Gold IRA vs Physical Gold

Are you considering investing in gold but unsure whether to choose a Gold IRA or physical gold?

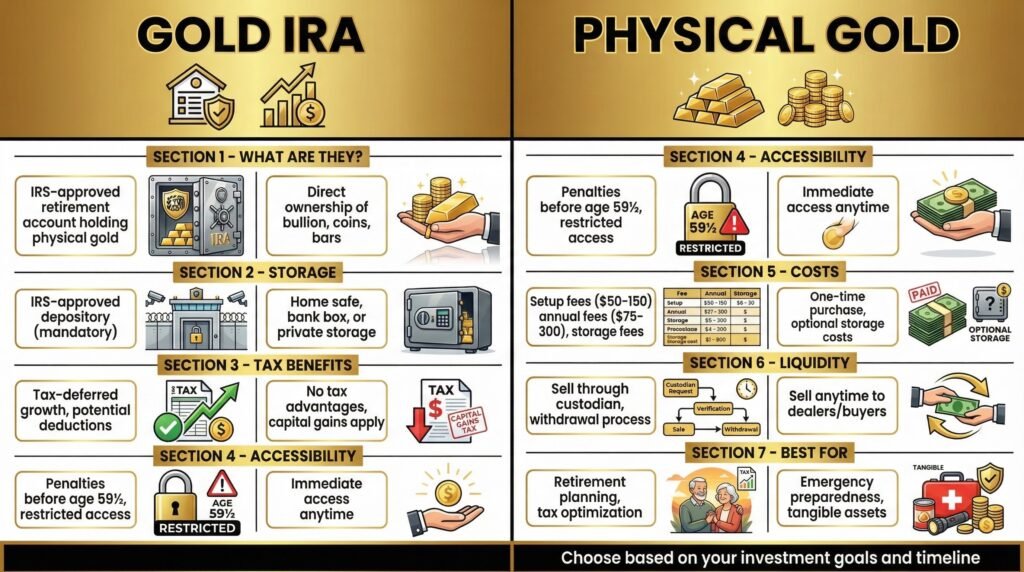

Gold IRAs and physical gold ownership investment strategies differ in terms of accessibility, liquidity, storage, and tax benefits. Both options provide wealth preservation and growth, protection against inflation, retirement planning optimization, and portfolio diversification.

To better understand the key advantages and disadvantages of a gold IRA vs physical gold ownership, we will discuss the following:

-What Is a Gold IRA?

-What Is Physical Gold?

-What Are the Differences Between a Gold IRA and Physical Gold?

-Which Is a Better Investment Option: Gold IRA or Physical Gold?

-What Are the Risks of Investing in Gold IRA and Physical Gold?

-How to Choose Between a Gold IRA and Physical Gold?

If you’re looking to make an informed decision about your gold investments, keep reading!

What Is a Gold IRA?

A Gold IRA, or Individual Retirement Account, is a specialized type of retirement account that allows investors to hold physical gold and other precious metals as part of their investment portfolio, offering unique tax advantages and diversification benefits.

These accounts operate similarly to traditional IRAs, but instead of holding paper assets like stocks or bonds, they are backed by tangible assets like gold, silver, platinum, and palladium.

The Internal Revenue Service (IRS) regulates Gold IRAs to ensure compliance with tax laws and contribution limits. Investors can choose from a variety of investment options within a Gold IRA, such as coins and bars of various weights.

The tax advantages of a Gold IRA include tax-deferred growth on investments until withdrawal and potential tax savings if the investor opts for a Roth Gold IRA.

What Is Physical Gold?

Physical gold refers to tangible gold assets such as bullion coins and bars, which investors can purchase and hold as a form of investment in precious metals.

Gold coins are typically minted by government entities and carry a face value, making them legal tender, while gold bars are produced by private mints or refineries and are known for their purity and lower premiums.

Gold coins like the American Eagle, Canadian Maple Leaf, South African Krugerrand, and Austrian Philharmonic are popular among investors. On the other hand, gold bars come in various sizes and weights, ranging from small bars of 1 gram up to hefty bars of 1 kilogram or more.

What Are the Differences Between a Gold IRA and Physical Gold?

Understanding the differences between a Gold IRA and holding physical gold directly is crucial for investors who want to make informed decisions about their retirement accounts and investment strategies.

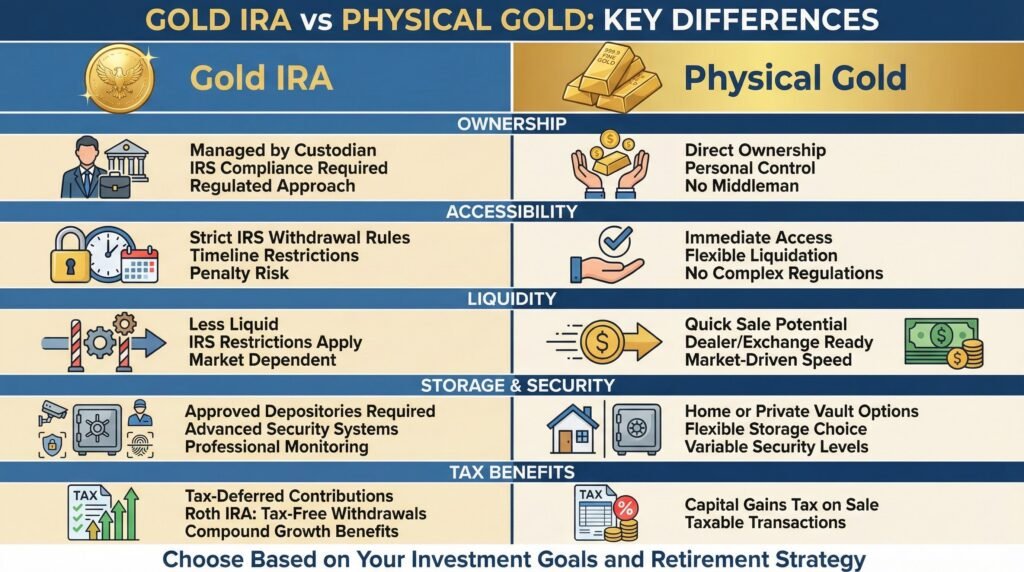

Ownership

Ownership of gold in a Gold IRA involves a custodian who manages the assets, whereas physical gold is owned outright by the investor and can be stored personally.

In terms of Gold IRAs, the role of the custodian is crucial as they are responsible for overseeing the investment and ensuring it complies with IRS regulations. On the other hand, owning physical gold directly means more immediate access and control over the precious metal without the need for a middleman.

This difference in ownership structure ultimately impacts the level of control and accessibility investors have over their gold holdings, with Gold IRAs offering a more regulated but slightly less direct approach compared to physical ownership.

Accessibility

Accessibility to assets is different for Gold IRAs and physical gold, with Gold IRAs having stricter rules on withdrawals and distributions enforced by the IRS.

In terms of Gold IRAs, one must adhere to specific IRS regulations governing withdrawals and distributions to ensure compliance and avoid penalties. The IRS mandates certain conditions and timelines that must be followed when accessing funds from a Gold IRA, which may limit immediate availability and flexibility.

On the other hand, owning physical gold provides more immediate access to your investment, allowing you to liquidate or use the gold as needed without navigating through complex regulations or facing potential tax implications.

Liquidity

Liquidity, or the ease of converting assets to cash, differs between Gold IRAs and physical gold, with Gold IRAs often being less liquid due to market conditions and regulations.

Gold IRAs are subject to various rules and restrictions set by the IRS, impacting how easily they can be sold. On the other hand, physical gold, like gold coins or bars, can generally be sold quickly through dealers or exchanges, depending on current demand.

Market fluctuations play a significant role in determining the ease of selling physical gold, with prices directly affecting the speed of transactions. The overall economic climate and geopolitical events can impact the demand for gold, influencing its liquidity as an investment asset.

Storage and Security

Storage and security are important considerations for both Gold IRAs and physical gold, with Gold IRAs requiring storage in a secure vault or depository, while physical gold can be stored at home or in a private vault.

Gold IRAs are required to be held in approved secure vaults or depositories to ensure the safety and integrity of the investment. These facilities are equipped with advanced security measures such as alarms, surveillance cameras, and physical barriers to protect the valuable assets stored within.

On the other hand, individuals who opt for storing physical gold have the flexibility to choose between keeping it at home or utilizing a private vault service.

Home storage provides convenience but may lack the same level of security as professional vaults, which offer specialized security features like biometric access, insurance, and round-the-clock monitoring.

Tax Benefits

Gold IRAs offer specific tax benefits, such as deferral of taxes on contributions and potential tax-free withdrawals in a Roth IRA, while physical gold is subject to capital gains tax upon sale.

One of the key advantages of investing in a Gold IRA is the tax deferral on contributions. This means that you can enjoy the benefits of your investment growth without immediate tax obligations, allowing your savings to compound over time.

In a Roth IRA setup, withdrawals can be made tax-free, providing a substantial advantage during retirement.

Which Is a Better Investment Option: Gold IRA or Physical Gold?

Choosing between a Gold IRA and physical gold depends on various factors, including an investor’s goals for diversification, potential for growth, protection against inflation, and retirement planning needs.

Diversification

Gold IRAs and physical gold both offer opportunities for diversification, helping to spread risk across different asset classes in an investment portfolio.

When considering diversification within an investment portfolio, it is crucial to understand the benefits of spreading risk. By incorporating Gold IRAs and physical gold, investors can mitigate the impact of market fluctuations in other asset classes.

The inclusion of precious metals, such as gold, adds a layer of security and stability to the overall portfolio. This balanced approach helps protect against inflation, geopolitical uncertainties, and economic downturns.

Gold has historically shown a negative correlation with the stock market, making it a valuable addition for risk management.

Potential for Growth

The potential for growth in a Gold IRA can be influenced by various investment options, including gold mining companies and mutual funds, whereas physical gold’s growth potential is tied to its market value.

Gold IRAs offer investors a diversified approach to precious metal investments. Investing in gold mining companies within a Gold IRA can provide exposure to potential profit from successful operations and discoveries in the industry.

Similarly, mutual funds focused on gold and precious metals allow investors to benefit from a basket of assets, spreading risk and potentially enhancing returns.

On the other hand, physical gold’s growth is primarily driven by the market demand and supply dynamics, along with macroeconomic factors affecting gold prices.

While physical gold can act as a safe haven asset, its growth is more reflective of market sentiment and external economic conditions.

Protection Against Inflation

Both Gold IRAs and physical gold are considered effective hedges against inflation, maintaining their global value when traditional currencies lose purchasing power.

Investors turn to these precious metal assets as a way to safeguard their portfolios from the erosive effects of inflation. Gold IRAs offer the added advantage of tax benefits and retirement savings, making them a popular choice for long-term wealth preservation.

On the other hand, physical gold provides a tangible and universally recognized store of value, independent of any specific financial system. This innate characteristic makes it a reliable asset during periods of economic uncertainty and currency devaluation.

Retirement Planning

Retirement planning with Gold IRAs involves understanding IRS regulations on contributions and withdrawals, whereas physical gold can be an additional asset outside of traditional retirement accounts.

When considering Gold IRAs, it’s important to note that contributions to these accounts are subject to strict IRS guidelines that can differ from regular retirement plans.

The IRS allows individuals to contribute a certain maximum amount each year to their Gold IRAs, ensuring compliance with the current tax laws. Withdrawals from Gold IRAs are also governed by specific regulations, including penalties for early distributions.

In contrast, incorporating physical gold into your retirement portfolio offers diversification and a hedge against market volatility. Gold’s intrinsic value can provide a sense of security and stability, especially during economic uncertainties.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

What Are the Risks of Investing in Gold IRA and Physical Gold?

Investing in Gold IRAs and physical gold carries certain risks, including market volatility, counterparty risks, and storage and maintenance costs that investors should carefully consider.

Market Volatility

Market volatility affects Gold IRAs and physical gold differently, with precious metals often moving inversely to the stock market indices like the S&P 500.

During times of market turmoil, investors turn to Gold IRAs and physical gold as a safe haven asset. The demand for gold typically increases when the stock market faces uncertainties, as it is considered a hedge against inflation and currency devaluation.

This inverse relationship with traditional assets like stocks and bonds makes owning gold a strategic diversification tool for a balanced portfolio.

Counterparty Risk

Counterparty risk in Gold IRAs involves the reliability of custodians and administrators managing the account, which can affect the security of the investment.

When considering a Gold IRA, it is crucial to understand the significance of custodians and administrators in the process.

Custodians play a crucial role in physically safeguarding the precious metals held within the account, ensuring their authenticity and secure storage.

On the other hand, financial advisors are responsible for guiding investors on making informed decisions regarding their Gold IRA, helping them navigate the complexities of the market.

The trustworthiness and competence of these professionals directly impact the overall performance and growth potential of the investment portfolio.

Storage and Maintenance Costs

Storage and maintenance costs are significant considerations for both Gold IRAs and physical gold, with Gold IRAs requiring secure vaults and insurance, while physical gold may incur home storage costs.

In terms of Gold IRAs, the need for secure vaults to store the precious metal is crucial, as these accounts are typically held by third-party custodians who ensure the safety and security of the gold. Insurance for Gold IRAs adds another layer of protection, safeguarding the investment against unforeseen events.

On the other hand, individuals who opt for physical gold often choose to store it at home, which can lead to additional expenses. Factors such as purchasing a safe, insurance for the gold, and implementing security measures to prevent theft all contribute to the overall maintenance costs of physical gold ownership.

Best Gold IRA Companies

To avoid the various risks involved with a gold IRA, choosing a long-established and trusted gold IRA company is key. In addition to offering competitive prices, transparency, reliable customer service, and security of your precious metals, a reputable gold IRA company understands the many rules and regulations required for compliance.

They eliminate much of the guesswork, costs, and worry involved with opening and maintaining a gold IRA account.

Finding the right gold IRA will also depend on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs whether you prefer a gold IRA or owning the physical gold in your place of residence. See our gold IRA reviews for more information so you can make the right choice.

How to Choose Between Gold IRA and Physical Gold?

Choosing between a Gold IRA and physical gold requires careful consideration of investment goals, liquidity needs, associated costs, and advice from a knowledgeable financial advisor.

When deciding how to allocate your assets, it is essential to think about whether you prefer the security and convenience of a Gold IRA or the tangible nature of physical gold. Gold IRA offers tax advantages and diversification within a retirement account, while physical gold provides a sense of ownership and the potential for direct possession.

Consider your investment timeline and risk tolerance; Gold IRA might suit long-term investors seeking stability, whereas physical gold could be appealing for those who enjoy collecting precious metals. Evaluating the fees and transaction costs associated with each option is crucial for maximizing your returns.

Click the banner below to visit Augusta Precious Metals’ official site to obtain their free gold IRA checklist.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

Click the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

Conclusion

Now you are aware of the key differences and benefits of gold IRAs vs physical gold ownership. With gold IRAs offering attractive tax advantages and greater security versus the ease of access and quick liquidity that comes with physical gold ownership, your decision is greatly dependent on your individual needs.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

Frequently Asked Questions

What is the difference between a Gold IRA and physical gold?

A Gold IRA is a retirement account that holds gold or other precious metals as the main investment, while physical gold refers to physical coins or bars of gold that are owned outright.

Which one is a better investment option, Gold IRA or physical gold?

It ultimately depends on personal investment goals and risk tolerance. Gold IRA offers tax benefits and is managed by a custodian, while physical gold can be held directly and has no custodian fees. Consult a financial advisor for personalized advice.

What are the advantages of a Gold IRA compared to physical gold?

Gold IRA offers tax advantages, diversification in a retirement portfolio, and professional management by a custodian. It also eliminates the need for storage and security concerns that come with physical gold ownership.

Are there any downsides to owning a Gold IRA?

The main downside to a Gold IRA is that it is subject to market fluctuations and may not always perform as well as traditional retirement accounts. Additionally, there are fees associated with setting up and managing a Gold IRA.

Can I hold physical gold in a Gold IRA?

Yes, a Gold IRA allows for the inclusion of physical gold, as well as other precious metals such as silver, platinum, and palladium. However, there are strict regulations on the types of gold that can be held, so it is important to consult with a custodian before making any purchases.

Is it possible to have both a Gold IRA and physical gold in my investment portfolio?

Yes, many investors choose to have a combination of both a Gold IRA and physical gold in their portfolio. This allows for diversification and the potential for both long-term growth and tangible asset ownership.

Find the right gold IRA conpany for you. Obtain a gold IRA guide and talk to a broker

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com