Why Do Gold Coins Have Different Prices?

Like a chameleon in a rainbow, the price of gold coins can change based on a myriad of factors. You might’ve noticed that not all gold coins carry the same price tag, even if they weigh the same.

The reason why gold coins have different prices can be attributed to manufacturing costs, the rarity and collectability of the coin, the ebb and flow of market demand and supply, as well as the reputation of the brand and mint.

Intrigued? Well buckle up, because we’re about to dive deep into this golden mystery.

Manufacturing Costs

When it comes to the cost of gold coins, the manufacturing process, with its intricate attention to detail and precision, plays a significant role in determining the final price. The production of gold coins isn’t a simple procedure. It requires expert craftsmanship, precision engineering, and unwavering attention to detail.

As an investor, you need to understand that the manufacturing cost involved in producing these coins significantly affects their final price. Not all gold coins are created equal. The quality of craftsmanship can vary between mints and coin series. High-quality coins demand a higher manufacturing cost, which, in turn, increases their premium.

Moreover, there’s another aspect of the manufacturing process that can affect the coin’s price – the unique features. Coins with special finishes or limited editions often carry higher premiums. These elements require additional work and special attention during manufacturing, thus increasing the cost.

As an investor or collector, you might be willing to pay more for these coins, recognizing their aesthetics, exclusivity, and quality. They’re not just a simple investment; they’re a testament to the craftsmanship and dedication that goes into their creation.

Best Gold Company for Low Minimum Investment.

Click the Banner Below to Visit Birch Gold Group’s Official Site to Receive Their Free Gold Investing Guide

Rarity and Collectability

Moving beyond the influence of manufacturing costs, it’s crucial to also consider the impact of rarity and collectability on the pricing of gold coins. There’s a direct correlation between the scarcity of a coin and its market value. The rarer the coin, the higher the premium it commands.

Rarity is influenced by a number of factors. Perhaps the coin was part of a limited mintage, with only a small number ever produced. Or perhaps a large portion of the coins were lost or destroyed, making the remaining few all the more sought after.

Even the year of minting can play a role – coins from certain years might be rarer than others, due to variations in production levels or historical events that impacted the coinage.

Collectability, on the other hand, relates to the appeal of the coin to collectors. This can be influenced by the coin’s design, its historical significance, or its condition.

A coin in pristine condition, for instance, will be more collectible than one that’s worn down. Similarly, a coin with an interesting backstory or a unique design might hold more appeal to collectors and therefore command a higher price.

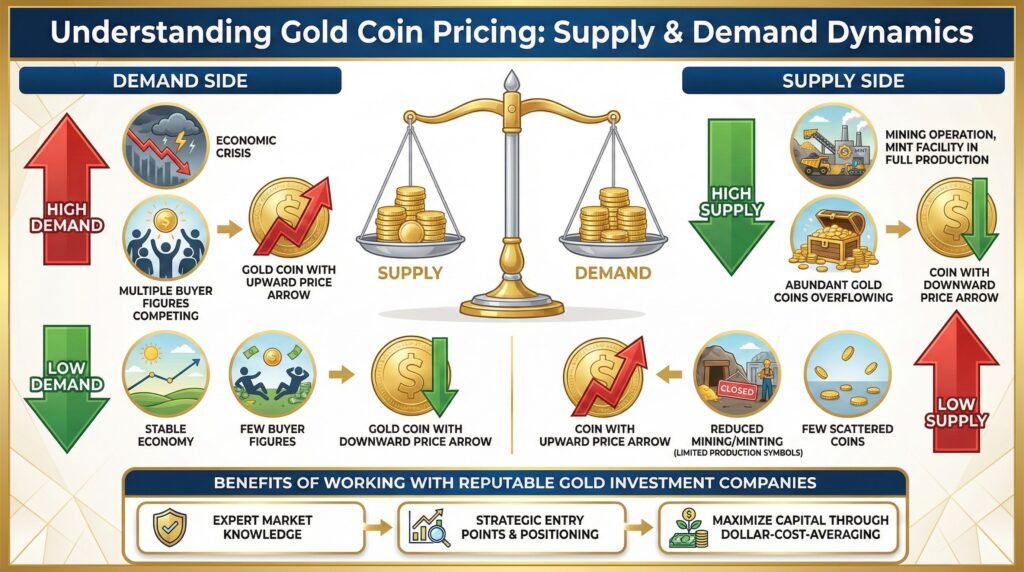

Market Demand and Supply

Just as with any commodity, the pricing of gold coins isn’t immune to the ebb and flow of market demand and supply. This pivotal economic principle plays a significant role in determining the premiums on gold bullion coins. When you understand this, you’ll have a better grasp of why gold coin prices can fluctuate.

The market demand for gold coins can cause premiums to rise and fall. High demand can drive up prices, while lower demand can cause them to drop. It’s a delicate balance, and various factors can influence this demand.

For instance, economic instability often leads to increased interest in gold, driving up demand and consequently, prices.

On the flip side, supply also dramatically impacts the price. If there’s a surge in the availability of gold coins, this could potentially lower the premiums. The market is flooded, and there’s less competition for each coin.

Conversely, if the supply is low, say due to a decrease in mining or minting activity, the price may creep up as buyers vie for a limited number of coins.

This interplay between supply and demand is a fundamental concept in economics, and it’s at the heart of gold coin pricing. You’ll notice these price movements, particularly in the long term.

So, as you venture into the world of gold coin investing, keep a keen eye on these market dynamics. Understanding the demand and supply of gold coins can help you make more informed buying decisions and potentially capitalize on market trends. Remember, knowledge is power in the realm of investing.

Benefits of Working with a Reputable Gold Investment Company

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key. Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and hassle.

Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital.

Gold IRAs provide additional benefits to merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one’s unique investing needs.

Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a tax-deferred gold IRA or owning the physical gold in your place of residence, make the choice that best suits your needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Brand and Mint Reputation

Another crucial factor that can impact the pricing of gold coins is the reputation of the brand or mint that produced them. You may not realize it, but the origin of a coin can significantly influence its cost.

This is because the reputation of a mint or brand often equates to the level of trust investors place in it.

You’ll typically find that coins minted by institutions with long histories of producing reliable and trustworthy bullion command higher premiums. This isn’t due to the coins being inherently superior in quality or design, but rather, it’s all about the assurance that comes with buying from a reputable source.

Brands like the United States Mint, the Royal Canadian Mint, or the Perth Mint in Australia, for instance, are well-known for their strict quality standards and consistency.

Conversely, coins minted by less-renowned institutions may be cheaper, but they also come with a higher risk. These coins might not meet international standards or could even be counterfeit.

Therefore, when you’re investing in gold coins, it’s not just about the gold content or the market demand. The credibility of the brand or mint that produced the coins is equally significant.

Conclusion

So, you see, the price of gold coins isn’t just about the precious metal’s value. It’s a complex blend of factors like manufacturing costs, rarity and collectibility, market demand and supply, and even the reputation of the brand or mint.

So next time you’re considering buying a gold coin, remember these factors – they’re what really drive the price. And who knows, you might just find a bargain in the process.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

Take Advantage of the Best Prices. Attend a Free Gold Investment Webinar for Investors with 100k or More to Protect. Click the Button Below to Reserve Your Place Today

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com