Are Gold Backed IRAs a Good Idea in 2026?

Deciding whether or not to roll over an existing IRA into a gold-backed IRA is no small decision and requires weighing specific individual goals.

A gold IRA is a good retirement investment decision based on the following criteria:

-Your individual gold investing goals vs. your short and long-term needs

-Weighing the tax advantages vs. fees associated with a gold IRA

-How much are you willing to allocate?

What is a gold or precious metals IRA?

A gold IRA is a self-directed individual retirement account that invests in actual tangible, physical assets such as gold and other precious metals. Gold or precious metals IRAs serve as a layer of protection from inflation, stock market volatility, and economic instability

These gold-backed Individual Retirement Accounts offer more flexibility and control to the investor than a traditional IRA that invests solely in mutual funds, stocks, bonds, and other paper assets that are more prone to manipulation and panic-induced market fluctuations.

1. Your individual gold investing goals vs. your short and long-term needs

The right gold IRA for the right goal

If your investment strategy is portfolio diversification, risk and loss mitigation, and overall preparation, a traditional gold IRA would be appropriate.

This strategy involves holding gold or precious metals as a hedge against losses elsewhere, whether depreciation within the stocks, bonds, or paper assets holdings, or overall inflation. This is a long-term strategy.

2. Weighing the tax advantages vs. fees associated with a gold IRA

To start, if you are considering investing in gold and precious metals, you are already gaining a tremendous tax advantage, protection of your wealth from the relentless invisible tax called inflation. This is an instant win right out of the gate.

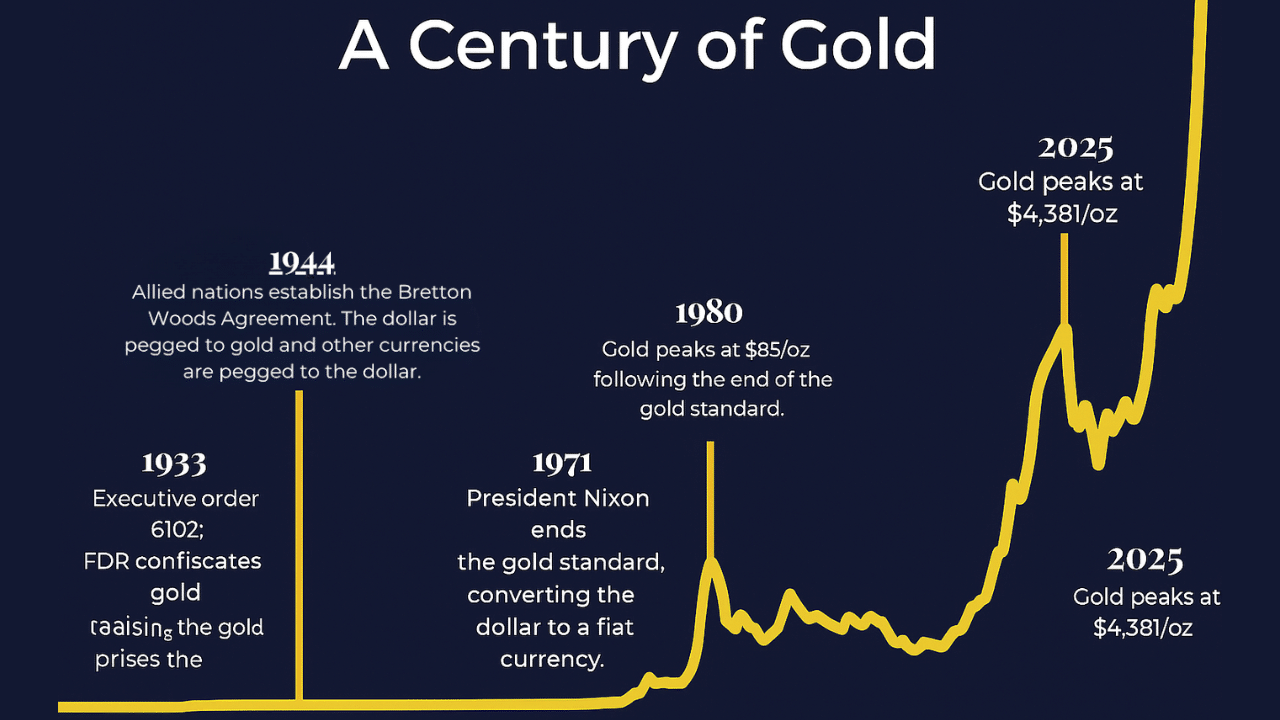

As you can see from the 100-year gold value chart above, the consistent, upward trend and appreciation of gold over time. If you simply flipped this chart on its head, what you would essentially see illustrated is the downward trend and depreciation of the dollar over time.

With any investment vehicle, there are tax advantages and tradeoffs. It is completely dependent on one’s goals, short-term and long-term goals.

A gold IRA often comes with additional fees when compared to a traditional or Roth IRA that invests solely in stocks, bonds, and mutual funds. Because you are storing and securing actual tangible, physical assets, there are custodian and storage fees associated with a gold IRA. Once again, IRS regulations strictly prohibit precious metals invested within a gold IRA from being stored at home, but within a secured and approved depository.

Tap the banner below to visit Birch Gold Group to receive their gold IRA guide.

Gold IRA Tax Advantages:

For rollovers into a traditional gold IRA, this account functions as a tax-deferred retirement savings account and works like a pre-tax traditional IRA. Your contributions and any gains will not be taxed, and, in most cases, contributions are tax-deductible as well.

With IRA rollovers, the existing IRA custodian will give the account holder the money they wish to withdraw. The account holder then has 60 days to deposit the funds into their new gold IRA account. If this deadline is not met, there is a 10% penalty on the withdrawal if you’re under 59 1/2 years of age.

As we discussed previously, your individual investment goals greatly determine which IRA is appropriate. A basic summary of the two options we discussed earlier explains the variance in terms of the tax structure.

To get a tangible idea of the many benefits of a gold IRA, click the button below to access the free gold IRA calculator below:

Traditional Gold IRA

Traditional gold IRAs are tax-deferred, so any gains or contributions aren’t going to be taxed. Bear in mind, this IRA has an annual limit. For people under 50, the limit is $7,000. People over 50 can invest $8,600. As discussed before, all taxes must be paid once distributions begin. Hence, this type of gold IRA is better suited for long-term holding.

Roth Gold IRA

In contrast, Roth gold IRAs do not provide tax reductions upfront as with a rollover to a traditional gold IRA, but with Roth gold IRAs, no taxes are due once distributions begin during your retirement. Therefore, this is more suitable for short-term holding.

3. How much are you willing to allocate?

What percentage of your portfolio should you hold in gold will depend greatly on your present net worth, portfolio size, and present earnings. Standard diversification is in the range of 5-10%, a high inflation allocation approach would be 10-20%, and record inflation hedging is 20% and as high as 25%.

As in many cases with nearly every gold IRA rollover, the greater the minimum initial investment, the greater the access to better pricing, such as Augusta Precious Metals. If you have 100k of retirement savings, get started by clicking the button below to attend Augusta’s free educational conference to gain the information you need to diversify and protect your retirement.

Knowing how to choose an IRA custodian will depend on your specific individual investment needs.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com