Pros and Cons of the Gold Standard

Did you know that nearly half of the world’s countries were on the Gold Standard by 1900? This system, where a country’s currency value was directly linked to gold, had its benefits and drawbacks.

The gold standard offered a sense of stability and predictability in conducting international trade. Theoretically, the gold standard could also restrict economic growth. Depending on what economic, ideological side of the spectrum you are on, limiting the growth of the money supply could either be a pro or a con. To truly understand the advantages and disadvantages of the gold standard, we will explore the following points:

- Features of Gold Standard

- What are Some Advantages of the Gold Standard?

- Disadvantages of the Gold Standard

- Gold Mining and Gold Production

So, you’re in for a balanced exploration of the pros and cons of this historical economic policy. Let’s dig into the golden past together.

Features of the Gold Standard

Let’s consider the potential benefits of the gold standard.

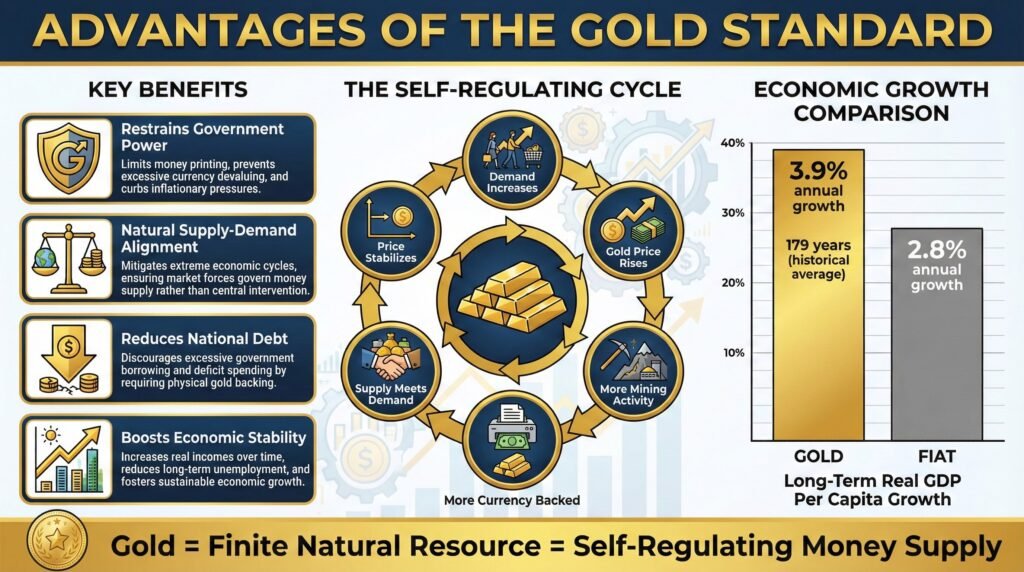

One could argue that gold’s enduring global value and a gold standard naturally align the money supply with demand, thus mitigating economic crises, boosting incomes, and reducing unemployment.

Furthermore, it’s noteworthy that a gold standard could restrain government power by limiting money printing and curbing national debt, possibly reducing the U.S. trade deficit and military spending.

Gold’s enduring global value and a gold standard naturally align the money supply with demand.

One significant advantage you’ll find with the gold standard is its natural alignment of the money supply with demand, due to gold’s enduring global value.

Gold’s production levels tend to match demand since it’s a finite natural resource requiring high costs to mine and process.

This creates a self-regulating system where increased demand raises gold’s market price, stimulating more mining. As a result, more gold backs more currency until it’s sufficient, leveling out the price of gold and reducing mining.

Unlike the fiat money system, the gold standard inherently self-regulates. This characteristic contributed to an average annual economic growth of 3.9% during the 179 years the U.S. followed a gold or metallic standard, significantly higher than the 2.8% average under a fiat standard.

What are Some Advantages of the Gold Standard?

How did the Gold Standard Promote Stability?

In addition to aligning money supply with demand, the gold standard could also serve as a potent tool to curb economic crises, elevate incomes, and cut down unemployment rates.

A gold standard could mitigate economic crises, boost incomes, and reduce unemployment.

Historically, the gold standard has shown potential in mitigating economic crises. The ability to print fiat money contributed significantly to the Great Recession.

A gold standard could prevent such occurrences by limiting the money supply to the gold reserves, reducing the risk of bubbles and subsequent collapses.

Furthermore, the gold standard has been associated with boosting incomes. Real median income for men increased more while on the gold standard than it has since its abandonment.

Additionally, the gold standard has been linked to reducing unemployment. The unemployment rate was lower during the gold standard era.

Does the Gold Standard Prevent Inflation?

A gold standard restrains government power by limiting the printing and curbing national debt.

You’ll find that one major advantage of the gold standard is its ability to restrain governmental power, as it limits the amount of money that can be printed and helps curb national debt. \

Under this system, new money can only be printed if a corresponding amount of gold is available. This restrains government power and prevents it from manufacturing money out of thin air.

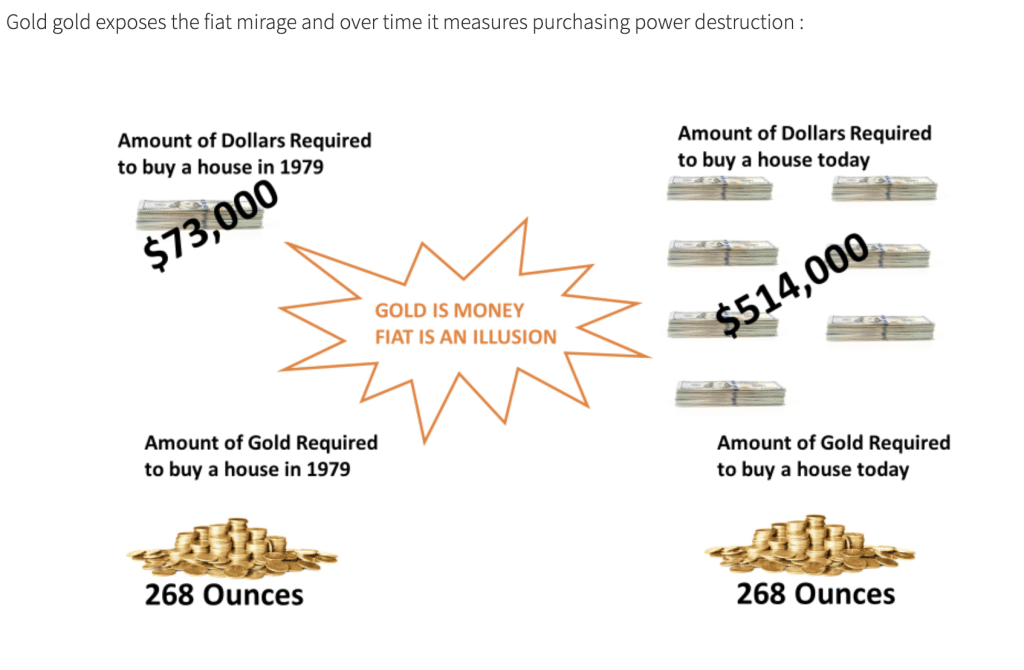

Think about it: since leaving the gold standard in 1971, the US currency in circulation increased exponentially, and so did the national debt. A gold standard could potentially prevent such a scenario.

It’s a check on government power, ensuring that our monetary system doesn’t drift into one resting solely on the unrestrained will of Congress.

A gold standard might cut money printing, lowering the U.S. trade deficit and military spending.

Notably, there have been some legislative calls for a return to the gold standard with H.R. 9157-Gold Restoration Act.

With a gold standard in place, you’d be seeing less money printing, which could potentially lower the U.S. trade deficit and cut back on military spending. Here’s how:

- Trade Deficit:

- The U.S. wouldn’t be able to finance large trade deficits by creating more money, leading to a more balanced trade system.

- A lower trade deficit means less reliance on foreign financing, reducing national debt.

- Military Spending:

- The government’s unlimited printing capability currently finances a massive global defense establishment.

- Under a gold standard, this spending would be restricted, leading to potentially more strategic and efficient military spending.

Disadvantages of the Gold Standard?

A gold standard would limit the Federal Reserve’s ability to address economic downturns and unemployment

In light of these potential pitfalls, you might wonder how a gold standard could impact the Federal Reserve’s capacity to tackle economic downturns and unemployment. Under the current fiat money system, the Fed can adjust interest rates and inject money into the economy as needed.

However, a gold standard would limit this flexibility. For example, during the 2008 financial crisis, the Fed’s intervention helped prevent a potential deflationary spiral. Similarly, during the COVID-19 pandemic, the Fed’s ability to lower interest rates and support businesses was crucial for economic stability.

Under a gold standard, these actions wouldn’t be possible. As Ben Bernanke, former Federal Reserve Chairman, stated, a gold standard would mean that no matter how high unemployment gets, the Fed couldn’t use monetary policy to address it.

A gold standard could hamper national security by restricting defense financing.

Without the flexibility of a fiat system, you’d find it harder to finance national defense in times of war under a gold standard. It restricts quick currency expansion, which is often necessary for war financing.

Historical instances, like Lincoln’s authorization of $450 million in fiat currency, known as ‘greenbacks,’ during the Civil War, illustrate this. Similarly, during World War I, several countries temporarily ditched the gold standard to finance their war efforts by printing more money.

The United States also funded its involvement in World War II largely through the Federal Reserve printing money, selling war bonds, and running large deficits.

This perceived disadvantage has also been challenged and will be explored later in a article.

Gold Mining and the Gold Production?

While a gold standard could potentially offer certain benefits, it’s crucial to also consider its drawbacks.

You might find that gold’s fluctuating availability and value pose a challenge for economic stability. Moreover, it could limit the Federal Reserve’s flexibility in addressing economic downturns and unemployment, exacerbate the environmental and cultural impacts of gold mining, and restrict defense financing, impacting national security.

Gold’s fluctuating availability and value don’t ensure the stability needed for a healthy economy

If you’re considering the gold standard, keep in mind that gold’s fluctuating availability and value can throw off the stability needed for a healthy economy.

For instance:

- In 1848, the significant gold discovery in California led to unexpected inflation, disrupting the U.S. economy and trade balance.

- Between 1913 and 1971, there were 12 deflationary periods under the gold standard system due to limited money supply.

- Furthermore, the gold standard can exacerbate financial panics. The US experienced several such panics between 1879 and 1933, with the gold standard often proving a hindrance in stabilizing the economy post-1929 stock market crash.

Also, with gold mining projected to be unsustainable by 2050, the long-term viability of a gold standard remains questionable.

This theoretical disadvantage has been largely challenged, given that on a year-to-year, decade-on-decade average of the growth of the gold supply has been approximately 1.5%. This annual percentage growth matched population growth.

A gold standard might worsen the environmental and cultural impacts of gold mining

Beyond the economic implications, you should also consider the environmental and cultural impacts of a return to the gold standard.

Environmental impact:

- An increase in gold demand would necessarily accelerate mining activities, which often employ harmful techniques like cyanide leaching.

- Each ounce of gold produces 79 tons of mine waste.

- Cyanide leach mining creates significant water pollution.

- Cultural impact:

-Nearly half of the gold mines are on indigenous lands, often violating the communities’ rights.

-The Yanomami tribe in Brazil, for instance, has seen its lands ravaged and its communities threatened by diseases brought by miners.

Thus, a gold standard can worsen the environmental and cultural impacts of gold mining.

However, this possibility is not entirely probable given the 21st-century technological improvements that make it easier for the mining industry to comply with the stringent environmental standards.

Personal Gold Standard with a Self-Directed Gold IRA

The many advantages of the gold standard can be applied to one’s own personal finances, wealth protection, and retirement planning, irrespective of whether the US government operates on a gold standard or not.

Mitigating your losses in other areas of your portfolio through diversification, hedging against inflation due to excessive government spending, and building generational wealth are just a few.

The key to taking advantage of the many benefits of gold investing is finding a trusted company to invest with.

Working with a long-established gold IRA company can provide access to competitive prices, price transparency, a reasonable buyback policy, reliable customer service, and security of your precious metals, saving a great deal of time and headache.

Gold IRAs provide additional advantages to merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one’s unique investing needs. Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Conclusion

So, you’ve seen the ins and outs of the Gold Standard. Sure, it offered price stability and bolstered international trade, but it wasn’t without its downsides – it could potentially limit economic growth.

It’s a complex system with both shining benefits and glaring drawbacks. Ultimately, understanding its pros and cons gives you a greater insight into the intricacies of global economics.

Remember, every economic system is a blend of trade-offs.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect and want to take advantage of the best prices, attend a gold educational webinar hosted by Augusta Precious Metals. Click the button below:

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com