Gold Retirement Account for Senior Citizens: A Comprehensive Guide

Retirement is a time to enjoy the fruits of a lifetime of hard work, but ensuring financial stability during this period is crucial. For senior citizens, preserving and growing retirement savings becomes more important than ever.

For senior citizens, one popular and increasingly sought-after option is investing in a gold retirement account, also known as a Gold IRA (Individual Retirement Account). Gold IRAs provide tax-advantaged portfolio diversification and risk mitigation, inflation hedging, and the ability to invest in this time-tested tangible commodity and form of money.

This guide will explore what a Gold IRA is, its benefits and drawbacks, how to set one up, and essential considerations for senior citizens.

What is a Gold IRA?

A Gold IRA is a self-directed retirement account that allows you to invest in physical gold and other precious metals instead of traditional assets like stocks, bonds, or mutual funds. A Gold IRA can hold gold bullion, coins, and bars approved by the IRS for purity standards. These accounts are managed by a custodian who handles the physical storage of the precious metals, usually in secure, insured depositories.

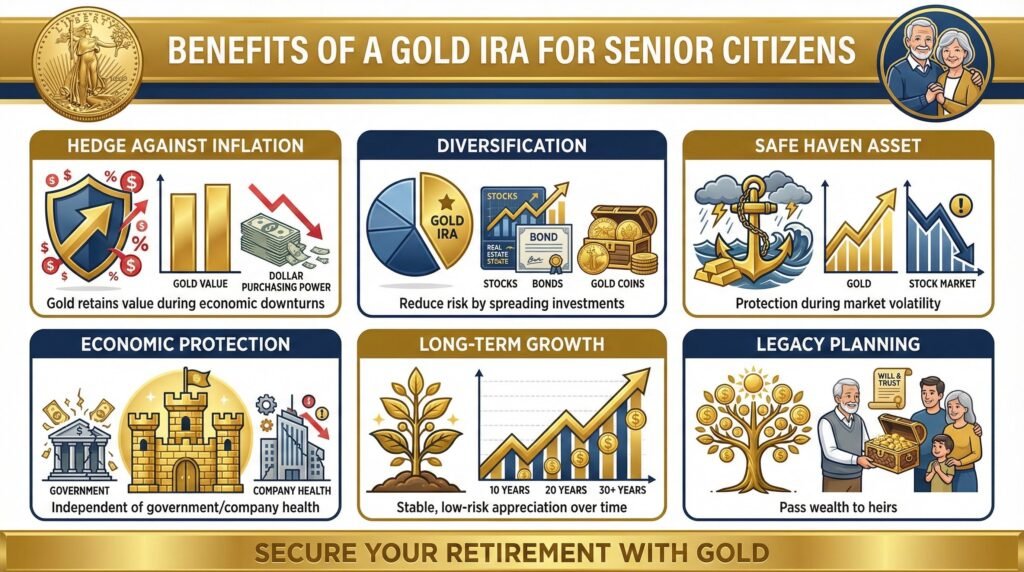

Benefits of a Gold IRA for Senior Citizens

- Hedge Against Inflation: Gold has been a time-tested hedge against inflation. Unlike paper currency, gold tends to retain its value during economic downturns and periods of high inflation, providing a reliable store of value.

- Diversification: Adding gold to your retirement portfolio can help diversify your investments. Diversification reduces overall risk, as gold often performs well when other asset classes, such as stocks, are underperforming.

- Safe Haven Asset: During times of geopolitical instability, market volatility, or economic uncertainty, gold is considered a safe-haven asset. Its value often rises when other investments lose value, providing a buffer against market downturns.

- Protection from Economic Instability: Gold is not tied to the health of a company, government, or economy. It protects against economic instability, market crashes, and currency devaluation.

- Long-Term Growth Potential: Gold has historically shown long-term growth potential. While it may not provide the same rapid returns as high-risk stocks, it is generally viewed as a stable, low-risk investment that appreciates over time.

- Legacy Planning: Gold IRAs allow you to pass on wealth to your heirs. This can be an attractive feature for seniors looking to leave a financial legacy for their children or grandchildren.

Drawbacks of a Gold IRA – Not for Short-Term Investing

-

- Higher Fees: Gold IRAs typically come with higher fees than traditional IRAs. These include setup fees, storage fees, and custodial fees, which can add up over time.

- Lack of Liquidity: Unlike stocks or bonds, gold is not easily liquidated. If you need quick access to your funds, selling physical gold can be more complicated and time-consuming.

- No Passive Income: Gold does not generate passive income, such as dividends or interest. Its value is solely dependent on market appreciation, so it does not contribute to a steady income stream in retirement.

- Regulations and Restrictions: The IRS has specific rules regarding the types of gold and other precious metals that can be held in a Gold IRA. Not all gold products qualify, and penalties may apply if the rules are not followed.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

How to Set Up a Gold IRA

Setting up a Gold IRA involves several key steps:

-

- Choose a Reputable Custodian: Gold IRAs must be managed by a custodian, usually a bank, brokerage firm, or other financial institution approved by the IRS. Research and choose a reputable IRA custodian with experience managing Gold IRAs.

- Open a Self-Directed IRA Account: Once you have chosen a custodian, you’ll need to open a self-directed IRA account. This type of account allows you to invest in a wider range of assets, including gold and other precious metals.

- Fund Your Account: You can fund your Gold IRA by rolling over or transferring funds from an existing retirement account, such as a 401(k), traditional IRA, or Roth IRA. Be sure to follow IRS guidelines to avoid penalties

- Purchase Approved Gold: Work with your custodian to purchase IRS-approved gold or other precious metals. The custodian will ensure the metals meet purity standards and are stored in an approved depository.

- Secure Storage: The gold must be stored in an approved depository. Home storage is not allowed for Gold IRAs, and attempting to do so could result in severe penalties from the IRS.

Benefits of Choosing a Reputable Gold IRA Company

It is crucial to remember that investing in a Gold IRA involves unique considerations. These include understanding the storage requirements of physical gold and the fees associated with these accounts. Additionally, like all investments, Gold IRAs come with risks, including the potential for loss if the price of gold decreases.

To take advantage of both investment vehicles, many gold IRA companies provide partial 401(k) rollover options to a gold IRA.

Finding the right gold IRA company for your individual needs is critical. For example, if you require a low investment minimum to start a gold IRA company, Birch Gold Group would be a great choice to consider.

However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive gold prices, then Augusta Precious Metals would be a good fit.

Decide based on your individual needs. See the links at the bottom of this article to each of these top-rated and reputable gold IRA companies and access their free gold IRA kit.

Click the banner below to visit Augusta Precious Metals’ official site to receive their free gold IRA investing guide and get started now:

Essential Considerations for Senior Citizens

- Risk Tolerance: Consider your risk tolerance and financial goals. While gold provides stability, it does not offer income-generating opportunities like stocks or bonds. Ensure that a Gold IRA aligns with your overall retirement strategy.

- Long-Term Horizon: Gold IRAs are best suited for those with a long-term investment horizon. They are not ideal for short-term gains or those needing immediate access to funds.

- Consult a Financial Advisor: Before making any significant changes to your retirement portfolio, consult with a financial advisor who specializes in retirement planning and understands the nuances of Gold IRAs. They can help you determine if this investment is right for you.

- Stay Informed About Market Trends: Gold prices can be volatile in the short term, influenced by various factors such as interest rates, inflation, and geopolitical events. Staying informed about market trends can help you make better investment decisions.

- Understand the Fees Involved: Be aware of all the fees associated with setting up and maintaining a Gold IRA, including setup, storage, and custodial fees. These can impact your overall returns, so it’s important to factor them into your decision-making process.

- Consider the Impact on Required Minimum Distributions (RMDs):Once you reach the age of 73, the IRS requires you to start taking RMDs from your retirement accounts, including Gold IRAs. Liquidating gold to meet RMD requirements can be more complex compared to traditional assets.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

Click the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

Conclusion

A Gold IRA can be a valuable addition to a senior citizen’s retirement portfolio, providing diversification, protection against economic instability, and a hedge against inflation. However, it’s not without its drawbacks, including higher fees, lack of liquidity, and no passive income.

For seniors considering this investment, careful planning, thorough research, and professional guidance are essential. By understanding both the benefits and potential pitfalls, you can make an informed decision that aligns with your retirement goals and financial security.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Click the button below:

Find the right gold IRA conpany for you. Obtain a gold IRA guide and talk to a broker

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com