Gold IRA Vs Real Estate

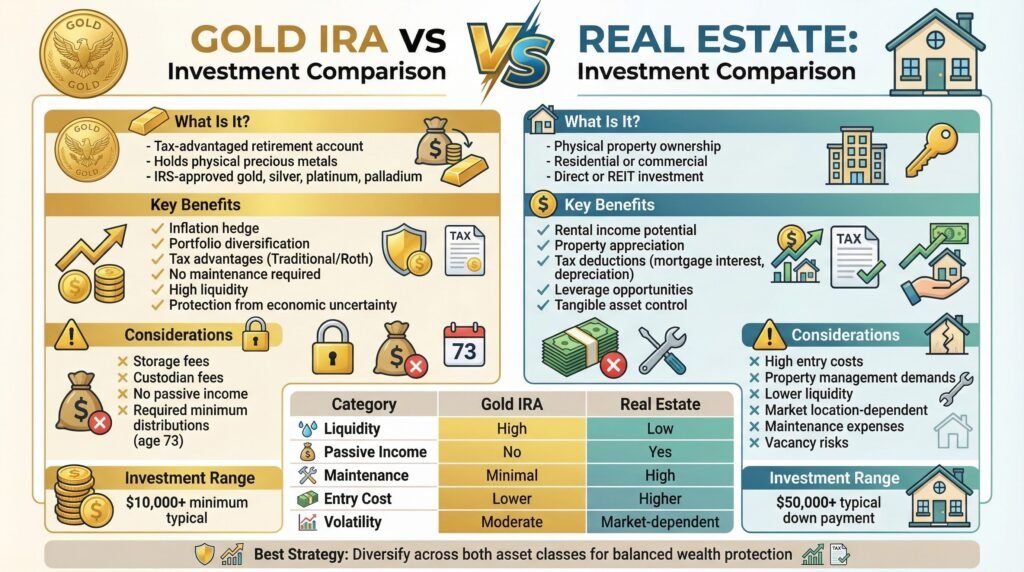

Comparing Gold IRA and real estate, it’s evident that each investment strategy has unique benefits.

Gold IRA offers a hedge against market volatility and inflation, while ensuring liquidity and tax advantages. On the other hand, real estate is another tangible asset that promises potential profits on sale, steady rental income, and certain tax benefits as well. Real estate generally requires more active management and might be less liquid than gold. To better grasp the difference between the two investments, we will discuss:

-Understanding Gold IRA Investments

-Real Estate Investment Basics

-Evaluating Returns and Risks

-Liquidity: Gold Vs Real Estate

-Portfolio Diversification Strategies

Your choice depends on personal factors like your risk tolerance, financial goals, and time you can dedicate to managing investments. Continue, and you’ll find more details on each option’s unique characteristics, risks, and potential returns.

Understanding Gold IRA Investments

As we plunge into the world of Gold IRA investments, it’s important to understand its historical performance. Gold, as we are aware, has served as a safe-haven asset and has consistently shown value appreciation over decades. This makes it particularly attractive for long-term investors.

Diversification is another key aspect of Gold IRAs. They enable you to spread your investments across different asset classes. This mitigates risks during times of market volatility and is essential for long-term wealth preservation.

One of the significant benefits of gold as an asset is its high liquidity. It’s easy to buy and sell gold coins or bullions, providing flexibility in managing your portfolio.

There are also potential tax advantages associated with Gold IRAs. You can defer tax on your gains until retirement. You may even be able to make tax-free withdrawals depending on your circumstances and whether the gold IRA withdrawal rules permit.

This is a factor you should seriously consider when planning your retirement investment strategy. Knowing how gold IRAs work and understanding the various rules and regulations regarding precious metals IRAs is critical.

Real Estate Investment Basics

Moving on from the domain of Gold IRAs, let’s now explore another potent investment avenue – real estate. As an investment, real estate offers a unique blend of benefits that can’t be found in other investment vehicles.

Firstly, it’s important to understand that real estate is a tangible asset. When you invest in real estate, you’re buying physical land or property. This means you have something concrete to show for your investment, which can provide a sense of security.

Secondly, real estate typically appreciates over time. While there are always exceptions, this general trend means that if you hold onto your property for long enough, there’s a good chance you’ll make a profit when you sell.

A third benefit is the potential for rental income. If you own a property and rent it out, you can enjoy a steady stream of income that can help supplement your retirement or other financial goals. This is an advantage that sets real estate apart from many other types of investments.

Fourthly, real estate provides opportunities for leverage, which is the use of borrowed money to increase the potential return of an investment. By using a mortgage to finance a real estate purchase, you can control a larger asset with a smaller amount of your own capital.

Finally, investing in real estate can offer certain tax advantages. For example, you may be able to deduct the interest on your mortgage on your tax returns, which can save you money over time.

Understanding these basics is the first step to making informed real estate investment decisions.

Evaluating Returns and Risks

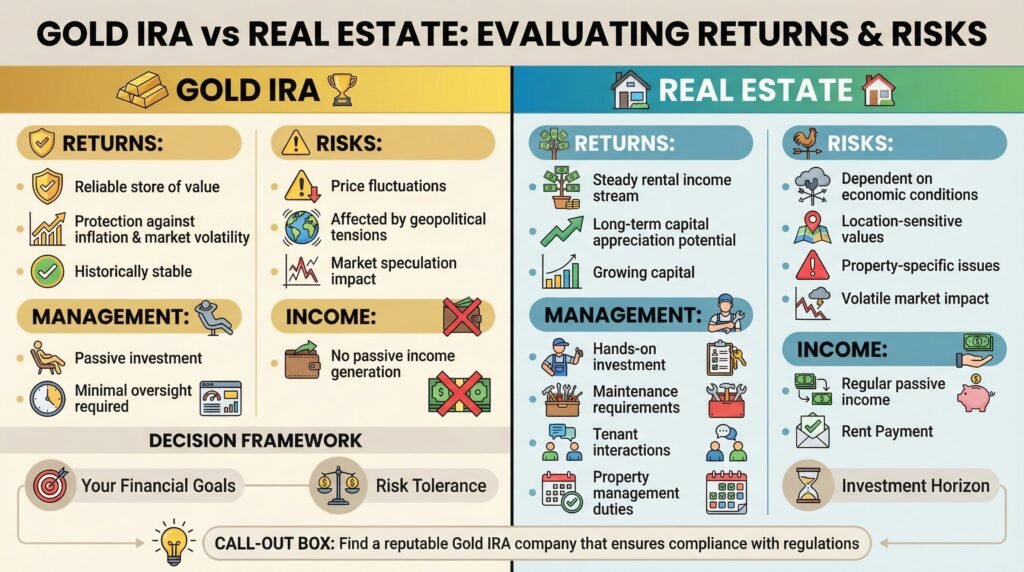

When we explore the domain of returns and risks, two key aspects of any investment, it is crucial to conduct a thorough analysis.

Let’s start with gold IRAs. Historically, gold has been a reliable store of value, protecting investors against extreme market volatility and inflation. It’s not without risks, though. The price of gold can fluctuate based on market speculation and geopolitical tensions.

Now, let’s consider real estate. Unlike gold, real estate can generate a steady stream of income through rentals and has the potential for capital appreciation over the long term.

However, real estate investments can be more volatile, with values dependent on economic conditions, location, and property-specific issues.

While gold is a passive investment requiring minimal oversight, real estate can be quite hands-on. Property management, maintenance, and tenant interactions-these are all part and parcel of owning real estate.

These factors can greatly affect your returns and should be considered as part of your risk assessment.

But here’s the rub. While gold can serve as a hedge against inflation and market volatility, it doesn’t offer the passive income that real estate does.

Conversely, while real estate can provide a steady income stream and potential appreciation, it’s subject to market fluctuations and property-specific risks.

In essence, both gold IRAs and real estate have their unique sets of returns and risks. Your choice between the two should be guided by your financial goals, risk tolerance, and investment horizon.

Finding a reputable gold IRA company that understands the many rules and regulations required for compliance is a crucial decision that should not be overlooked.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Liquidity: Gold Vs Real Estate

Let’s explore the liquidity aspect of gold and real estate investments. Liquidity, in investment terms, refers to how easily an asset can be converted into cash without affecting its market price.

It’s an important factor to evaluate when choosing between different investment options.

Gold is known for its high liquidity. You can sell gold coins or bullion almost instantly worldwide, making it a flexible option if you need access to your investment quickly. This high liquidity is due largely to the constant global demand for gold.

However, it’s important to remember that while gold can be sold quickly, its price can fluctuate, affecting the return on your investment.

On the other hand, real estate is typically regarded as a less liquid investment. Selling a property can take weeks or even months, and it also involves various transaction costs like agent fees and taxes.

Additionally, the selling price of a property can be influenced by numerous factors, including market conditions, property location, and property condition.

So, even though real estate can offer attractive returns, it may not be the best option if you anticipate needing quick access to your invested funds.

Portfolio Diversification Strategies

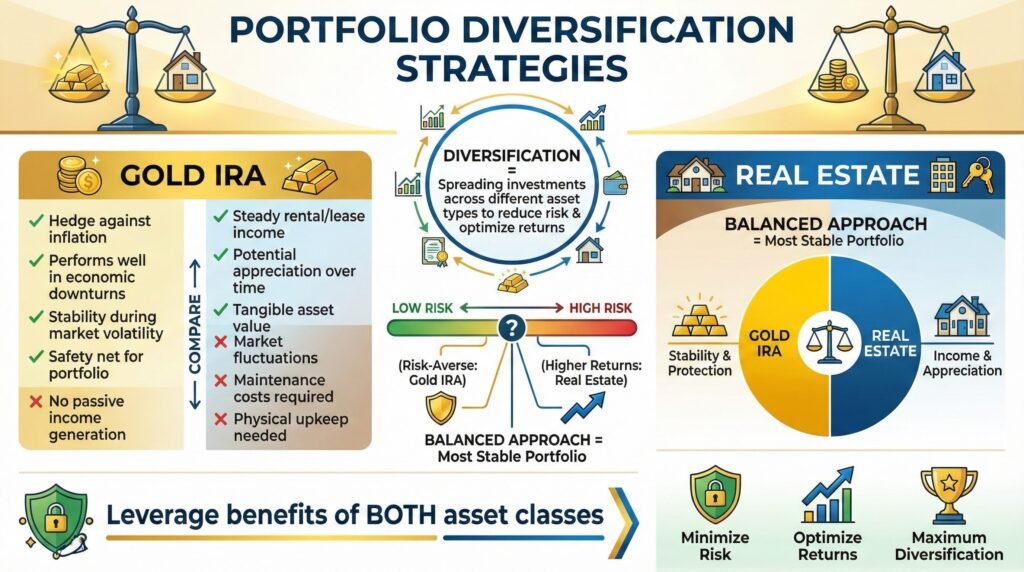

In the domain of investment, diversification is an essential strategy to reduce risk and optimize returns.

When we talk about diversification, we’re talking about spreading your investments across different asset types to balance the potential rewards and risks. Let’s take a closer look at how this works with gold IRAs and real estate.

One of the chief benefits of a Gold IRA, is its unique diversification attributes. Gold is often considered a hedge against inflation and performs well during economic downturns. This can provide a safety net for your portfolio when the stock market is volatile.

However, it’s crucial to recognize that gold doesn’t generate passive income like real estate can.

On the other hand, investing in real estate can offer a steady stream of income through rents or leases, along with potential appreciation over time.

Real estate can be an excellent addition to a diversified portfolio, but it’s not without its risks. It’s subject to market fluctuations, and like any physical asset, it requires maintenance and has associated costs.

One of the biggest considerations in diversification strategies is your risk tolerance. If you’re more risk-averse, you might lean towards gold IRAs for their stability.

If you’re comfortable with a bit more risk for the potential of higher returns, real estate could be a good fit.

Ultimately, a balanced approach that includes both gold and real estate could provide the most stable and diversified portfolio. It allows you to leverage the benefits of both asset classes, potentially optimizing your returns while minimizing risk.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

Click the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

Conclusion

In summary, both Gold IRA and real estate investments come with their unique perks and challenges. Your choice should depend on your financial goals, risk tolerance, and investment horizon. It’s essential to diversify your portfolio and not put all your eggs in one basket.

Remember, knowledge is power, and understanding these asset classes can lead to more confident and informed investment decisions. Best of luck on your gold investing journey.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com