Gold IRA vs 401K

Choosing between a Gold IRA and a 401(k) for retirement savings comes down to personal circumstances and goals. A 401(k), typically employer-sponsored, usually offers limited investment options but higher limits on annual contributions and potentially an employer match.

Understanding the benefits, risks, and tax implications can help shape your strategy and help guarantee your nest egg is as golden as the years it funds. If you continue exploring this topic, you’ll be able to make a more informed decision.

In considering retirement plans, it’s crucial to distinguish between a 401(k) and an IRA.

401k and gold IRAs are taxed-advantaged, with 401k accounts providing upfront tax deductions, while gold IRAs offer tax-deferred growth.

A 401(k) is a company-sponsored plan to which you and your employer can contribute, while a gold IRA is set up by you, offering more flexibility to invest in precious metals. To gain a better understanding of the subject, we will discuss:

-What’s a 401(k)?

-What’s a Gold IRA?

-Choosing a gold IRA vs. a 401(k)

-Gold IRA vs. 401(k): A road map

-Key features of IRAs vs 401(k)s

-Tax Considerations for Gold Investments

Let’s compare these two to help you understand which may be the best fit for your retirement goals.

What’s a 401(k)?

A 401(k) is a qualified, employer-sponsored retirement plan falling under the “defined contribution” category.

This means that you, and potentially your employer, contribute a certain amount periodically, but the payout you’ll receive during retirement depends on the market value of the account.

Here are some key points to remember about 401(k) plans:

-They’re primarily funded by the employee, with potential matching contributions from the employer, typically between 3% and 6%.

-The contribution limit and an additional $6,000 ‘catch-up’ contributions for those over 50 will vary from year to year.

-The investment choices can be limited, as they’re often pre-selected by the employer.

-If your employer doesn’t offer a 401(k) or other sponsored plan, you might consider starting with a Roth IRA or traditional IRA.

What’s a Gold IRA?

Moving on from the 401(k) plans, let’s explore another retirement savings option – the gold IRA or individual retirement account. Self-directed gold IRAs function like traditional IRAs in many regards, but in the case the investment is centered around tangible assets such as precious metals

Unlike 401(k)s, which are tied to your employment, anyone can contribute to a gold IRA. This opens up the possibility of saving for retirement to a wider range of people, including those who are self-employed or whose employers don’t offer a 401(k) plan.

Gold IRAs come with their own set of benefits. Tax-wise, your gold or silver investment earnings grow tax-deferred until you start making withdrawals in retirement. However, you should note that there are income limits for tax-deductible contributions, so high earners may be partially or fully phased out.

Again, self-directed Gold IRAs provide the opportunity to invest in physical precious metals, which hedge against inflation, diversify an investor’s portfolio, and protect an individual’s retirement from a currency debasement.

Choosing an IRA vs. a 401(k)

As we navigate through the complex world of retirement planning, the choice between opening an Individual Retirement Account (IRA) and opting for a 401(k) becomes essential.

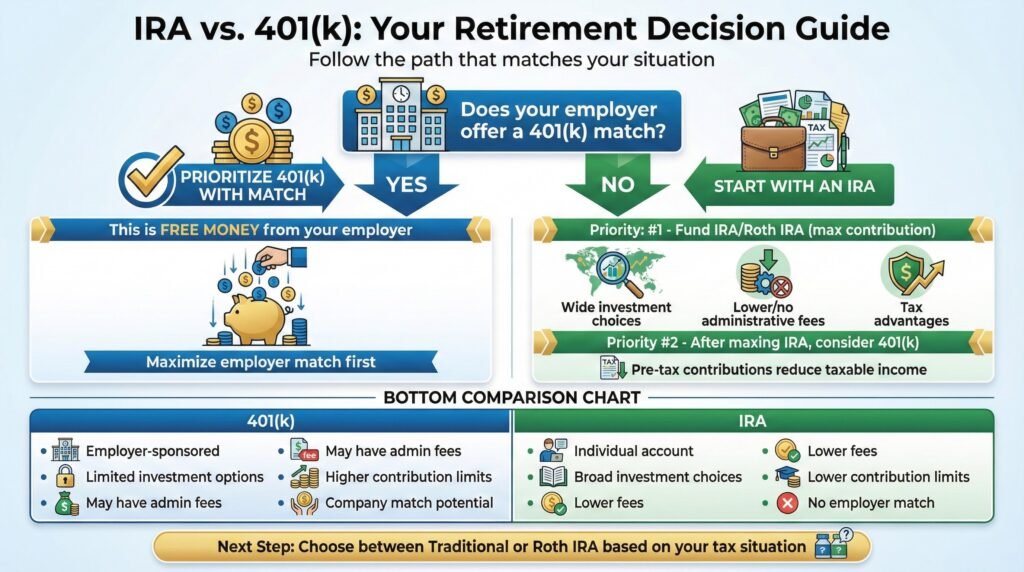

If your employer offers a match, a 401(k) may be the more advantageous choice. However, if there’s no company match, an IRA, with its wider range of investment choices and potential tax benefits, might be the better option for you.

If your employer offers a 401(k) with a company match

Steering through the maze of retirement options can be intimidating, but if you’re fortunate enough to have an employer who offers a 401(k) with a company match, you’re already a step ahead.

This employer-sponsored plan is a promising starting point for your retirement savings journey, thanks to the company match that fundamentally offers free money.

To make the most of this opportunity, consider the following actions:

-Contribute enough to secure the maximum company match. If your employer matches 100% up to 3% of your salary, aim to contribute at least that amount.

-Once you’ve obtained the full match, consider opening and maxing out an IRA. This move can offer more diverse investment options and potentially lower fees.

-With your IRA maxed out, consider returning to your 401(k) to continue contributing. This strategy allows for additional tax benefits and retirement savings.

-Regularly review and adjust your contributions based on your changing financial goals and retirement plans.

If your employer doesn’t offer a company match

Let’s shift gears a bit and consider a different scenario. Suppose your employer doesn’t match your 401(k) contributions.

Where should you put your money then? You might want to seriously consider starting with an IRA or Roth IRA. Why? Well, IRAs give you access to a wide array of investments when opened with a broker.

You’re not limited to the typically narrow range of options offered by 401(k)s. Plus, you sidestep any administrative fees that often accompany 401(k) plans.

Now, don’t write off the 401(k) just yet. After you’ve maxed out your IRA contribution, it’s worth considering funding your 401(k), even without the company match.

Remember, your 401(k) contributions are pre-tax, reducing your taxable income and providing a tax advantage.

Choosing between a Roth and a Traditional IRA can be a tad bit tricky. But don’t worry, I’ve got you covered. I’ll guide you on how to make that choice in the next section. For now, focus on getting started with your IRA, and remember, every step you take today brings you closer to a secure retirement.

IRA vs. 401(k): A road map

Maneuvering the financial highways of retirement savings can be complex. When it comes to choosing between an Individual Retirement Account (IRA) and a 401(k), your first step should be contingent on whether your employer matches your contributions.

If your employer does offer a 401(k) match, it’s smart to contribute enough to earn the full match first. This is basically free money that you shouldn’t leave on the table.

To take advantage of both investment vehicles, many gold IRA companies provide partial 401(k) rollover options to a gold IRA. Finding the right gold IRA company for your individual needs is critical. For example, if you require a low investment minimum to start a gold IRA company, Birch Gold Group or American Hartford Gold would be two choices to consider. However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive gold prices, then Augusta Precious Metals would be a good fit. Furthermore, Noble Gold Investments provides gold IRA as well as private investment options for home storage. Decide based on your individual needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Key Features of IRAs vs 401(k)s

Steering through the key features of IRAs and 401(k)s, it’s clear that each offers its own unique benefits and considerations. It’s important to understand that eligibility, contribution limits, tax treatments, and investment options differ between these two retirement savings vehicles.

401(k) plans, primarily offered through employers, allow contributions up to $24,500 in 2024; if you’re 50 or older, you can kick in an extra $8,000. Many employers also match contributions, typically around 3%, which is practically free money.

While 401(k) plans offer less investment flexibility, they can contain less expensive funds than those outside of 401(k)s. However, you’re required to start making minimum distributions at age 73.

On the other hand, IRAs, opened individually, have a lower combined contribution limit of $7,500 in 2026 for those under 50 years old, or $8,600 if you’re 50 or older.

No employer match is available, but the investment selection is typically larger. Traditional or gold IRAs can reduce taxable income in the year contributions are made, with distributions in retirement taxed as ordinary income.

Roth IRAs, while offering no immediate tax benefit, do allow tax-free withdrawals in retirement. And unlike 401(k)s and traditional IRAs, Roth IRAs have no required minimum distributions.

In choosing between these two, consider your income, tax situation, and retirement goals. If your employer offers a 401(k) match, it’s wise to contribute enough to secure that first. After that, an IRA could offer more control over investments. Always remember to regularly review and adjust your retirement plans based on your financial goals.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

Click the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

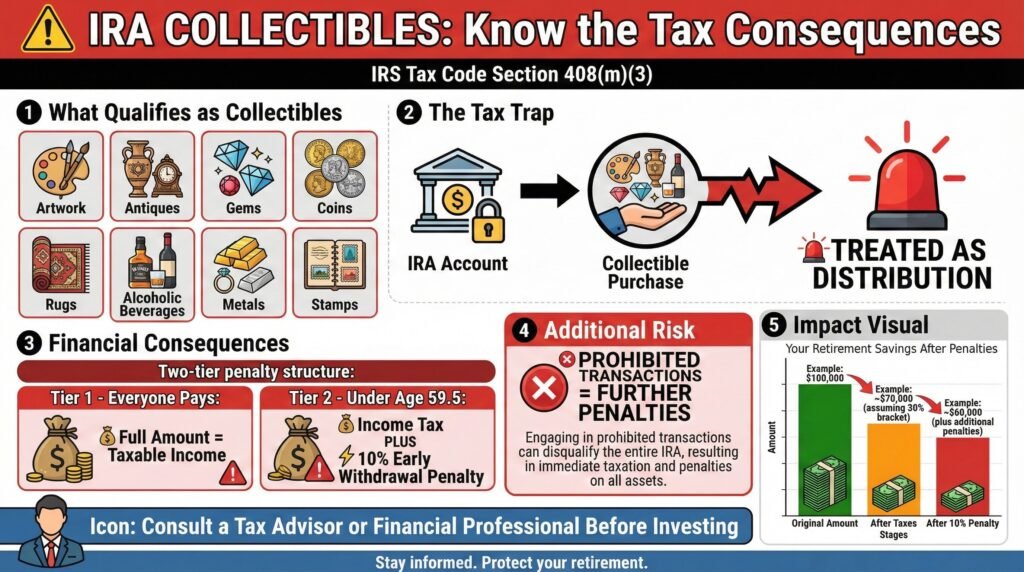

Tax Considerations for Gold Investments

Delving into the domain of Gold IRAs, it’s vital to grasp the distinct tax implications that come with this form of investment.

Unlike traditional IRAs or 401(k)s, which may allow for investments in stocks, bonds, or mutual funds, a Gold IRA focuses on investing in physical precious metals, including gold coins and bars.

This difference in investment type necessitates a distinct approach to taxation. Let’s examine these tax considerations in detail:

-Investments in a Gold IRA grow tax-deferred. This means that you won’t have to pay taxes on any gains until you make withdrawals.

However, when you do decide to withdraw, those distributions are taxed as ordinary income, based on your tax rate at the time of withdrawal. Knowing the rules, regulations, and tax implications of a precious metals IRA is necessary.

-Contrary to some assets in traditional retirement accounts that may qualify for long-term capital gains tax rates, typically lower, Gold IRA distributions don’t benefit from this lower rate.

-Starting at age 72, Required Minimum Distributions (RMDs) are mandatory, just as with a 401(k) or a traditional IRA. This factor influences how and when you decide to liquidate part of your investment.

-Don’t overlook the specific fees associated with the purchase, storage, and insurance of physical gold. However, the gold IRA companies listed at the end of this article provide lower fees or a possible waiver of fees dependent on the contract.

Understanding these tax implications is imperative if you’re considering gold as part of your retirement strategy. It guarantees that the benefits of such an investment align with your long-term financial goals and tax planning strategies.

To learn more about how gold investing can protect your long-term wealth and the advantages of tax-deferred gold IRAs, click the banner below to access and download National Gold Group’s gold IRA guide to make sure you are aware of all aspects of the gold IRA process:

Conclusion

Gold IRAs and 401(k)s each have their unique advantages. Your choice really hinges on your personal financial goals and retirement plans. Remember, diversification is key in any investment strategy.

So, while gold can provide a solid hedge against inflation, it shouldn’t be the only asset in your portfolio. Make sure to consult a financial advisor before making any major decisions. Here’s to a secure and prosperous retirement!

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Obtain a gold IRA guide and talk to a broker

Augusta Precious Metals

Best Prices, 50K Minimum Investment

National Gold Group

Best Buyback, 10K Minimum Investment

American Hartford Gold

Best Price Match, 10K Minimum Investment

Birch Gold Group

Lowest Fees, 10K Minimum Investment

Noble Gold Investments

Best Secured Storage, 20K Minimum Investment

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com