Are All Free Gold IRA Kits Legitimate?

If you are considering diversifying your retirement portfolio, a Gold IRA kit might be on your radar. But what exactly is it, and how does it work? This article explores Gold IRA kits, highlighting benefits like asset diversification and inflation protection.

This article also addresses important questions about their legitimacy, how to spot potential scams, and what alternatives exist. By the end, you will have a clear understanding of whether a Gold IRA kit is the right choice for your financial future.

Yes, free gold IRA kits or information guides from trustworthy gold IRA companies are legitimate. The purpose of these free guides is to inform and educate investors about gold investing, the benefits of gold IRAs, and the account rollover process. To gain a better understanding of the subject, we will cover: what is a gold IRA kit,

-How does a gold IRA kit work?

-What are the benefits of a gold IRA kit?

-Are all gold IRA kits legit?

-How to determine if a gold IRA kit is legitimate?

-What are the alternatives to a gold IRA kit?

What is a Gold IRA Kit?

A Gold IRA Kit is a specialized investment tool designed to facilitate the inclusion of precious metals like gold into a retirement savings plan, offering new investors an opportunity to diversify their investment portfolios and hedge against market volatility and inflation. This kit typically includes educational resources, guides, and access to certified financial planners who can provide expert advice on gold investing strategies.

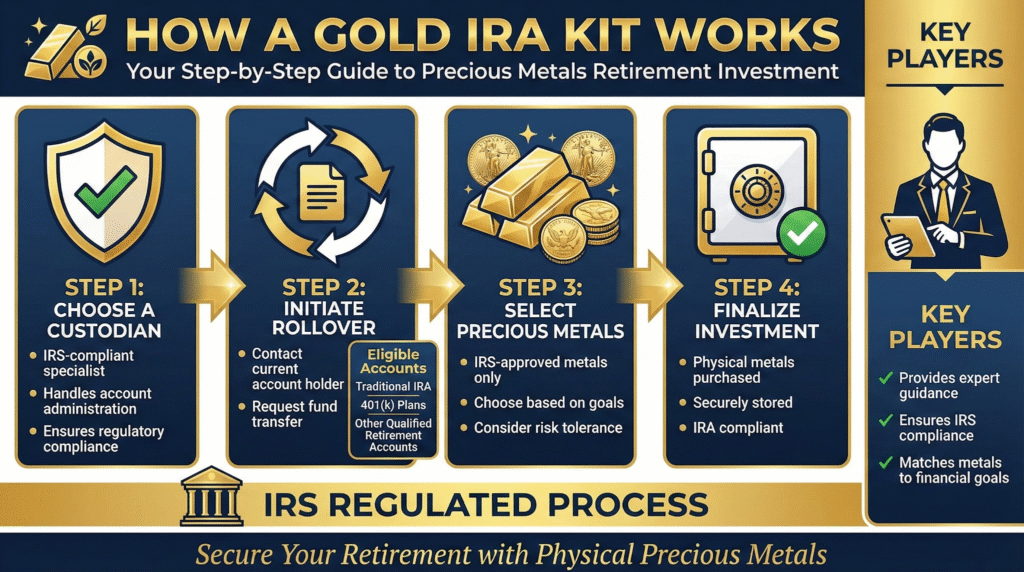

How Does a Gold IRA Kit Work?

A Gold IRA Kit works by guiding investors through the process of rolling over funds from an existing retirement account into a gold IRA, which allows them to buy and hold physical gold and other precious metals as part of their investment strategy. This process is regulated by IRS rules, ensuring that investment planning aligns with legal standards.

The first step in utilizing a Gold IRA Kit typically involves choosing a trusted custodian who specializes in precious metals and is compliant with IRS regulations. This custodian handles the administration of the account and ensures that all transactions adhere to the necessary guidelines.

Once the custodian is selected, the investor initiates the rollover procedure by contacting their current retirement account holder to request a transfer of funds.

Investors can typically roll over funds from a variety of accounts, including traditional IRAs, 401(k) plans, or other qualified retirement accounts, allowing them a wide range of options for their investment.

After the transfer is initiated, the next step is to select the types of precious metals to hold in the IRA. IRS-approved metals generally include:

-Gold bullion and coins

-Silver bullion and coins

-Platinum and palladium

Financial professionals play a crucial role in this process, providing expertise on which metals might suit the investor’s financial goals and risk tolerance. They facilitate compliance with all IRS regulations, ensuring that the investment strategy is both secure and fruitful.

What Are the Benefits of a Gold IRA?

These free kits provide details on the many benefits of a Gold IRA are manifold, including the ability to diversify assets within a retirement portfolio, providing a solid inflation hedge, and the potential for higher returns through investment strategies focused on precious metals.

As market volatility increases, having a Gold IRA can protect retirement savings from economic downturns and enhance long-term financial planning.

To get a tangible idea of the many benefits of a gold IRA, use our free Gold IRA calculator here.

Diversification of Assets

Diversification of assets is a crucial benefit of a Gold IRA, as it allows investors to balance their investment portfolio with different types of assets, including precious metals like gold, which can help mitigate risks associated with traditional market investments.

The importance of spreading investments across varied asset classes cannot be overstated. When investors incorporate a Gold IRA into their strategy, they are not only enhancing their potential for long-term growth but also safeguarding their finances against unexpected market downturns.

Historically, for instance, during periods of heightened economic uncertainty, such as the 2008 financial crisis, gold prices surged while many stocks plummeted. This behavior illustrates how gold often serves as a safe-haven asset, providing stability when other investments falter.

-In 2008, while the S&P 500 Index saw a decline of approximately 37%, gold prices rose nearly 25%.

-Similarly, during the pandemic-related market sell-off of 2020, gold outperformed many traditional investments, showing its capacity to preserve wealth.

By adding a Gold IRA to an investment portfolio, individuals can reduce overall risk while potentially stabilizing their returns during turbulent times, thus fostering a more resilient financial future.

Protection Against Inflation

Gold IRAs serve as a robust protection against inflation, acting as an inflation hedge since the value of gold tends to rise when the purchasing power of fiat currencies declines, thus safeguarding retirement savings from erosion.

This phenomenon can be traced back through numerous historical instances where inflation surged, particularly during the 1970s when the U.S. faced soaring prices alongside stagnant economic growth. During that decade, the price of gold skyrocketed, ultimately increasing from around $35 per ounce to over $800. Such data illustrates that the precious metal often retains its value, even thriving during challenging economic times.

When considering a gold IRA, individuals should think about diversifying their portfolio to offset inflation bets.

Experts encourage investors to consult with financial advisors to identify the right balance between traditional assets and gold.

Customer reviews highlight the peace of mind that comes with gold as a long-term investment, emphasizing its capacity to maintain wealth and act as a safeguard against unpredictable market movements.

Potential for Higher Returns

Investors may experience potential for higher returns by incorporating a Gold IRA into their investment strategies, as precious metals have shown favorable performance in various market conditions compared to traditional assets. The historical context illustrates how gold has served as a reliable store of value during economic downturns, often displaying less volatility than both stocks and bonds.

For instance, during the 2008 financial crisis, while stock markets plummeted, gold prices soared, providing investors with a safe haven. Testimonials from seasoned investors highlight that integrating gold into one’s portfolio not only serves as a hedge against inflation but also can enhance overall performance.

One investor noted a 150% return on their gold investment over five years, significantly outperforming their stock investments during the same period.

Another individual described their gold IRA as a “lifeline” during turbulent market times, providing peace of mind amidst uncertainty.

To maximize returns through gold investments, various strategies can be implemented. These include diversifying within the gold sector by investing in different forms such as bullion, coins, and mining stocks, as well as using dollar-cost averaging to mitigate market fluctuations.

The get started, educating yourself on what a reputable gold IRA company looks like, tap the banner below to visit Augusta Precious Metals official site to access a free gold IRA company integrity checklist

Are All Gold IRA Kits Legit?

While many Gold IRA Kits are legitimate, investors need to remain vigilant as the market does have its share of gold IRA scams, which can undermine financial planning and erode trust in the industry. Understanding how to identify scams to avoid them is critical for maintaining customer satisfaction during the investment process.

What Are the Red Flags to Look Out For?

Red flags indicating potential gold IRA scams include high-pressure sales tactics and promises of guaranteed returns that seem too good to be true, which can lead inexperienced investors astray from reputable financial professionals.

Plus these warning signs, another critical indicator of a scam is a lack of transparency regarding fees or fund handling. A reputable gold IRA provider should readily share details about all associated costs, including storage and administration fees. Unsolicited phone calls or emails, particularly those that push for quick action, should raise alarms.

Investors might also encounter companies that claim to have exclusive investment opportunities or that use complex jargon aimed at intimidating those without a strong financial background. Understanding the importance of conducting thorough online research is paramount; checking customer reviews and seeking out credible resources can significantly help in evaluating potential providers.

When assessing options, consider the following:

-How long the company has been in business,

-The reviews and ratings from previous clients

-Any records of complaints filed with financial authorities

Being proactive in this regard can prevent significant financial loss and ensure well-considered choices in what can be a complicated investment landscape.

How to Determine if a Gold IRA Kit is Legitimate?

To determine if a Gold IRA Kit is legitimate, investors should check for proper accreditation and certifications from recognized bodies, read customer reviews, and consult with financial professionals who can provide expert guidance on the investment.

Check for Accreditation and Certifications

Checking for accreditation and certifications is crucial in assessing the legitimacy of a Gold IRA, as reputable companies will be recognized by authoritative entities that govern the industry.

Having the right credentials establishes a foundation of trust and accountability. Investors are often reassured when a gold dealer or investment firm possesses key certifications, such as those from the Better Business Bureau or the American Numismatic Association. These organizations strive to uphold high standards of ethics and professionalism. It’s also vital that firms comply with regulations set forth by entities like the Securities and Exchange Commission.

-Industry Standards: Accredited firms are more likely to adhere to the best practices within the sector.

-Legal Compliance: Certifications ensure compliance with state and federal regulations, minimizing risks.

In short, these qualified endorsements not only attract investors but also provide an additional layer of security, enhancing overall confidence in their investment choices.

Read Reviews and Testimonials

Reading customer reviews and testimonials can provide valuable insights into the experiences of other investors with a Gold IRA, helping to assess the industry reputation of the gold dealer or firm.

Finding authentic feedback can lead you to a wealth of information. By exploring various review platforms and forums, investors can uncover genuine customer experiences that reflect the level of service and trustworthiness of a company.

Understanding the context behind each review is crucial; it’s important to consider factors such as the reviewer’s background and specific circumstances. When evaluating opinions, keep the following in mind:

-Look for patterns in the feedback.

-Be wary of overly positive or negative reviews that seem exaggerated.

-Consider how recent the reviews are, as circumstances may change over time.

This comprehensive analysis ultimately aids in making informed decisions regarding potential partnerships in the gold investment sector.

Compare Prices and Fees

Comparing IRA fees and prices are getting a fair deal and can effectively implement their investment strategies without incurring hidden costs.

Understanding the nuances of pricing can significantly impact an investor’s bottom line, especially since these Gold IRA Kits can come with a variety of fees, including setup, maintenance, and storage charges. Therefore, investors should take the time to:

-Ask detailed questions regarding each fee’s structure.

-Inquire about any potential hidden costs that might not be immediately obvious.

-Compare offers from multiple providers to identify the most competitive rates.

Seeking clarity from financial professionals can also provide invaluable insights, enabling better decisions when it comes to these investment opportunities. The right guidance can make all the difference in ensuring that an investor chooses the best option to align with their financial goals.

Tap the banner below to visit Birch Gold Group’s official site to receive their free gold IRA kit from one of the longest-running gold IRA companies in the industry:

Best Gold IRA for Low Minimum Investment

What Are the Alternatives to a Gold IRA Kit?

Alternatives to a Gold IRA Kit include options such as physical gold ownership, investing in gold ETFs, or purchasing gold mining stocks, each offering unique benefits and considerations in terms of an investment portfolio.

Physical Gold Ownership

Physical gold ownership involves acquiring tangible gold assets, such as gold bars and coins, which can provide investors with a sense of security and a direct investment strategy outside of traditional retirement accounts, offering a hedge against inflation and geopolitical uncertainty. This form of investment attracts individuals seeking to diversify their portfolios, as the value of physical gold often moves independently of stock market trends.

There are important considerations to keep in mind. To truly benefit from physical gold, one needs to understand the intricacies of the market, especially when it comes to collectible items, as they can significantly vary in value. Here are some pros and cons to consider:

-Pros: Includes liquidity in times of crisis, inflation hedging benefits, and a sense of tangible asset ownership.

-Cons : Potential storage costs and security risks, as investment-grade gold must be safely stored to avoid theft.

When investing in physical gold, proper storage solutions, such as a safe deposit box or a home safe, are crucial for minimizing risks. Integrating this asset into an overall investment strategy can enhance your financial stability, especially in uncertain times. Knowledge is power; understanding when to buy or sell can maximize returns.

Gold ETFs

Gold ETFs, or exchange-traded funds, provide investors with an efficient way to gain exposure to gold without the need to own physical assets, allowing for easy trading and liquidity in response to market volatility. These financial instruments are structured to track the price of gold, making them a popular choice for those looking to hedge against inflation or economic uncertainty.

Investors interested in diversifying their portfolios can benefit significantly from gold ETFs in numerous ways. Unlike physical gold, which requires secure storage and comes with additional costs, gold ETFs offer a streamlined investment experience. They eliminate concerns about theft or insurance, making it simpler for individuals to manage their wealth.

-Liquidity: Easily buy or sell shares during market hours.

-Cost-Effective: Lower expenses than maintaining physical gold.

-Accessibility: Purchase through regular brokerage accounts.

There are potential drawbacks to consider, such as management fees and potential tracking errors. These aspects can influence overall returns, and investors should remain vigilant when integrating gold ETFs into their broader investment strategy.

By doing so, they can effectively manage risks while also capitalizing on fluctuations in gold prices.

Bear in mind, there is greater counterparty risk with paper gold products vs physical gold ownership, as it does not involve owning the tangible asset itself, whether through a gold IRA or direct holding of the metal in your home.

In general, paper gold contracts may not have an equal amount of physical gold backing the contract, so it is incumbent on the investor to perform their due diligence and to thoroughly review the contract before proceeding.

Gold Mining Stocks

Investing in gold mining stocks offers another alternative, allowing investors to profit from the operational success of gold mining companies, often leading to higher potential returns than physical gold or ETFs.

This investment approach can be particularly appealing during times of rising gold prices, as mining companies typically benefit from increased profitability and production expansion. Potential investors should be aware that these stocks are also influenced by various factors beyond gold prices, such as operational efficiencies, labor costs, and geopolitical risks, which can lead to volatility in stock prices.

Understanding these dynamics is crucial for making informed decisions. It is also advisable for individuals interested in this sector to engage with financial professionals who can provide insights and help identify strong opportunities, ensuring a well-rounded investment strategy.

-Pros: Higher returns possible, operational leverage.

-Cons: Stock price volatility and company-specific risks.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement Calculators. Perform real-time calculations as you read our reviews. See the buttons below to access these calculators and start protecting your wealth today.

Gold IRA Calculator

Inflation-Retirement Calculator

Final Thoughts on Gold IRA Kits

In conclusion, Gold IRA Kits represent a compelling option for investors seeking to incorporate precious metals into their investment planning, offering potential benefits like diversification, protection against inflation, and alignment with long-term retirement goals within wealth management strategies.

These kits not only provide a systematic approach to gold investing and how these gold IRAs work but also serve as a hedge against economic volatility and currency fluctuations, thereby enhancing financial security.

As inflation rates continue to rise, many individuals are looking for alternative assets that can withstand economic uncertainties. Here are some critical advantages linked to Gold IRA Kits:

-Capital Preservation: Gold has historically maintained its value over time.

-Diverse Portfolio: Introducing precious metals can stabilize overall investment performance.

-Tax Benefits: IRAs often come with advantageous tax treatments.

Ultimately, exploring gold investments could significantly impact retirement accounts, adding a level of stability that traditional assets may not offer. Therefore, considering such options is worthwhile for a balanced, future-ready portfolio.

Frequently Asked Questions

Is a Free Gold IRA Kit Legit?

Yes, a Free Gold IRA Kit can be a legitimate offer from a reputable company. However, it’s important to do your research and be cautious of any potential scams.

What is a Gold IRA?

A Gold IRA is a type of individual retirement account that allows you to invest in physical gold and other precious metals as a way to diversify your retirement portfolio.

What does a Gold IRA Kit typically include?

A Free Gold IRA Kit usually includes information about the company offering the kit, details about the process of setting up a Gold IRA, and potentially a free consultation or investment guide.

Are there any risks associated with investing in a Gold IRA?

As with any investment, there are risks involved with investing in a Gold IRA. It’s important to carefully consider your financial goals and consult with a financial advisor before making any decisions.

Can I trust the information provided in a Free Gold IRA Kit?

While companies offering Free Gold IRA Kits may have valuable information, it’s always important to do your own research and verify the information provided. Be wary of any exaggerated claims or promises.

Is a Gold IRA a good investment option for me?

The decision to invest in a Gold IRA ultimately depends on your individual financial goals and risk tolerance. It’s best to consult with a financial advisor to determine if a Gold IRA is a suitable option for you.

Conclusion

Knowing the benefits of Gold and precious metals IRAs is crucial in retirement planning. These accounts offer potential tax and inflation and market hedging benefits.

Self-directed gold IRAs are a means of owning gold either through a current account rollover or the establishment of a new account. However, there are specific gold IRA tax rules that are easily understood. Finding the right gold IRA company is the main key

Understanding the subjects we discussed can help you navigate this complex landscape. Armed with this knowledge, you’re now better equipped to make informed decisions about your financial future.

If you have 100k of savings to protect and want to take advantage of the best gold prices and lifetime customer support, click the banner below to join a free gold and silver web conference hosted by Augusta Precious Metals. Secure your place today:

Obtain a gold IRA guide and talk to a broker

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com