before you do it, you should know whether such a move counts as a contribution or not.

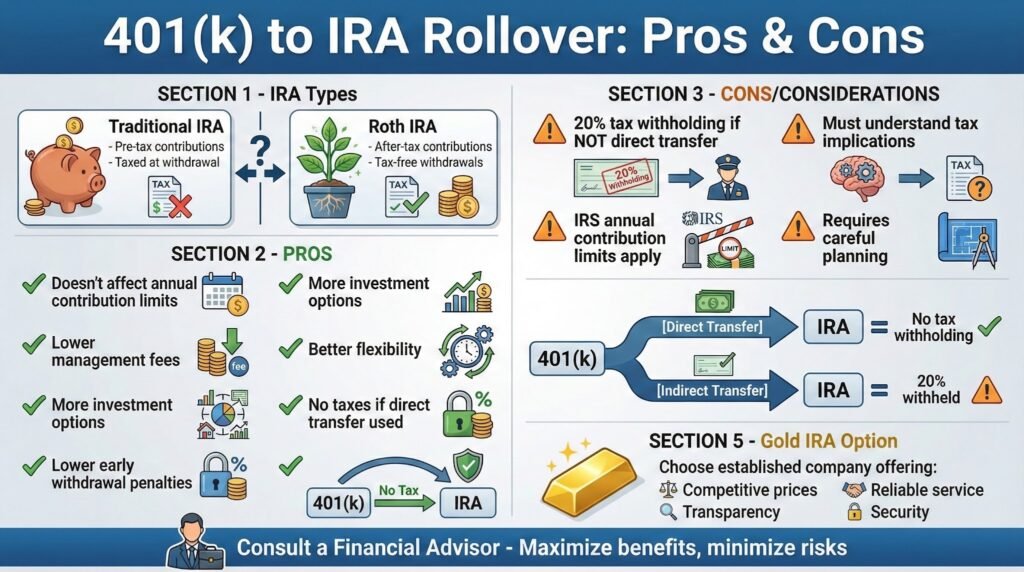

The short answer is no, a 401k rollover to an IRA, or a gold IRA in this case, does not count as a contribution. Account rollovers and direct transfers are considered separately from annual contributions. \

However, knowing the rules and regulations around 401(k) rollovers, along with their tax implications and advantages, is key. To fully understand this subject, we will answer common questions such as:

-Should I keep my 401k or roll it over to an IRA?

-What are the pros and cons of rolling over a 401k into an IRA?

-If I roll over my 401k do I pay taxes?

-What happens if you don’t roll over 401k within 60 days?

-What are the advantages of rolling over a 401k to an IRA in retirement?

If you are interested in rolling over your existing retirement account into a gold IRA, we will also provide retirement resources from reputable companies that we have researched and vetted. So read on to learn more about rolling over your 401(k).

To get started on your gold IRA investing journey right now, tap the banner below to be taken to Augusta Precious Metals’ official site to access a free gold IRA checklist:

Should I Keep My 401k or Roll It Over To An IRA?

Discovering how to best manage your retirement savings can be a complex task, but understanding the options available to you is key to making sure your money works for you.

One option that may be beneficial for some people is rolling over their 401(k) into an IRA. Rolling over a 401(k) does not count towards your annual contribution limit, and it can offer tax advantages such as avoiding penalties and possibly paying less in management fees.

It’s important to note that reporting 401(k) rollovers as income on your taxes can affect your ability to contribute to a Roth IRA. Additionally, rolling over funds must be completed within 60 days, and 20% of the amount is withheld for taxes.

Direct transfer is recommended when planning a 401(k) rollover, so things go smoothly; however, it can still be confusing, so talking with a financial advisor may help minimize potential tax liability.

IRAs are another way to save for retirement, offering different benefits such as traditional IRAs, allowing for tax-deductible contributions, and Roth IRAs, providing tax-free withdrawals in retirement. However, there are annual contribution limits imposed by the IRS that should be taken into account when deciding which type of IRA fits best with your plans.

What Are the Pros and Cons of Rolling Over a 401k Into an IRA?

The advantages and disadvantages of rolling over a 401k into an IRA will largely depend on your present goals and immediate needs. That will, in turn, determine the type of IRA you choose.

Understanding the basics of IRAs can help you make more informed decisions about your retirement planning and ensure that your savings are optimized for maximum return on investment.

Traditional IRAs allow you to contribute pre-tax income, meaning you don’t pay taxes until you start withdrawing from the account in retirement. Roth IRAs offer tax-free withdrawals in retirement; however, they require after-tax contributions.

The IRS imposes annual contribution limits on retirement plans like IRAs, so be sure to check with them before contributing.

When it comes to converting funds from a traditional IRA to a Roth IRA, this may provide significant tax benefits if done correctly.

It’s important to understand how taxation works when making this conversion, as it could affect your ability to contribute annually and maximize your return on investment.

Be sure to talk with a qualified financial advisor when considering an IRA rollover or conversion – they can help ensure that you’re taking full advantage of all available options while minimizing potential liabilities.

You can benefit from rolling a 401(k) into an IRA, as it won’t affect your annual contribution limit and could help you pay less in management fees. An IRA offers more flexibility than a standard 401(k), allowing you to access a wider range of investments and potentially better returns.

You may also be able to avoid paying taxes on the amount rolled over if the funds are transferred directly between accounts, saving you money and time when filing taxes.

Additionally, IRAs don’t have the same early withdrawal penalties as 401(k)s, so you’ll be free to use your funds without incurring heavy fees.

One important consideration when rolling over a 401(k) is that 20% of the amount needs to be withheld for taxes unless it’s done through direct transfer.

This means you need to make sure there’s enough money in the account being rolled over to cover any potential tax liability that could result from cashing out all or part of your retirement savings.

Talking with a financial advisor can help minimize these risks and ensure that all appropriate steps are taken during the rollover process.

It’s important to take your time when making decisions about how best to manage your retirement funds, as these decisions have long-term implications for your future security. Doing research on different options available for investing or reaching out for professional advice can help provide clarity on what will work best for your unique situation and goals.

Finding the Best Gold IRA Company for Your Needs

When weighing the advantages and disadvantages of rolling over an existing account into a gold IRA, choosing a long-established and trusted gold IRA company that understands the many rules is key.

Also, a dedicated gold IRA company can provide competitive prices, transparency, reliable customer service, and security of your precious metals.

Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs, whether you prefer a gold IRA or choose to own the physical gold in your place of residence.

Tap the banner below to visit Noble Gold Investments to receive their gold IRA guide

If I Roll Over My 401k Do I Pay Taxes?

Rolling a 401(k) into an IRA can save you from hefty taxes and penalties, and give you access to more investment options. It’s important to understand the tax implications of a 401(k) rollover before making the move. Here are some key points to keep in mind:

– Rolling over a 401(k) may not count against your annual contribution limit, but it must be reported as income on your taxes.

– Converting traditional IRA funds to a Roth IRA can provide tax benefits but may be subject to income limits.

– A direct transfer is recommended when rolling over a 401(k), as it helps avoid any potential tax liabilities.

It’s also important to seek advice from qualified financial advisors before taking any action with your retirement accounts. Advisors can help you understand any associated fees or other costs, which could affect the amount of money you have available for retirement savings.

They can also guide you through the process of rolling over a 401(k), so that you get all the advantages without any surprises come tax time.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles. See the buttons below to access these calculators and start protecting your wealth today.

What Happens If You Don’t Roll Over 401k Within 60 days

When it comes to rolling over a 401(k), timing is key – you’ll want to complete the rollover within 60 days in order to avoid tax penalties or other costs.

As part of the rollover process, 20% of the amount will be withheld for taxes and must be reported as income on your taxes. That’s why it’s important to start preparing ahead of time so you have enough time to go through all the steps and double-check paperwork.

If you’re considering rolling over your 401(k) into an IRA, make sure that you understand all of the implications and compare fees from both accounts.

An experienced financial advisor can help guide you through this process, answer questions, and ensure that everything gets done correctly. Additionally, they can provide helpful advice about which type of retirement account makes sense for your individual situation.

Rolling over a 401(k) might seem like a daunting task at first glance but with a little bit of planning and research, it doesn’t have to be complicated.

Just remember that completing a rollover within 60 days is essential if you want to minimize any potential costs or liabilities associated with the transaction.

What are the Advantages of Rolling Over a 401k to an IRA in Retirement?

Making the switch to an IRA can save you money and open up a world of opportunities for your retirement. An IRA is often more cost-effective than leaving your 401(k) behind, as it can spare you from higher management fees.

Additionally, rolling over a 401(k) to an IRA does not count towards your annual contribution limit, allowing you to make larger contributions if desired. When rolling over funds to an IRA, you’ll also get access to different investment options that may suit your needs better.

Not only will switching to an IRA help you save money in the long run, but it can also offer tax advantages. By converting traditional IRA funds into a Roth IRA, you could benefit from tax-free withdrawals in retirement – something that isn’t available with many other types of accounts.

Furthermore, cashing out a 401(k) can result in taxes and penalties; however, these won’t apply when doing a rollover into an IRA.

It’s important to understand the process of rolling over funds before making any decisions – otherwise, you might find yourself dealing with unexpected fees or taxes down the line. Talking to a financial advisor can be helpful for ensuring that the transition goes smoothly and that all potential liabilities are understood ahead of time.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Conclusion

You’ve seen the advantages of rolling over a 401(k) to an IRA, as well as the tax implications and timeframe involved. Now, it’s time to decide if this is the right move for you.

Perhaps you are nearing retirement, already in retirement, or a senior citizen curious about gold IRA investing. Consider consulting with a financial advisor or retirement planning expert to make sure you have all the facts before making any decisions. With their help, you can ensure your retirement savings are invested wisely and set yourself up for success in your golden years.

Obtain a gold IRA guide and talk to a broker

More Featured Articles

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com