How Much Do I Need to Start Investing in Gold?Ask Successful Investors – Part 2

A constant question when investing in gold is ‘How much do I need to allocate to start investing in gold’. The general rule for inflation hedging and asset loss is an allocation of 10% of one’s investments should be allocated to gold and precious metals.

However, this gold allocation amount can vary depending on who you ask. Also, the larger economic milieu will also dictate how much, at any one time, a person should be allocating to gold, as a percentage of their investment portfolio.

In this article, we will discuss some gold allocation examples from popular and successful investors. As the adage goes, ‘success leaves clues’.

Jim Rickards

Jim Rickards is an American lawyer, economist, investment banker, speaker, media commentator, and New York Times bestselling author on matters of finance, geopolitics, and precious metals.

Rickards maintains that investors hold 10% of their portfolio in gold as a hedge against currency devaluation and market volatility. He has also disclosed that he personally holds up to 20% of his portfolio in gold and gold-related investments.

He states that the increasing instability of the dollar’s reserve currency status in global trade and the rising BRICS-plus nations’ desire to de-dollarize in favor of hard assets like gold will effectively drive up the price of gold.

Gold, due to its scarcity, value, and historic ability to establish trust, will likely continue to be used as a means of settlement among eastern nations, further distancing itself from the US dollar. Given 2022 and 2023’s record mass purchasing of gold by central banks, there appears to be a race for the precious metal,l and therefore will continue pushing the price upward.

Rickards has warned of this currency war for years, and we are starting to see the beginnings of what has been described popularly as the gradual de-dollarization.

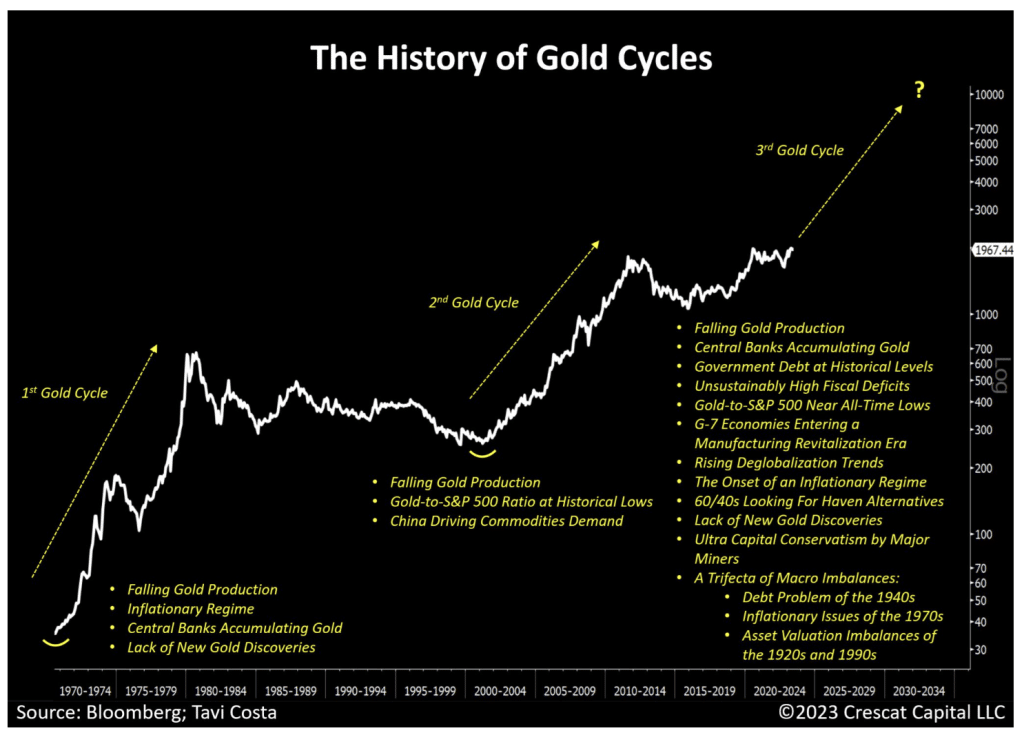

Tavi Costa

Global Macro Analyst at Crescat Capital and a guest speaker to the International Monetary Fund expects a rapid re-emergence of inflation similar to the stagflation environment of the 1970s and 80’s. He is a proponent of owning a variety of commodities, with gold being the largest percentage.

As a result of the trend of foreign central banks moving from US treasuries to gold as a reserve, the eventual resurgence of inflation, unsustainable corporate and sovereign debt, and overvalued equities is expected. He sees the standard portfolio shifting to 20 – 30% in gold, as a growth asset, not just a defensive asset.

Global central banks’ policy reversal from US treasuries to gold purchases signals a return to historical averages where central banks hold 40-percentage ownership of gold relative to international reserves, similar to the 1970s.

This would require the addition of 3.2 trillion of gold purchases, which would result in a 25 percent increase in the value of gold above ground. This alone would push gold prices to record levels.

Historically, when this trend among central banks owning hard assets such as gold occurs, smaller institutions, 60/40 portfolios, patient funds, and endowment funds start to trend in that direction, similar to what was seen in the 1970s.

In his view, betting against gold assumes that the compounding national debt and federal deficits are going to be resolved soon. One does not need to be overly cynical to believe that there is a very low likelihood of that happening.

Tavi maintains that if the rationale for owning US Treasuries today is solely based on the premise that the system cannot endure substantially higher interest rates, then gold is a far superior choice, as will be explained further.

He points out, along with macro-economic expert Luke Grommen, that the long-standing correlation between gold prices and real interest rates will decouple over the next decade, similar to what was seen in the recessionary times of the 1970s. In the 1970s, 10-year yields were rising right alongside gold prices.

The reasons for this long-standing correlation breakdown are the recent demand for gold being pulled back into the system as a primary central bank reserve asset, the increased solvency risk due to unserviceable sovereign debt with the combined high-interest rates, and the historic debt-to-GDP ratio of 120% and rising. These dynamics lead to fiscal dominance risk, which creates very secular inflation.

Rising rates are no longer negative for gold as these variables increase.

When you add the risk of national debt default, and the resurgence of inflation driven by the government/fiscal spending side, which the Federal Reserve cannot control, the real rate and gold price correlation part ways. This adds immense stress to the treasury markets.

Gold is a neutral asset, with no counterparty risk that also carries centuries of credible history as a safe haven and monetary alternative.

Leveraging the expertise of investment and macroeconomists like Tavi Costa is important when embarking on any new investment path.

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key.

Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and financial setbacks.

Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital

Gold IRAs provide additional advantages over merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

If you are a serious investor and have 100K in savings. Attend Augusta Precious Metals’ free educational web conference hosted by Harvard-trained economic analyst Devyln Steele. Click the Banner below to get started today.

Naguib Sawiris

One of Egypt’s wealthiest men, Orascom TMT Investments Chairman and CEO Sawiris, holds about a quarter of his wealth in gold and recommends holding 20-30% of your portfolio in gold. The billionaire even launched a $1.4 billion gold mining fund and sees gold as a buffer against market risks.

Robert Kiyosaki

Millionaire real estate investor and founder of Global LLC and Rich Dad Company has publicly stated that he has allocated around 10% of his portfolio to gold as a hedge against currency debasement and political risk.

He believes gold and silver are wise hedges against inflation and unpredictability, and he suggests people buy them over paper assets.

Kevin O’Leary

The famous investor from the ABC Show “Shark Tank” and chairman of O’Leary Capital has publicly stated on YouTube that he keeps 5% of his portfolio allocated to gold at all times, with annual rebalancing.

Recently quoted at the beginning of 2023 ‘Gold over a very long period of time has proven to make very big moves in very short periods of time…’

Kevin typically does not own gold mining stocks and prefers physical and well-managed ETFs. It is Kevin’s opinion that the mining stock is a bit too volatile due to poor management.

Notable Mentions

Sam Zell

The late real estate titan with an estimated net worth of $5.5 billion, Zell believed in buying gold as a hedge against inflation and other risks.

He bought gold for the first time in January 2019, stating that it was a good hedge. Before the first purchase, Sam Zell had been a vocal critic of buying gold as a hedge against inflation.

He has said that he never saw the appeal of gold as it doesn’t generate any income and requires storage expenses, but the current debasement of currency due to rising inflation has made him reconsider.

He expressed concerns about the global governments resorting to “printing money” to mitigate the economic impact of the COVID-19 pandemic and compared the current economic situation to that of the 1970s.

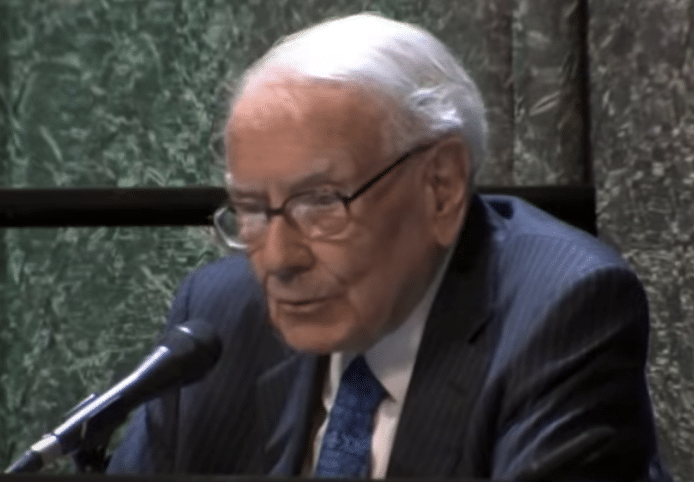

Warren Buffett

The world’s fifth-richest man, who once scoffed at the idea of owning gold but made exceptions for silver, surprised many investors with Berkshire Hathaway’s substantial purchase of US$565 million in shares of Canadian miner Barrick Gold.

Michael Burry

Famous for predicting and profiting from the great financial crisis, he stated recently “Long thought that the time for gold would be when crypto scandals merge into contagion,” Burry said.

To get started with your specific portfolio gold and silver investment allocation, see the links below to access the free investment guides from the best gold IRA companies that we have personally researched and vetted.

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com