What is the BRICS Currency?

What Does It Mean for Gold and the U.S. Dollar?

To better understand what the BRICS currency is and its possible downstream effects on the dollar and, more importantly, its relationship with gold, it is necessary to expand on some fundamentals.

The BRICS currency, stated simply, is a consolidated reserve currency made up of the: the Chinese RMB Yuan, the Russian Ruble, the Indian Rupee, the Brazilian Real, and the South African Rand.

This list of the ‘basket of currencies’ from the five nations represents only the surface-level knowledge of the subject. A more thorough understanding of this new reserve currency can be explained by expanding on the following points:

- What is BRICS and its purpose?

- What is the BRICS currency backed by?

- How will this new currency affect international trade?

- What will be the new world reserve currency?

What is BRICS and Its Purpose?

The Great De-Dollarization and the Rise of Gold

This multi-nation alliance between China, Russia, India, Brazil, and South Africa is quickly rising to challenge the western powers who have maintained a hold on international trade and reserve currency dominance within the global markets.

Spearheaded by leaders Vladinir Putin, Xi Jinping, Narendra Modi, and Jair Bolsonaro, the BRICS currency will present a significant affront to the present holders of the most powerful currencies held by the G7 countries including the United Kingdom, Canada, Japan, the European Union and, more specifically, the long-held hegemony of the U.S. dollar as the world reserve currency.

To get an idea of the scale of the BRICS economy, the combined population of these five nations comprises over 40 percent of the world and is growing.

The BRICS total GDP is estimated at 31.5% of the world’s GDP and will likely rise to 50% by the year 2030. This is quite significant.

Given the share of the global economy, these nations presently and soon will encompass, will make the BRICS currency a major contender in the stage of international trade.

What should be truly troubling to the western nation’s position at the top of the international trade food chain is not the global economic share of these nations. The real damage to the strength of major Western currencies rests with what the BRICS currencies will be valued in.

What is the BRICS Currency Backed By?

Enter Gold-Valued Backing

In the BRICS 14th annual meeting in June of 2022, the announcement of this new global reserve currency was officially made.

Composed of the five-member BRICS nations, this semi-decentralized, highly stable currency exceeds the U.S. in terms of diversification. For example, if the South African economy experiences a slight downturn, the currency can still rely on the other four BRICS nations for stability.

By the same token, if the U.S. economy takes a hit, the U.S. dollar weakens, and the holders of this currency, domestic or international, are on the losing end.

We can quickly see the appeal of the BRICS currency by its ability to hedge against risk and, if necessary, absorb the ‘pain’ of losses elsewhere. This diversification essentially imitates what gold and precious metals do naturally within an investment portfolio.

This should serve as a lesson on the macroeconomic scale as well as at the micro-personal investment level.

The desire and necessity for a more stable and value-backed currency are all the more urgent, given the extreme volatility in the most recent years of the U.S. dollar as well as other global fiat currencies.

Not to mention compounding inflation that has been steadily rising over the last 50 years since these Western currencies were removed from the gold standard.

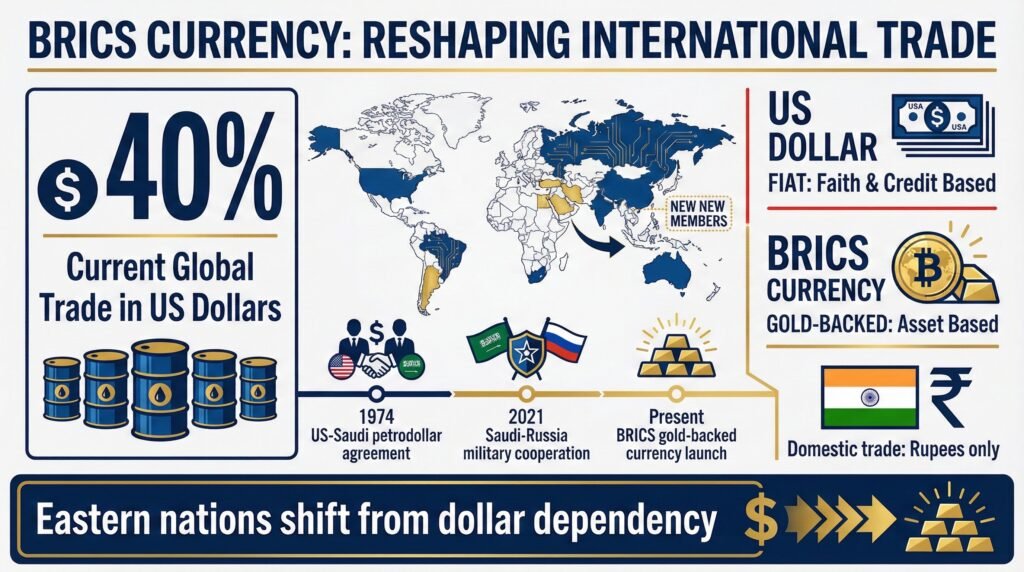

To this point, above all other reasons, the rising power of the BRICS currency will ultimately displace the U.S. dollar as the world reserve currency because it would be valued and backed by physical gold.

As you may already know, the U.S. dollar, as well as the numerous other G7 currencies, are fiat and are backed by the ‘faith’ and ‘credit’ of the government and central bank that produces them.

With mounting inflation within these debt-fueled Western economies in which these fiat currencies reside, this does not paint a pretty picture moving forward. The shift away from fiat to a better alternative by Eastern nations has only just begun.

How will this new currency affect international trade?

Trade with Gold Valued Currency or Faith-based Fiat?

Presently, nearly 40% of international trade transactions are conducted in the U.S. dollar. More importantly, the buying and selling of crude oil. This is due to change in the very near future with the adoption of the BRICS currency.

Soon, the BRICS alliance will not just be limited to these five nations. Even prior to the two main BRICS nations, China and Russia, announcing the newly issued gold-backed currency, many countries have been signaling their desire to de-throne the U.S. dollar as the world reserve currency.

Reports suggest countries such as Saudi Arabia, Egypt, Iran, Argentina, and Turkey are now considering joining the BRICS nations.

Saudi Arabia has already signaled their intentions to join the BRICS nations and a movement away from the U.S. dollar as the chosen reserve ‘petrol dollar’. This is significant. In 1974, the U.S. dollar’s ‘petrol dollar’ reserve status was granted in exchange for the protection of the Saudi kingdom by the United States.

The day after the United States clumsy and questionable withdrawal from Afghanistan, Saudi Arabia announced a joint military cooperation agreement with Russia, a BRICS member. Hence, this 1974 U.S.-Saudi agreement is now tenuous at best.

India, another BRICS member, for which the United States is their largest trading partner, recently announced that all domestic trades will be done in rupees, not dollars.

As mentioned in our article, What is the digital dollar? , China’s digital yuan has already been gaining ground. In the last two years alone, the yuan has settled all the Belt and Road trades and has conducted over 12 billion in successful transactions.

The Chinese yuan is just one of a basket of currencies within this gold-backed BRICS denomination.

Energy and commodity-producing countries within the east have long been beholden to the U.S. dollar, and they have looking for a way out for quite some time. They have now found it.

Be it international settlements or just mere domestic commerce, it would seem unreasonable when faced with the choice of either transacting and holding money that is fiat versus another currency that is tied to value, that one would choose the former over the latter. I would pose the same question to the reader.

Would you prefer a payment for an exchange of service with money-backed ‘faith and credit’ or a hard-tangible asset like gold that can be easily converted? It is not a difficult choice to make.

What Will Be the New World Reserve Currency?

BRIC vs. USD = Gold vs. Faith

Historically, the dollar has always been seen as a ‘safe bet’ and has maintained its dominance for the aforementioned reasons enumerated in this article.

At the time of writing this article, the dollar is considered ‘strong’ when compared to other world currencies, experiencing the weight of inflation and over-leveraged debt, namely European countries.

Presently, the dollar is the ‘prettiest mare in the slaughterhouse’. Countries will buy and hold U.S. treasuries because there are no other competitive alternatives. Until there is.

As mentioned earlier in this article, the 1974 agreement for the U.S. dollar as the reserve oil trading currency was established in exchange for the protection of the Saudi kingdom by the United States.

This is the main reason almost every country on the planet has had to own its own dollars to buy and trade oil for the past 50 years. Now, Russia is protecting Saudi Arabia with a joint military cooperation agreement.

If and when Saudi Arabia decides to join the BRICS nations, as they have indicated they have, the country, as well as OPEC, will be free to sell oil in other currencies: yuan, ruble, rupee, euro, etc.

Once that happens, the dollar gets dumped. This exit from the ‘petrol dollar’ will not be overnight, but it is well in our collective American interest to be prepared. This one shift alone could send dollars flooding back to the U.S., resulting in greater inflation, possibly hyperinflation.

As an American, it gives me no pleasure to write and report on such news. Sometimes, tough love is the best love, and hard truths are the best truths.

In all dramatic fashion, this could best be described as a war not fought by guns, but by currencies. The United States and its various Western allies have become comfortable with the status quo and therefore ‘fell asleep at the wheel’.

This challenge of dominance has begun, but the victor will not be evident immediately. But the recent conflicts in Europe have only sped up the process.

The expected and deserved sanctions against one of the BRICS nations, Russia, have quickened the urgency for other nations to find alternatives outside the Western trading system.

When Russia was pushed out of SWIFT as a result of the invasion of Ukraine, many nations were left wondering, ‘Are we next?’, and ‘Will we have our assets frozen?’ This continued escalation will continue to accelerate the move of the eastern nations to the diversified, gold-valued BRICS reserve currency.

What Can We As Investors Do To Prepare?

The BRICS nation’s proposal of a collective, diversified, gold-backed currency, reveals a very sad and almost embarrassing irony. This irony is, a staunch, communist country such as China and a formerly communist nation such as Russia have a better concept and understanding of sound money than the western ‘capitalist free-market’ western nations.

Certainly, there are many Libertarian arguments that the United States doesn’t have an actual ‘free market’. This will remain a conversation for another time.

There are calls in our U.S. Congress for the return of the U.S. dollar to the gold standard. Read here. However, I would not suggest waiting on the United States legislature to save us as a nation from hyperinflation and debt insolvency. D.C. will always move at the speed of D.C.

There are steps you can take as an individual investor, retiree, or someone just getting started. Read our list of the best gold and precious metals investment companies here.

If you are ready to get started, attend a free gold and silver web conference by clicking the button below.

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com