What Are the Advantages and Disadvantages of Investing in Gold?

You’ve always been intrigued by gold, haven’t you? It’s more than just a shiny ornament; it’s a potential investment. But, like any investment, it’s not without risks.

The advantages and disadvantages of investing in gold will depend on your short and long-term goals. To have a full understanding of the pros and cons of this time-tested asset, we should review the following:

- Gold’s Stability

- Security as a Safe Haven

- An inflation hedge Asset

- Portfolio Diversifier

- Capital growth upside

- Direct and indirect gold exposure

- Portability

- Costs of securing gold

- Paper-based gold investments

- Investment costs

- Underestimated volatility

- Income stream

- Purity considerations

- Opportunity costs

- Jewelry investment complexity

- Gold investment companies

This article will help you weigh the pros and cons of investing in gold, so you can make an informed decision. Whether you’re an experienced investor or just starting, understanding the complexities of gold investment could be your golden ticket to financial success.

Let’s delve into the details.

Gold’s Stability

As you consider your investment options, gold presents several compelling benefits.

With its reputation for stability and security, it acts as a hedge against inflation, keeping your wealth intact even when currencies falter.

Furthermore, having gold in your portfolio can add valuable diversification, and if you opt for gold shares, there’s the added perk of dividends.

In times of economic instability, you’ll find that gold often serves as a stable investment, outperforming other asset classes during financial crises. Gold’s stability stems from its inherent properties, including scarcity, durability, and malleability, which contribute to its lasting value.

Its finite supply makes it a sought-after asset, especially when the market is volatile. Unlike stocks or bonds, gold’s worth doesn’t rely on an entity’s performance, which adds to its resilience during downturns.

Data from GoldSilver shows that in six out of the last eight major stock market crashes, gold prices increased. This demonstrates gold’s capacity to preserve, even enhance, your wealth during turbulent times.

Therefore, investing in gold can provide a hedge against financial uncertainty, providing a safety net when other investments falter.

Security as a Safe Haven

Building on gold’s stability, you’ll find that one of the primary advantages of investing in gold is its inherent security. As a tangible asset, you can actually hold gold in your hands, giving you a sense of certainty and assurance. This tangibility lends itself to a sense of security not found in other investments like stocks or bonds.

Moreover, gold’s value is rooted in its rarity. Unlike paper currencies, gold can’t be artificially manufactured or manipulated by politicians or policymakers. This makes your investment immune to the whims of economic policy, further enhancing its security.

Ultimately, the physical nature and scarcity of gold provide a level of security that bolsters its appeal as a reliable, trustworthy investment.

An Inflation Hedge Asset

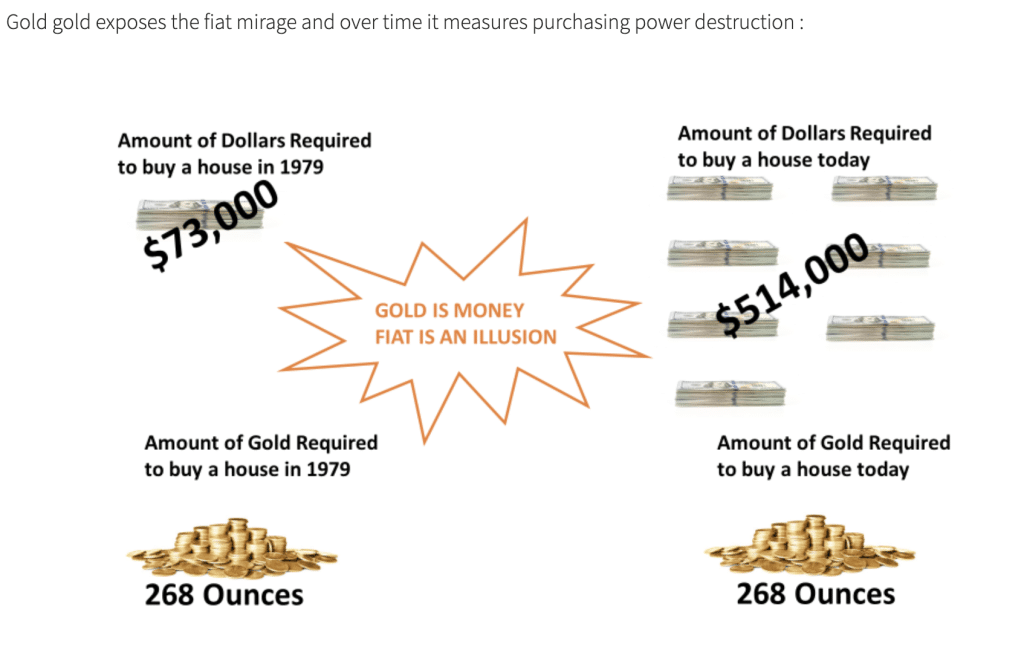

After understanding the security gold provides, it’s time for you to consider how it can act as a hedge against inflation, another major advantage of investing in gold. When inflation rises, the value of currency falls, but gold tends to maintain its purchasing power. This shields your investment from the deteriorating effects of inflation.

Historical analysis shows that the precious metal has outpaced inflation since 1974, delivering a 1.2% annual after-inflation return. Particularly in the current climate of rising interest rates, gold’s inflation-hedging qualities become even more attractive.

Portfolio Diversifier

So, how does gold add that extra layer of safety to your investment portfolio? Here’s how:

-

- Uncorrelated Asset: Gold typically moves independently of stocks and bonds. This means when your other investments are underperforming, gold might be doing well, helping to offset losses.

- Stability during Market Volatility: Gold has historically held its value during economic downturns. In fact, its value often increases during these times, providing a safe haven in tumultuous periods.

- Negative Equity-Gold Correlation: There have been multiple instances where the negative correlation between gold and equity has exceeded -50%. In 2021, the 65-day correlation was -58%, the most negative since 2003, indicating a strong diversification benefit.

In essence, investing in gold offers a solid strategy for diversifying your portfolio, reducing risk, and providing a safety net during economic uncertainty.

Benefits of Working with a Reputable Gold Investment Company

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key. Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and hassle.

Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital.

Gold IRAs provide additional advantages over merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist

Capital Growth Upside

Building on the idea of dividends from gold shares, there are a few key aspects to keep in mind regarding the capital growth upside of investing in gold.

Firstly, gold companies provide leveraged exposure to the underlying gold price. This means that even a small increase in the gold price can trigger a more significant rise in the company’s stock price. This leverage allows for amplified returns and increases the potential for profitability.

Secondly, a well-managed gold company can offer more significant increases in stock price compared to the gold price. This growth potential is attractive to investors looking for higher returns and capital appreciation.

Lastly, it is important to consider gold shares as part of a diversified investment portfolio. Balancing risk and reward is crucial in any investment strategy, and gold shares should be included alongside other assets to mitigate potential risks.

Direct and Indirect Gold Exposure

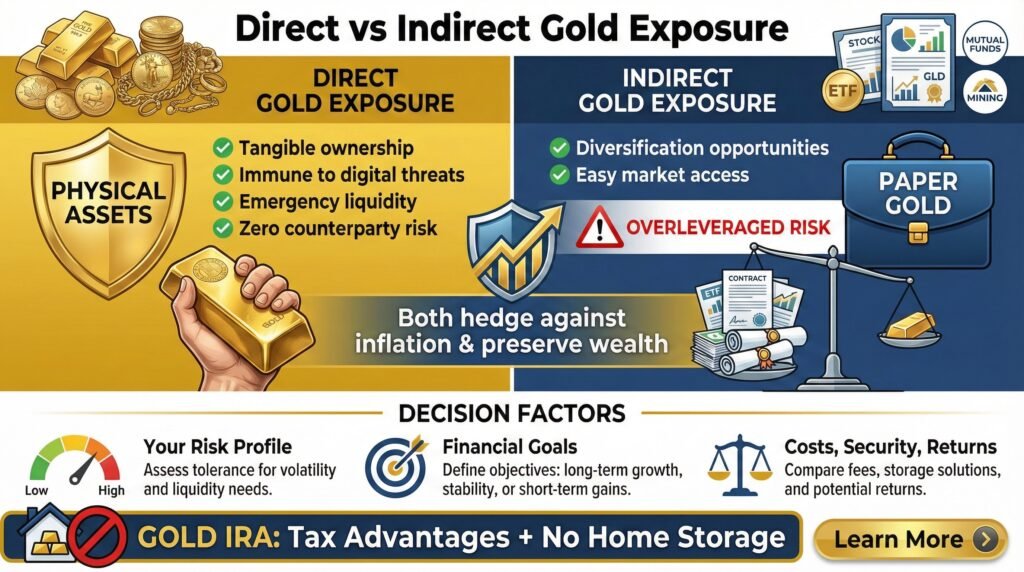

In terms of direct and indirect gold exposure, you’ll find several advantages to investing in gold.

Direct exposure, such as owning gold bullion, coins, or jewelry, offers tangibility. These assets are immune to digital threats and can be used in emergencies, providing a sense of security.

Also, you avoid the counterparty risk exposure inherent with what can be termed indirect ‘paper gold’ investments.

Indirect gold exposure, via investing in gold stocks, ETFs, or mutual funds, offers diversification opportunities. However, once again, these gold derivative investment instruments can, by their nature, be overleveraged.

To state simply, there may not be an equal amount of physical gold backing the number of contracts in open interest.

However, both methods act as a hedge against inflation, helping maintain the value of your wealth when economies falter.

The choice between direct and indirect exposure depends on your risk profile and financial goals. It’s crucial to consider costs, security issues, and potential returns before making a decision.

A tax-advantaged means of owning physical gold without the need to store the precious metal in your own home is a gold IRA. Click the banner below to receive more information

Best Gold IRA for Low Minimums and Price Transparency

Portability

Despite the size or form of your gold investment, you’ll enjoy the advantage of its portability, making it a convenient and flexible asset to have in your portfolio. The portability of gold stands out as a major asset in a world of increasing uncertainty, allowing you to safeguard your wealth in an easily transportable form, whether it be coins, bullion bars, or jewelry.

Here’s why portability matters:

- Ease of Transport: You can physically move your gold investment, giving you control over your wealth.

- Flexibility: Gold’s portability allows for easy conversion into cash, anywhere in the world.

- Security: In times of economic or political instability, you can safeguard part or all of your investment simply by moving it.

Costs of Securing Gold

While gold’s luster often attracts investors, it’s essential to consider the potential downsides. These include the costs of securing gold, investment costs, and the often-underestimated volatility gold can present.

Moreover, physical gold doesn’t generate an income stream, and assessing the purity of your investment can be challenging.

As an investor, you’ll find that securing your gold investment comes with ongoing costs such as storage and insurance, which could cut into your potential profits. Analyzing these costs is crucial to understanding the true return on your investment.

Here are three major costs you need to consider:

-

- Storage Costs: Storing gold at home requires a significant investment in a high-security safe. Alternatively, professional storage comes with a fee, often a percentage of your gold’s value.

- Insurance Costs: Insuring your gold against theft or loss isn’t optional. This cost varies depending on your storage choice and the value of your gold.

- Security Risks: Storing gold at home increases the risk of theft, potentially resulting in total loss.

Balancing these costs against potential gains is key to successful gold investing.

Investment Costs

Even though you might be drawn to the allure of investing in gold, it’s important to consider the investment costs that can potentially eat into your profits. The glitter of gold doesn’t come without its price.

Buying gold bars and coins involves paying a premium for the dealer’s services. This premium is an additional cost over the market price of gold, which you need to recoup through an increase in the gold price to break even.

Similarly, if you opt for gold ETFs and shares, you’ll encounter brokerage fees. These are costs for the services provided by the broker in facilitating the transaction. Remember, these fees can add up and significantly reduce your potential return.

Hence, a detailed cost-benefit analysis is vital before you plunge into gold investment.

Underestimated Volatility

You mightn’t realize it, but gold’s volatility can be a major drawback in your investment journey. Although gold generally offers a steadier ride over time compared to other assets, its volatility can be underestimated.

Severe Swings: Gold can experience dramatic swings, ranging between -50% to 100% in as brief as two years.

Prolonged Negative Returns: This volatility can lead to prolonged periods of negative returns.

Uncertain Profitability: Rapid changes in gold prices can make long-term profit predictions unpredictable.

It’s crucial to understand that while gold can serve as a hedge against inflation and economic instability, it’s not immune to volatility. Therefore, before diving into gold investment, make sure you’re prepared for potential unexpected twists and turns.

Income Stream

Unlike stocks or bonds, investing in gold doesn’t provide you with a regular income stream, which is an important factor to consider in your investment decisions. This means that while gold can be a safe haven during economic uncertainties, it doesn’t actively contribute to your wealth growth through dividends or interest.

Over time, as history shows, gold’s value continuously appreciates, but the lack of ‘real-time’ income that is constantly paying out will not be felt until you sell your holdings. Additionally, the costs associated with storing and insuring physical gold can detract from your potential gains if you are only holding for a short amount of time.

Suffice it to say that gold and the majority of precious metals are for long-term investing and building generational wealth.

One recent exception to this long-held objection to the non-yielding nature of holding physical gold is new and innovative fixed-income products from the company Monetary Metals.

Monetary Metals pays investors interest on gold, paid in gold through their unique gold leasing investment product. To learn more, tap the banner below.

Purity Considerations

While considering gold as an investment, it’s crucial to note that determining the purity of physical gold can be quite challenging. Trustworthy sellers: It’s not easy to judge the purity of gold just by looking at it. This makes it vital to buy from reputable sellers who can provide a guarantee of purity.

Verification costs: After purchasing, you might feel the need to get the gold’s purity checked independently, which adds to your expenses.

Risk of counterfeits: Despite your best efforts, there’s always a risk of ending up with counterfeit gold, which is a complete loss.

Opportunity Costs

Investing in gold also means potentially missing out on the substantial gains you could have made from other asset classes. Gold can underperform for significant periods, and history shows that equities have outperformed gold by a staggering 16 times since 1974.

This is what’s known as opportunity cost – the loss of potential gain from other alternatives when one option is chosen.

So, while gold can provide a safe haven during volatile times, it’s not always the most profitable investment. You’re also tying up capital that could be used elsewhere, potentially yielding higher returns.

Therefore, it’s crucial to consider the opportunity costs and how they might impact your overall investment strategy and performance.

Investing in gold isn’t just about the potential for gains; it’s also about what you might be giving up.

Paper-Based Gold Investments

You might find that investing in paper-based gold, such as shares, ETFs, and mutual funds, doesn’t offer the same advantages as owning physical gold.

-

- Correlation Discrepancies: While gold’s price might be increasing, your gold portfolio’s value could actually be declining. This is because the performance of paper-based gold investments isn’t perfectly correlated with the price of physical gold.

- Lack of Tangibility: Unlike physical gold, you can’t hold shares, ETFs, or mutual funds in your hand. This lack of tangibility can limit your control and flexibility over your investment.

- Potential for Mismanagement: You’re relying on the management of these funds or companies. If they perform poorly or make bad decisions, your investment could suffer, even if gold’s market price is strong. Investing in paper-based gold requires trust in third parties, which adds an extra layer of risk.

Jewelry’s Investment Complexity

After exploring paper-based gold investments, let’s now delve into the complexities of investing in gold jewelry, a factor that can make gold investment quite challenging.

When you buy and sell jewelry, you aren’t just dealing with the inherent value of the gold. Additional factors come into play, many of which can’t be rationally quantified, adding a layer of uncertainty to your investment.

Furthermore, the costs of crafting jewelry are higher than the premium you’d pay for other physical gold forms. These costs can range between 6% and 14% of the gold price.

Gold Investment Companies

Gold is a valuable asset and should managed with care. A reputable and trusted precious metals investment and gold IRA company can provide competitive prices, price transparency, reliable customer service, and, most importantly, the security of your precious metals.

Gold IRAs, more specifically, provide a means of owning the physical metal without the downside counterparty risk of digital gold etfs, shares, or other such derivative-based investment instruments.

Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a tax-deferred gold IRA or owning the physical gold in your place of residence, make the choice that best suits your needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Conclusion

In sum, investing in gold offers a solid hedge against inflation, a diversified portfolio, and a safe haven during political unrest.

But it’s not all glitters. You may face short-term volatility, storage and security challenges, and a lack of steady income.

Understanding these pros and cons helps you make an informed decision. Whether you’re an experienced investor or a beginner, knowing the intricacies of gold investment could be your golden key to financial success.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect and want to take advantage of the best prices, attend a gold educational webinar hosted by Augusta Precious Metals. Click the button below:

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com