Silver Investing During Stagflation

Silver performs well in periods of economic stagflation because it trails the of value gold and because many investors exit the standard, publicly traded investments like stocks, bonds, and other paper assets. To truly understand why, we need to consider the following:

- What are the dangers of stagflation?

- What is a good portfolio for stagflation?

- Why does silver do well during stagflation?

- What are the major uses of silver?

- What was the stagflation crisis 1970s?

- Fiscal dominance vs monetary dominance

1. What are the Dangers of Stagflation?

What Causes Stagflation

During periods of stagflation, you have three things occur: economic stagnation, high inflation, and rising unemployment. It is the worst of many worlds. Economic stagflation historically leads to lower returns on investments and lower demand for goods and services.

Inflation creates higher prices due to currency devaluation. In the present context, the contributing factors could be:

- Supply shocks due to de-globalization lead to shortages of products and commodities along the supply chain.

- Poor fiscal discipline and monetary policy of banking and government institutions. This dynamic would overpower the typical recessionary effects of falling prices.

The Federal Reserve is presently trying to bring down inflation by raising interest rates as its primary tool. This is creating stress on banking institutions. Part of the Fed’s mandate is financial stability within the banking system. As a result, the Federal Reserve may have to back off on tightening and hence their fight against inflation.

Hence, much like during the 1970s Arthur Burn’s era of the Federal Reserve, inflation will jump back up but for different reasons.

Again, the banking system has been accustomed to a low to zero percent interest rate environment for over 10 years, so this is a massive shock to their systems as well as the bonds they presently hold. Collectively, the banks will be less profitable.

The higher cost of capital will result in less borrowing and reduced bank lending. This will have a knock-on effect on less business expansion and economic activity. Low growth. This will result in unemployment rising. This is already being felt in the technology section of the economy.

The Federal Reserve’s mandate also extends to sustaining maximum employment. If the unemployment rate starts reaching the 5 percent range, a Fed pivot could be possible here as well.

2. What is a Good Portfolio for Stagflation?

This classic and basic risk parity portfolio of 60% investments in stocks and 40% bonds has been a relatively safe and passive way to invest for the last 15 to 20 years. Particularly, when the Federal Reserve was injecting liquidity into the market and keeping a zero to low-interest rate environment.

However, the flaws of this model are revealed during times of economic turbulence, particularly during times of recession with sticky inflation stacked on top. The 60/40 model is not true diversification since this specific portfolio is merely limited to two asset classes. Some would argue at this point in marketplace history, stocks and bonds are highly correlative in a financial ‘headwind’ environment. The year 2022, was delivered the worst nominal returns year since 1871 for the bond and equity market.

You can see from this historical chart above, the clusters of drawdowns from these two asset classes in periods of economic volatility. Mainly, during the 1930s and 1970s. We could be entering another period of drawdowns presently. The S&P 500 fell by 40 percent during the stagflation event of 1974. US treasuries and government bonds gave negative returns when adjusted for inflation.

Bear in mind, the present equity investment market is far more overvalued and overleveraged than it was in the 1970s. This is largely due to over a decade of the artificially low cost of capital maintained by the Federal Reserve with historically low-interest rates since after the financial crisis of 2008. Lower rates, more borrowing, more risk, and greater artificial growth.

In times of stagflation, “real assets’, sometimes known as hard assets such as commodities and property, are the best-performing assets. However, property investing is presently in a place of adjustment due to value corrections, higher rates, and uncertainty within the private and commercial real estate investment and construction space.

Benefits of Working with a Reputable Gold Investment Company

Working with a credible and trustworthy precious metals vendor is key when starting your silver and gold investing. Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and hassle. Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital.

Gold and silver IRAs provide additional advantages to buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one’s unique investing needs. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

To learn more about how gold investing can protect your long-term wealth and the advantages of tax-deferred gold IRAs, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

3. Why Does Silver Do Well During Stagflation?

Some of the signs leading up to stagflation are, silver starting to outperform gold and long-term bonds outperforming equities. Stagflation, as covered before, encompasses high recessionary unemployment, low growth, and stubbornly high inflation.

During times of economic contraction, or the fear thereof, tangible commodities such as precious metals, base metals, and energy are a more reliant place to park investment capital. Silver provides safety as well as increases in value due to its direct relationship with gold. Preservation and prosperity are built into one investment.

In periods of bull markets and economic booms, precious metals are typically considered a ‘boring asset’ to hold. But in times of stagflation, that being recessionary unemployment, low growth, high inflation, and panicked markets, this ‘boring investment’ begins to look quite appealing. Precious metals, such as silver, are essentially wealth insurance against losses that are felt elsewhere. Silver won’t go bankrupt on you and it cannot be printed or manipulated by central banks.

During a typical recession, industrial production slows down due to negative growth. As a result, the demand for silver decreases. But with periods of high inflation, silver maintains its value. Even though silver is an industrial precious metal, and the wheels of the industry may slow, they simply can’t stop. Hence, silver will continue to have value given its constant utility in industry.

4. What are the Major Uses of Silver?

Silver Industrial Uses

Evergreen industrial demands such as medical applications, electronics, automotive components, and green energy products for solar power will continue to drive demand for silver. Solar power alone represents 12% of the total demand for silver. Which is quite significant given the expanding demand and popularity of solar technology.

Also, whether we like this fact or not, federal government spending on infrastructure and green energy investments does not appear to be going away. The massive infrastructure spending bill, ironically titled, ‘The Inflation Reduction Act’, directs 370 billion dollars to green energy transition projects. As we all know, when the US Congress commits to spending money, they keep their word. The American investor, whether they agree with these policies or not, can at least invest in the commodities that will appreciate as a result.

There is encouragement and compensation by the US government for the production of electric vehicle (EV) charging stations throughout the United States. EV charging stations actually require more silver than electric vehicles themselves. EVs, also growing in popularity, use twice as much silver as internal combustion engine vehicles.

5. What was the Stagflation Crisis of the 1970s?

History Rhymes

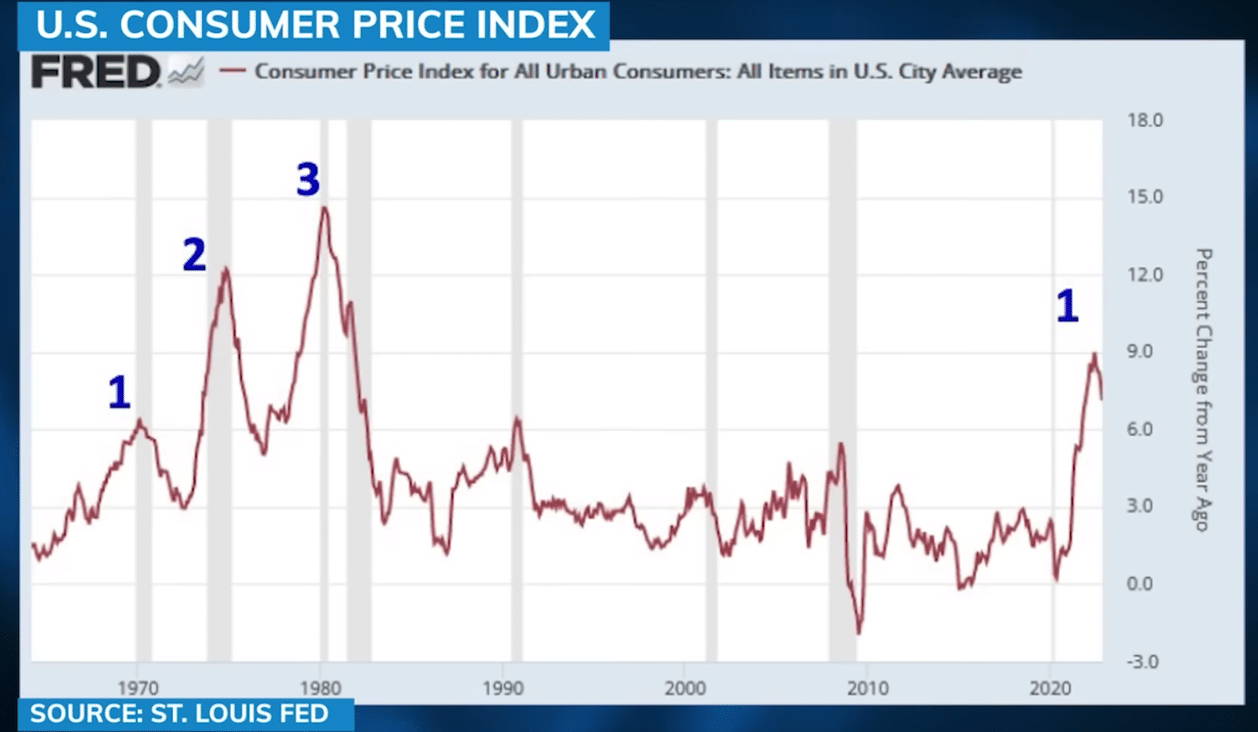

Our last analog for stagflation is the 1970’s for which we experienced multiple waves of inflation as seen in the chart above. If we are using these as models, the first wave of inflation was far milder than the two subsequent peaks. This was due in large to the Federal Reserve easing off tightening too soon and was followed by a more violent spike afterward and eventually the highest spike in 1980 of 18 to 20%. This required the Federal Reserve to apply its quantitative tightening ‘tools’ in a more aggressive way, resulting in double digital interest rate hikes. This was a painful period for the average American and investor.

Would the same measures work now? There is a great difference between the 1970s economic environment and our present one. The main one is the nation’s debt-to-GDP ratio. In the 1970s, the United States debt to GDP ratio was 32-35%. At present, that same ratio is now 130% and rising. Clearly, the ability of the US government to service the national debt during massive interest rate hikes in the 1970s and 80s was far easier than our present economic milieu.

If the past is prologue, the Fed interest rate would have at the minimum meet and possibly exceed the inflation rate to bring down the Federal Reserve’s target level, which is 2%. This could prove difficult since economic stress is already being felt at the 5% Fed rate.

Americans may need to get accustomed to a minimum 4% inflation for possibly the next decade if inflation proves to be as sticky as many economists are predicting.

6. Fiscal Dominance vs Monetary Dominance

It is worth noting that although the stagflation era of the 1970s and early 1980s is our most recent reference point for excessively stubborn inflation, the character and source of our present inflation is more kin to the inflation of the 1940s.

Whereas the source of 1970s inflation was generated by excessive bank lending, oil and commodity price spikes, decoupling of the USD from the gold standard, and other demand-driven elements of the economy, the inflation of the 1940s was mainly generated on the supply side with massive government and fiscal deficits.

There is a tipping point where monetary dominance shifts to fiscal dominance. The Federal Reserve can, to a certain degree, quash the demand side of inflation, but the supply side that is presently being driven by massive government spending and deficits is largely out of their reach.

Essentially, the US central bank, along with the smaller private banking sector, is slamming on the economic brake pedal and the federal government is jamming on the accelerator pedal. When the Federal Reserve is forced to pivot and stop its monetary tightening and resume quantitative easing, that is where inflation has the potential to resurge at a more extreme, possibly violent, rate.

We will be covering the subject of fiscal dominance in future articles. See the video below where investor and economist Lyn Alden provides further detail on this subject.

Stagflation Investing – Summary

Silver is an excellent hedge in good times, but a crucial hedge in stagflation times. The forces facing the US, as well as the world, are far more intense than they were in the last stagflation cycle of the 1970s to 1980s. The United States debt to GDP ratios are nearly four times higher, the M2 money supply is magnitudes in proportion, equities are highly overvalued, and the ‘salad days’ of cheap Federal Reserve money are likely not to return.

The normal recessionary slowdowns in industrial demand for silver will not likely take shape. Evergreen industries such as electronics, automotive electrical components, medical products and applications for an increasingly aging population, as well as green energy investment growth supported by Federal funding will steady industrial production.

Historically, silver and other precious metals stand strong against challenging economic headwinds. To learn more about silver and gold investing, see the links below to access the many investment guides from the best gold IRA and precious metals investment companies that we have personally researched and vetted.

You, as an investor, will be building a long-term relationship with whatever gold IRA company you choose. For this reason, we have also detailed each company’s culture and core values. See our list of the top gold IRA companies and find the right company for all the right reasons. Also, click the button below to get access to the free gold investment guides and start protecting your retirement savings today.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect and want to take advantage of the best prices, attend a gold educational webinar hosted by Augusta Precious Metals. Tap the button below:

More Featured Articles

Precious Metals and Gold IRA Company Reviews

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com