How to Buy 1 Oz Gold Bars

You’re about to dive into the fascinating world of gold investment. It’s a smart move, and buying 1 oz gold bars could be your golden ticket.

Buying 1 oz gold bars holds many advantages, such as portfolio diversification, inflation hedging, and owning a physical asset that stores value. However, finding the best source is key. To better understand the process of buying 1 oz gold bars, it is necessary to discuss the following points:

- What is a 1oz gold bar?

- Why invest in 1oz gold bars?

- How Much Gold Is in a 1 oz Gold Bar?

- What Is the Price Of 1 oz Gold Bar Price?

- Should Investors Buy 1 oz Gold Bars?

This guide will provide you with all the know-how you need, from choosing the right bar to understanding its value. So, whether you’re a seasoned investor or a beginner, let’s embark on this exciting journey together.

You’ll soon be navigating the gold market with confidence and ease.

Buy 1oz Gold Bar – What It Is?

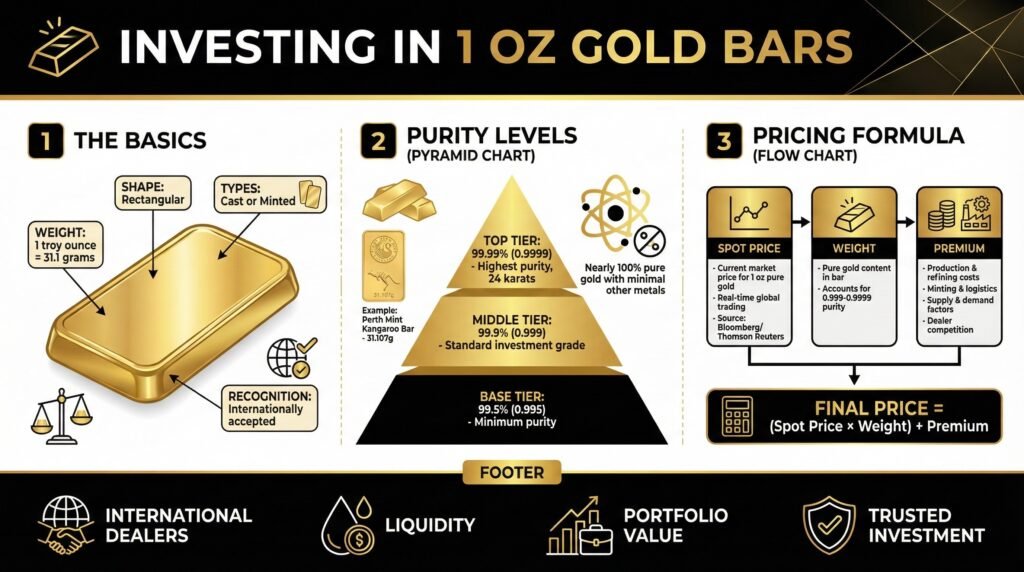

When you’re ready to invest, buying a 1 oz gold bar can be a straightforward and rewarding process. These bars are made from investment-grade gold bullion, each weighing exactly 1 troy ounce, or 31.1034768 grams.

The fineness, purity, or gold content of these bars is at least 99.9%, making them a valuable addition to any gold portfolio.

1 oz gold bars usually come in a rectangular shape and are produced either as cast or minted bars. Their look and feel can vary significantly, as they’re manufactured by a variety of refineries and government mints.

Despite this, all 1 oz gold bars are recognized by gold bullion dealers internationally, ensuring their value and liquidity.

Why invest in 1oz gold bars?

Investing in 1 oz gold bars offers several advantages that make them an attractive addition to any investment portfolio. They’re competitively priced, conveniently sized, and widely recognized in both domestic and international markets. This makes them not just suitable for delivery and storage, but also a great store of value.

Here are four key reasons why you should consider investing in 1 oz gold bars:

-

- Affordability and Size: 1 oz gold bars are affordably priced, making them a cost-effective option for both budding and experienced investors. Their convenient size also makes them easy to handle, store, and transport.

- Recognized and Trusted Brands: Brands like Johnson Matthey, Credit Suisse, MKS PAMP, Heraeus, and government mints such as the Royal Canadian Mint and the Perth Mint produce 1 oz gold bars. These brands are globally recognized, ensuring the authenticity and quality of your investment.

- Purity and Weight: Each 1 oz gold bar has a minimum purity of 0.995 and contains exactly 1 troy ounce of gold. This standardization assures of the bar’s value and makes transactions straightforward.

- Storage and Delivery Options: Reputable dealers like GoldCore and Kitco provide secure, insured delivery and storage options. This ensures your investment is safe and accessible when you need it.

Working with a Suitable and Trusted Gold Investment Company

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key. Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and hassle.

Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital.

Purity standards matter. Partnering with a trusted company guarantees that these gold bars are always crafted in pure gold (.9999 fine), producing a cost-effective option for gold investors. You can easily buy these bars online from Kitco at competitive gold prices.

Gold IRAs provide additional advantages to merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one’s unique investing needs. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

How Much Gold Is In A 1 oz Gold Bar?

You might be wondering, how much gold is actually in a 1 oz gold bar? As an investor, understanding the purity and weight of gold bars is critical to your investment strategy.

Each 1 oz gold bar contains exactly 1 troy ounce of gold. The term ‘troy ounce’ is specific to the precious metals market and is equal to approximately 31.1 grams, a little more than the regular ounce you might be familiar with.

The purity of a 1 oz gold bar is also important. The minimum purity of these bars is 0.995, meaning 99.5% of the bar is pure gold. However, most bars are between 0.999 and 0.9999 pure, or 24 karats. This means that almost the entire bar is made of pure gold, with very minimal amounts of other metals.

For example, the Perth Mint, a popular producer of gold bars, makes a 1 oz Kangaroo gold bar. This bar boasts a fineness of 99.99%, making it one of the purest gold bars you can buy. It has a minimum gross weight of 31.107 grams, fitting our earlier definition of a troy ounce.

Knowing the gold content of your bars can help you make informed decisions about your investments. So when you invest in a 1 oz gold bar, you’re getting nearly pure gold, equivalent to 1 troy ounce. That’s the wealth and reliability of gold that investors have trusted for centuries.

What Is the Price Of 1 oz Gold Bar Price?

Let’s delve into understanding the pricing of a 1 oz gold bar, which can be a bit complex if you’re new to the world of gold investing.

The price of a 1 oz gold bar is calculated using three components: the gold spot price, the weight of the gold, and the gold price premium.

-

- Gold Spot Price: This is the price for 1 oz of pure gold available for immediate delivery. It’s determined by the best bid and offer for gold by large bullion banks trading in real time globally. Data providers such as Bloomberg and Thomson Reuters provide this information.

- Weight of Gold: The weight of pure gold in a gold bar being purchased contributes to its price. A 1 oz gold bar has 0.999 or 0.9999 parts of pure gold, so it will weigh slightly more than 1 troy oz when impurities are accounted for. Bars with extremely high purity levels can be more expensive due to increased production costs.

- Gold Price Premium: This is a percentage adjustment added or deducted from the gold spot price value of the gold bar. It’s determined by the costs of production, refining, fabrication, minting, and logistics. It’s also impacted by supply and demand in the market and competitive forces between gold brokers.

- Price Calculation: To determine the price of a 1 oz gold bar, multiply the spot price of gold by the number of gold troy oz in the bar (1 oz) and add or subtract the current premium for that gold bar.

Knowledge about these factors helps you make informed decisions when investing in gold.

Should Investors Buy 1 oz Gold Bars?

Considering the numerous benefits, it’s no wonder many investors opt for 1 oz gold bars as a key part of their investment portfolio.

These bars are competitively priced, often with premiums between 2.5% and 3.75%, making them an economical choice over gold coins. Their convenient size and affordability also make diversifying your investment portfolio easier.

Renowned brands and mints produce 1 oz gold bars. These include Johnson Matthey, Credit Suisse, MKS PAMP, Heraeus, and government mints such as the Royal Canadian Mint, the Royal Mint, and the Perth Mint. Their widespread recognition enhances their resale value, making them a smart buy.

In terms of specifications, each 1 oz gold bar has a minimum purity of 0.995, often reaching between 0.999 and 0.9999 pure. This high level of purity ensures you’re getting a quality product. Different brands and mints can offer varying looks and feels, but the gold content remains consistent.

Conclusion

In conclusion, investing in 1 oz gold bars is a savvy move. They’re affordable, convenient, and hold long-term value potential. Understanding the gold content and pricing is crucial, as is selecting a reputable brand.

Online purchases offer secure transactions and insured deliveries. Whether you’re a novice or seasoned investor, buying 1 oz gold bars can be a golden opportunity for wealth preservation.

So why wait? Make your mark in the gold investment world today.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com