Precious Metals Investing and Gold IRA Company Reviews

Safegaurd your money and family in times of looming inflation and imminent recessions

ABOUT US

Precious Metals Investment Portfolio's mission

Our mission is to simplify the IRA rollover and precious metals investment decision-making process. We arm you with the latest economic and global marketplace information. Placing the control of your investment and retirement planning back in your hands.

We’ve seen a lot of economic volatility in recent years. Record inflation, COVID, supply chain shortages, poor monetary policies of central banks, an erratic stock market, geo-political instability, and another great recession have thrown uncertainty and doubt into our IRA investing and retirement planning.

A number of questions arise. Will I run out of money in retirement? Will I have to go back into a radically changing job market? How to survive inflation and what to buy before hyperinflation hits? Will my 30 to 40 years of hard work and savings go down the drain in less than 5?

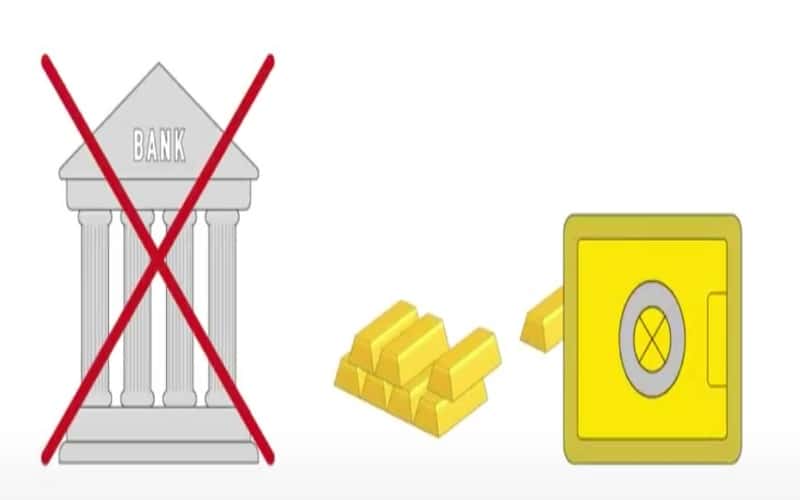

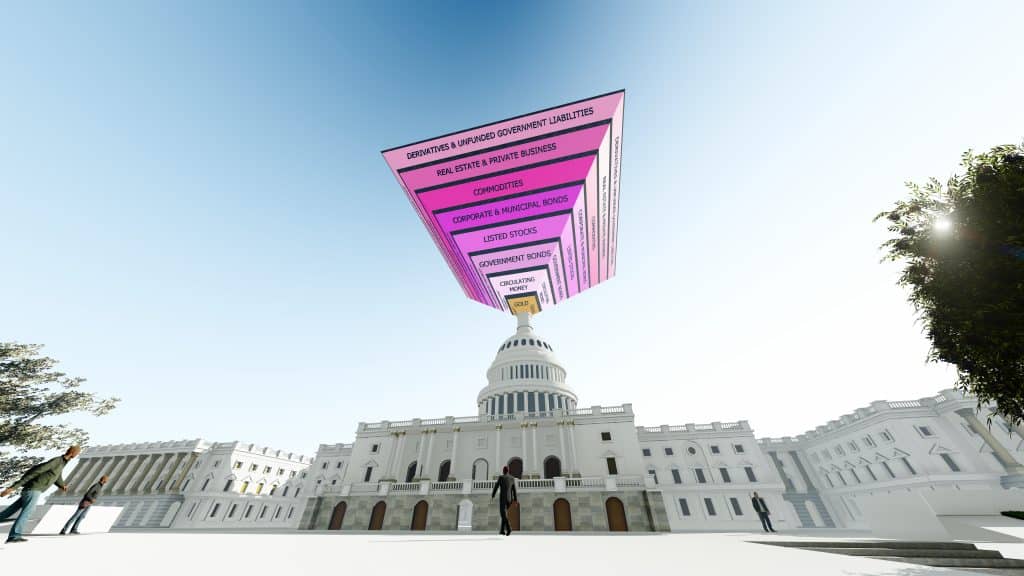

Placing your hard-earned retirement savings in the right place requires knowledge and, more importantly, trust. If you are a retiree or a serious investor, you know that having the lion’s share of your money and investments exclusively in stocks, bonds, and other paper assets can open you up to potential risk. With U.S. inflation surpassing historical highs and the possibility of hyperinflation always looming, the risk is even greater.

Fortunately, gold, silver, and other precious metal investments are the ideal way to diversify your portfolio and protect your wealth and retirement savings during unpredictable times. Since time immemorial, precious metals have been, and remain, a place of safety and a store of value for one's wealth. Given their time-tested stability, one can clearly see the benefits of investing in gold and other precious metals. Click the button below to read our latest gold company reviews so you can make the wisest choice for your retirement planning and private investments.

CATEGORIES

Will Your Retirement and Social Security Last?

Is Inflation Eating Up 40 years of Your Hard-Earned Retirement Savings and Government Benefits?

Who Is Investing In Precious Metals? - Educated Business Owners, Professionals, Preppers, Entrepreneurs, and Many Types of Retirees See the Benefits of Investing in Gold, Gold IRAs, and Precious Metals Diversification

Retirees from multiple professions like doctors, lawyers, pilots, dentists, and nurses as well as other skilled trades like electrical technicians, machinists, welders, carpenters, and plumbers are just some of the largest investors in precious metal retirement accounts. Whether as retired employees or independent small business owners or entrepreneurs, these investors understand the value of precious metals as a safe haven for their retirement savings.

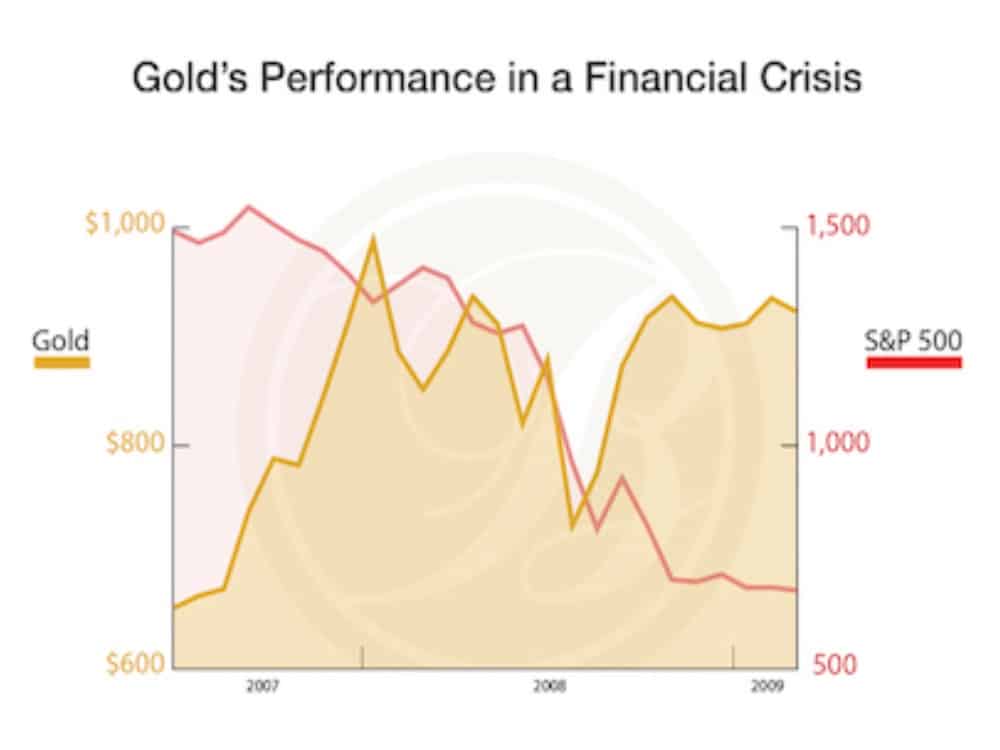

Educated investors are moving as much as 10 to 20% of their retirement assets into gold, silver, and other precious metals to insulate and safeguard their wealth from a tidal wave of inflation and a possible recession much like the one seen in 2008.

Best Gold Lease and Bond Investment Company

Monetary Metals Review

Best Investment Company for Gold and Silver Lease Fixed-Income Products and Gold Bonds

√Competitive Interest Yields on Gold and Silver Leases

√Paid Interest Earnings Paid in Gold

√Provides Gold Bonds for Accredited Investors

√Free Storage and Insurance for Non-Leased Metals

√Proven Performance and History Since 2016

Precious Metal Company Reviews

Choose the Best Precious Metal IRA Company Your Wealth Protection

Best Gold IRA Company for High Networth Investors, Prices, and Educational Resources

Augusta Precious Metals Review

√Best pricing in the industry

√Excellent buyback policy.

√1000s of 5-star ratings. Positive Reviews with the BBB, BCA, and TrustLink. Money magazine's "Best Overall" Gold IRA Company in 2022

√Simplified and streamlined IRA rollover process.

√Great educational resources. Unique, free one-on-one web conference call with Harvard-trained economist Devlyn Steele.

Click the banner below to access Augusta Precious Metals' free gold promotion when you open a gold IRA account and receive a free Ultimate Gold IRA guide

National Gold Group Review

Best Precious Metals IRA Company for Low Investment Minimums, Buyback Policy, and Education

√Low minimum investment

√Excellent buyback policy.

√Extensive educational resources

√Simplified and streamlined IRA rollover process.

√ Investment consultation services are available.

Click the banner below to access National Gold Group's free gold promotion when you open a gold IRA account and receive a free Ultimate Gold IRA guide

Birch Gold Group Review

Best Precious Metals IRA Company for Trust and Conservative Retirees

√Ranked #1 for customer service

√Platinum and palladium precious metals are available.

√Wide range of gold IRAs with metals from around the world.

√Established trust backed by nearly 20 years in the marketplace

√Numerous conservative partners and endorsements

√Known for their solid expertise in the gold IRA industry.

American Hartford Gold Review

Best Gold IRA Company for Price Match Guarantee and Buyback Commitment

√Competitive

√The buyback program is the best in the industry

√Excellent customer support and client retention

√Wide range of precious metals to choose from around the world

√Complete cost disclosure before the final sale.

Noble Gold Review

Best Precious Metals IRA Company for Storage and Product Diversity for Independent-Minded Investors

√User-friendly online navigation to easily start investing

√Secure Texas state-segregated storage

√Platinum and Palladium investments are available

√Gold and Silver IRAs available in the form of a Roth or Traditional IRA

√Perfect for independent-minded investors who want more control of their investments.

√First year fees are also waived for qualifying IRAs.

Click the banner below to get Noble Gold's free guide

See the Buttom Below to Read More Indepth Precious Metals IRA Company Reviews

Is Gold Considered a Risky Investment?

Gold is considered a safe investment. Historically, gold has played the role of a safety net, asset insurance, and wealth protection in case of financial crashes, panicked markets, economic downturns, or major geopolitical threats.

Gold is a natural hedge against inflation. Since time immemorial, gold naturally emerged and served as a medium of exchange until the arrival of the highly manipulatable paper and fiat currency. The yellow metal is still a rare and universal asset that seasoned investors have always held in uncertain times. No other financial asset can boast such trustworthiness and legitimacy.

Is Gold a Good Retirement Investment?

If you are concerned about soaring inflation, the future of the U.S. dollar, the next possible recession, and how all of this will affect your retirement savings...Then the answer is yes.

Gold and other precious metals act as a portfolio stabilizer and a store of wealth because they maintain their value over a long period. Gold’s purchasing power has remained stable and consistent over time, while the US dollar has lost 98% of its purchasing power since 1971. Inflation is on the rise, weakening the dollar. Typically, gold and silver have an inverse relationship with the dollar's buying power. Gold IRAs provide protection from stock market volatility, geopolitical instability, and weathering the inevitable cycles of inflation and recession. The winds can change very quickly and preparation is key.

When is a Gold IRA Not a Good Investment?

If you are planning on using your IRA for day-to-day living expenses, then a gold IRA may not be the right fit for you. Stated simply, gold is for holding.The purpose of gold or other precious metals investments is a kin to maintaining a car or home insurance policy. You do not use the insurance actively on a daily basis. The policy is there for your protection in case you need it. By the same token, precious metals are present in your portfolio for diversification and hedging against losses elsewhere, be it in stocks, bonds, and paper assets.