Gold IRA vs Annuity

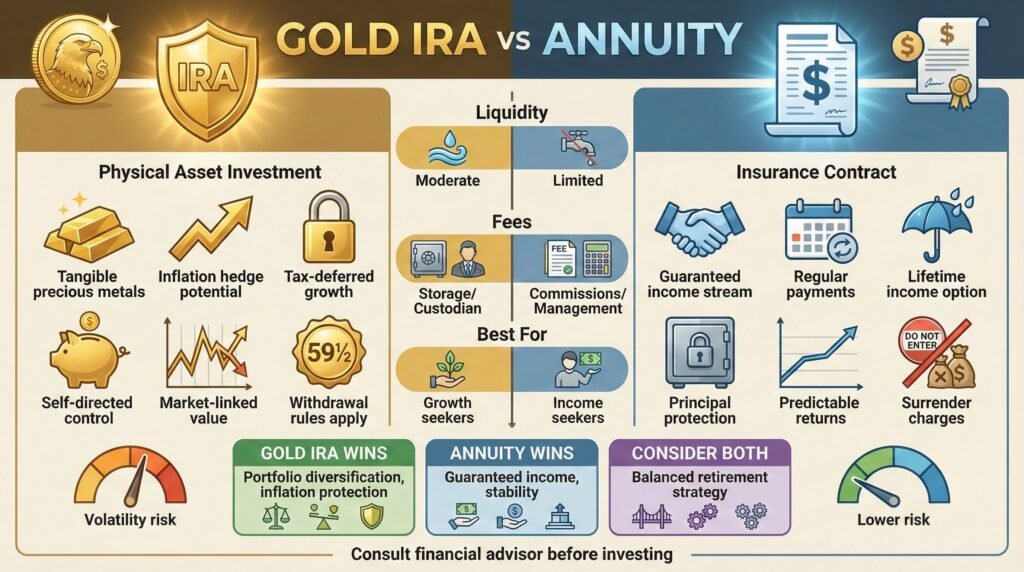

Gold IRAs and annuities differ markedly in their approach to retirement planning.

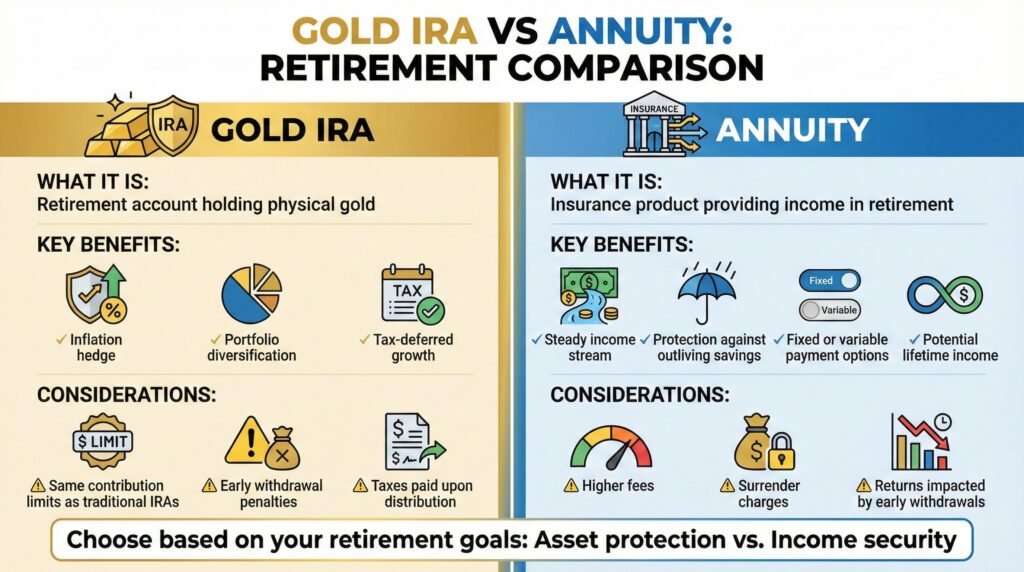

A gold IRA invests in physical gold, serving as a hedge against market volatility and inflation, with benefits similar to traditional IRAs, such as tax-deductible contributions and tax-deferred growth.

However, it carries management requirements and fees for physical asset storage. On the other hand, annuities are insurance products, providing a guaranteed, steady income during retirement, making them a safe option. But they can come with high fees and potentially lower returns.

Understanding these differences is essential when deciding which suits you best, as breaking down the specifics of each could provide further clarity.

Understanding IRAs and Annuities

When planning for retirement, understanding the differences between IRAs and annuities is crucial. An Individual Retirement Account (IRA) is a savings account with tax advantages that allows you to put money aside for your retirement.

An IRA is a versatile investment vehicle, offering you the ability to invest in a variety of assets, including stocks, bonds, and mutual funds.

There are two main types: Traditional IRAs, where your contributions may be tax-deductible, and your earnings grow tax-deferred until withdrawal, and Roth IRAs, where you contribute after-tax dollars, allowing for tax-free growth and withdrawal.

On the other hand, an annuity is an insurance product. You invest in the annuity, and it then makes payments to you on a future date or series of dates.

The income you receive from an annuity can be doled out monthly, quarterly, annually, or even in a lump sum payment. You can opt for payments for the rest of your life, or for a set number of years.

The choice between an IRA and an annuity depends on your individual needs, your risk tolerance, and your retirement goals.

If you’re looking for an investment with potential for growth and don’t mind taking on some risk, an IRA may be an ideal choice. But if you want a guaranteed income stream in retirement, an annuity could be the way to go.

It’s important to evaluate your options carefully and perhaps consult with a financial advisor before making a decision.

Benefits of Investing in Gold IRAs

As we’ve explored the basics of IRAs and annuities, let’s now turn our attention to a unique form of IRA – the Gold IRA. A Gold IRA, also known as a precious metals IRA, provides a hedge against inflation, something that traditional IRAs and annuities might not offer.

When we invest in gold, we’re investing in a tangible, finite resource that has maintained its value throughout history.

There’s a certain peace of mind that comes with knowing your investment isn’t just a number on a screen, but a physical asset you can hold. Gold IRAs also provide an excellent opportunity for portfolio diversification.

By spreading your investments across a variety of asset classes, including precious metals, you can help mitigate risk and potentially increase returns.

Gold IRAs also offer the same tax benefits as traditional IRAs. Contributions are tax-deductible, and earnings grow tax-deferred until you begin taking distributions.

This means you won’t pay taxes on your gold investments until you’re ready to retire, which can lead to significant tax savings.

However, it is crucial to remember that investing in a Gold IRA involves unique considerations. These include understanding the storage requirements of physical gold and the fees associated with these accounts.

Additionally, like all investments, Gold IRAs come with risks, including the potential for loss if the price of gold decreases.

To take advantage of both investment vehicles, finding the right gold IRA company for your individual needs is critical.

For example, if you require a low investment minimum to start a gold IRA company, Birch Gold Group or American Hartford Gold would be two choices to consider. However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive gold prices, then Augusta Precious Metals would be a good fit. Furthermore, Noble Gold Investments provides a gold IRA as well as private investment options for home storage. Decide based on your individual needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Annuities: Pros and Cons

Diving into the world of annuities, it’s crucial to weigh the pros and cons before making a decision.

Annuities, products offered by insurance companies, can provide a steady source of retirement income. However, like any financial vehicle, they come with their own set of benefits and drawbacks.

Pros of Annuities

One of the biggest advantages of annuities is the guaranteed income. No matter how long you live, you’ll continue to receive payments. This removes the risk of outliving your savings, a critical concern for many retirees.

In addition, your payments can be indexed to inflation, ensuring your purchasing power remains constant over time. Finally, earnings from annuities are tax-deferred until withdrawal, potentially offering significant tax savings.

Cons of Annuities

On the flip side, annuities can be complex and often come with high fees. Surrender charges may apply if you withdraw your money early, limiting your liquidity.

Additionally, the returns on annuities could be lower than if you invested the money elsewhere. It’s also worth noting that your annuity income may be taxed once you start receiving payments.

Understanding Your Needs

As with any investment decision, your personal circumstances play an important role. If you value the security of a steady income stream and are willing to pay for it, an annuity could be a solid choice.

However, if you’re confident in your investing skills and prefer greater control over your money, other retirement options might be more suitable.

Comparison: Gold IRA Vs Annuity

While comparing a Gold IRA to an annuity, it’s essential to evaluate the unique characteristics and benefits of each.

Let’s start with the Gold IRA. This retirement account allows you to invest in physical gold, offering a hedge against inflation and providing a diversification benefit. It’s tax-deferred, meaning you don’t pay taxes until you take distributions.

But remember, it’s subject to the same contribution limits as traditional IRAs, and premature withdrawals can incur penalties.

On the flip side, an annuity is a financial product sold by insurance companies. It’s designed to provide a steady income stream in retirement, which can be a lifeline if you’re concerned about outliving your savings.

Annuities can offer fixed or variable payments, and some even provide lifetime income. However, they often come with higher fees and surrender charges, which can eat into your returns if you need to withdraw funds early.

Making the Right Choice

Choosing between a Gold IRA and an annuity isn’t a decision to be taken lightly; it involves a careful assessment of your financial situation, retirement goals, and risk tolerance. Both options offer unique advantages, but they also carry distinct risks and considerations.

-

- Gold IRA: A Gold Individual Retirement Account (IRA) allows you to invest in physical gold, offering a hedge against inflation and market volatility. However, it requires careful management and an understanding of gold’s market value.

- Annuity: An annuity, on the other hand, provides a steady, guaranteed income stream during retirement. Annuities can be an attractive option if you’re concerned about outliving your savings. But, they often come with high fees and surrender charges.

So, how do you make the right choice?

Firstly, consider your risk tolerance. If you’re comfortable with potential market fluctuations and have time to manage your investments, a Gold IRA might be more suitable.

If you prefer a steady income and want to mitigate longevity risk, an annuity could be a better choice.

Secondly, think about your retirement goals. Do you want to leave a legacy for your heirs? A Gold IRA can be a great tool for estate planning. If your goal is to secure a steady income throughout retirement, an annuity might be more appropriate.

Lastly, consider seeking advice from a financial advisor. They can provide personalized advice based on your specific circumstances, helping you navigate the complexities of retirement planning.

Remember, the ultimate goal is to make a decision that aligns with your financial needs and retirement aspirations.

Click the banner below to visit Augusta Precious Metals and get started today with their gold IRA integrity checklist.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

Click the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

Conclusion

To sum up, both Gold IRAs and annuities have their unique merits and risks. Your choice should align with your financial goals and risk tolerance. Gold IRAs offer potential growth and hedging benefits, while annuities provide guaranteed income.

Understanding these options inside and out is critical. Remember, a well-informed decision can lead to a comfortable retirement. So, take your time, do your research, and choose wisely. Your future retired self will thank you for it.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

Find the right gold IRA conpany for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com