What is H.R. 9157 – Gold Standard Restoration Act?

And Why Was the Gold Standard Important?

As stated quite succinctly in the title of the bill: H.R. 9157 – To define the dollar as a fixed weight of gold, and for other purposes. But to better understand H.R. 9157 , the Gold Standard Restoration Act, it is necessary to review the history of the gold standard and why it was so important.

Stated simply, the gold standard was a monetary system where the value of a country’s currency was directly linked to and backed by the physical precious metal, gold. H.R. 9157 seeks to reinstate this crucial component of the U.S. currency. The Gold Standard can be explained with the following points:

- What is the gold standard, and why was the Gold Standard Act important?

- Why did the U.S. abandon the gold standard?

- What would happen if we returned to the gold standard?

- Would H.R. 9157: The Gold Standard Restoration Act Pass?

What is the Gold Standard and Why Was The Gold Standard Act Important?

As stated in the introduction, the gold standard is a monetary system in which a currency’s value is tied to a fixed weight of gold at its market price.

The gold standard enforces controls over the issuance of money and, therefore, the expansion of the money supply. By virtue of this direct relationship between the currency and this physical, tangible asset, inflation as well as deflation can be avoided. Thereby creating a more stable economic environment.

Introduced in October 2022 by Republican Congressman Alex X. Mooney, H.R.9157 proposes returning the U.S. dollar to a gold standard. Federal Reserve notes, or dollars, would be exchangeable with and fully redeemable for gold at the new fixed price.

In 1933, President Herbert Hoover once famously stated, “We have gold because we cannot trust governments.” The gold standard, in essence, hinders the government’s ability, in this case, the United States, to devalue the currency and takes the control of the country’s money supply out of the hands of imperfect human beings.

Re-pegging the dollar to gold addresses the many ‘front of mind’ pain points that Americans have been confronting more recently, but in all honesty, have been occurring for years.

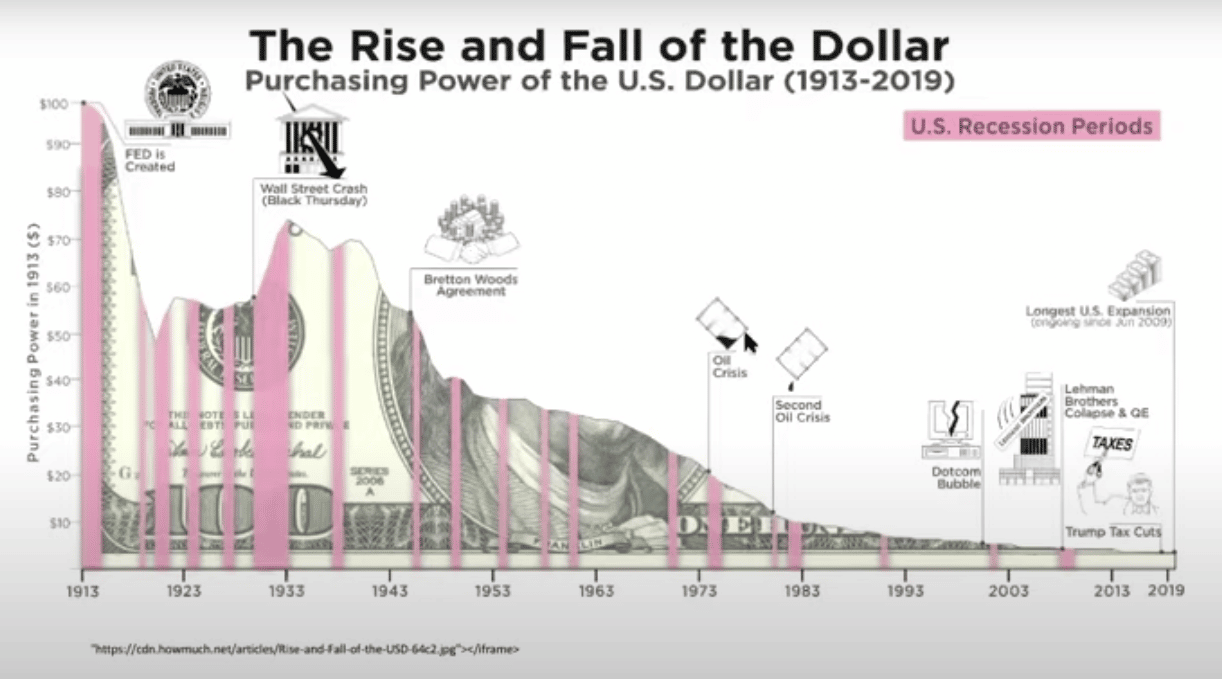

Since the abandonment of the gold standard, Americans have been saddled with stubborn inflation now at historic highs, runaway federal debt exacerbated by increased government spending, and monetary system instability.

Why did US abandon gold standard?

To give a brief summary, the U.S. abandonment of the gold standard came out of a culmination of historical events that eventually led to the abandonment of this monetary system and the adoption of the fiat currency system we have today.

With the end of the First World War in 1918, the aftermath left many governments in debt and in financial ruin.

This led to the loosening of the practice and enforcement of the gold standard among many nations. With the inevitable expansion of the global economy, the gold standard provided less flexibility for each nation to increase its money supply through its respective central banking system.

The stock market crash of 1929, along with the inability of governments to manage the crisis through interest rate hikes in order to protect their stock of gold, only worsened the global economy. In 1931, Britain would stop using the gold standard, and the U.S. quickly followed in 1933.

Upon the end of World War II in 1945, the Bretton Woods Agreement was created by the Western Alliance nations. This agreement would provide a framework for the global currency markets for the next 25 years.

As a mandate of the Bretton Woods system, the U.S. dollar became the dominant world reserve currency. As a result, the dollar would be convertible to gold at a fixed rate of $35 per ounce.

The final ‘nail in the coffin’ of the practice of the gold standard in the United States came in 1971 under the direction of President Richard Nixon. It was originally declared as a temporary suspension of the convertibility of the U.S. dollar to gold.

As we well know, this ‘temporary’ measure is now surpassing 50 years. To paraphrase President Nixon, “Slamming the gold window shut” would appear to be a more apt description.

Upon historical reflection, it is reasoned that this move by President Nixon was to better fund the Vietnam War as well as compensate for the ever-diminishing gold supply that the U.S. held at that time. Essentially, the U.S. was spending more than there were gold reserves to back it.

As you can see from the chart below displaying the M2 money supply, it is evident just how much expansion has occurred since that time.

What would happen if we returned to the gold standard?

Enter H.R. 9157- Gold Standard Restoration Act

So, what would the H.R. 9157 do more than 50 years after the wholesale abandonment of the gold standard? As stated eloquently by Republican Congressman Alex X. Mooney, the core sponsor of H.R.9157, “The gold standard would protect against Washington’s irresponsible spending habits and the creation of money out of thin air.

Prices would be shaped by economics rather than the instincts of bureaucrats. No longer would our economy be at the mercy of the Federal Reserve and reckless Washington spenders.”

This statement echoes Herbert Hoover’s earlier sentiments regarding the collective trust of government, at least among more conservative-minded individuals.

I am sure many Americans, regardless of their political affiliation, can find common cause with Congressman Mooney’s harsh criticism of the present system and the sheer lack of fiscal sanity within Washington.

We as citizens have to live within our means; should the same rules not apply to government bodies? As seen in recent years, we as Americans bear the brunt of inflation, deflation, and excessive economic volatility.

In terms of providing for a more transparent government, H.R.9157 calls for what would effectively be an audit of the Federal Reserve in terms of the U.S. government’s gold holdings and gold-related transactions over the last sixty years.

“…the Treasury Secretary and the Board of Governors of the Federal Reserve shall each make publicly available… all holdings of, with a report of any purchases, sales, leases, and any other financial transactions involving gold, since the temporary suspension on August 15th, 1971, of gold redeemability obligations under the Bretton Woods Agreements of 1944.”

To determine what the price of gold would need to be to accurately peg and back our present money supply, it is a simple equation. Take the total amount of money in circulation, as seen in the M2 Money Supply chart seen above, and divide that number by the total amount of the U.S. Treasury’s stated gold holdings.

According to the most recent data provided by the Department of the Treasury Bureau of the Fiscal Service Status Report of U.S. Government Gold Reserve, the total U.S. government gold reserves are presently 261,498,926.241 fine troy ounces of gold.

To better illustrate this calculation, see the chart below. The resulting price per troy ounce in order to properly back the USD would be $81,893.26 at the present supply. If that number shocks you, it should.

This excessive price should show the average American just how much money printing has actually cost to this point.

Observing history, the United States return to the gold standard as it was practiced before its gradual and then final removal as a government policy would, in theory, enforce greater fiscal restraint and limitations on the U.S. government and the central bank’s ability to intervene in the economy.

There have been discussions about the Eastern alliance known as the BRICS (Brazil, Russia, India, China, South Africa) nations, creating a gold and commodity-backed currency. The BRICS currency will likely take the form of a settlement system before evolving into a concrete gold-backed currency. We will see how things develop in the coming years.

Would the H.R. 9157 – The Gold Standard Restoration Act Pass?

Will H.R.9157 Put America Back on the Gold Standard?

The question of whether the Gold Standard Restoration Act, H.R.9157, would pass into law may fall along ideological lines given the highly polarized environment of Washington D.C.

Given the most recent collective pain of historically high inflation felt by all Americans, there may be a even amount of pressure from constituents from both ends of the political spectrum.

Among the Republican Party, the Gold Standard Restoration Act would find a warm welcome among those in the Freedom Caucus and other long-time conservative advocates calling for a return to sound money and the resulting limitations in government spending that would result.

For those politicians on the more liberal side of the aisle who are proponents of greater government expansion, H.R.9157 may be a harder sell.

Fiscal irresponsibility and spending beyond its means have always been hallmarks of government.

But as history clearly shows, this pattern of government is all the more evident when viewing the graph below. The sharp rise in inflation and the constant eroding of the everyday American’s purchasing power are all too evident after the full abandonment of the gold standard.

Also, the rise and deployment of the five-nation gold-backed currency known as the BRICS currency could create numerous difficulties for the United States and the dollar’s international dominance.

A new, gold-backed currency could easily displace the fiat ‘faith-backed’ currency with relative ease due to the intrinsic value of a currency backed by a real, tangible, physical asset. We will be discussing the implications this BRICS currency will have for the U.S. dollar in future articles.

In summary, would the return to the Gold Standard be difficult and disruptive initially? Certainly.

It would be quite the task to stuff that government spending ‘genie’ back into the bottle, especially after it has been loose for over half a century. But I am sure many conservatives would argue that we are running out of roadway to kick that proverbial can any further.

The graph below quickly shows the rise in the value of gold since the exit of the gold standard in the early 1970s. One merely needs to flip this graph on its head, and this represents the spiraling descent of the value of the dollar over that period.

These circumstances may seem out of your control, but there are many ways to protect yourself and your hard-earned savings.

Read our reviews of the best gold and precious metals companies to better secure your IRA, 401k, or diversify your portfolio through private investments in gold and silver. Learn more here.

Gain more control over your wealth and hedge against the cycles of inflation as well as present and imminent recessions by attending a free gold and silver conference. Click the button below to get started.

If you have 100k in savings to protect and want to take advantage of the best prices, attend a gold educational webinar hosted by Augusta Precious Metals. Tap the button below:

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com