Buying Gold and Silver for Survival (For SHTF Scenario)

Investing in gold and silver can be beneficial when preparing for survival scenarios. Opt for products like the Gold CombiBar, PAMP Gold Bar, or Gold American Eagle, which offer high purity, divisibility, and recognition. However, carefully consider factors like spot premium, size, weight, and the variety of your investment’s denomination. To better plan for buying gold and silver for a survival situation, we cover the following subjects:

-Best Gold for Prepping and Survival

-Factors to Consider When Choosing Gold

-Size, Weight, and Recognition

-Gold IRA Custodians for Diversified Protection

-Using Gold for Survival

-Gold Investing Research and References

It’s important to diversify your holdings for flexibility. With strategic planning, gold and silver can provide financial stability, acting as a hedge against inflation and economic uncertainty. To make informed decisions, explore historical references, academic papers, and expert opinions. This will arm you with practical tips and strategies for survival planning.

Best Gold for Prepping and Survival

Is it a good idea to buy gold and silver?

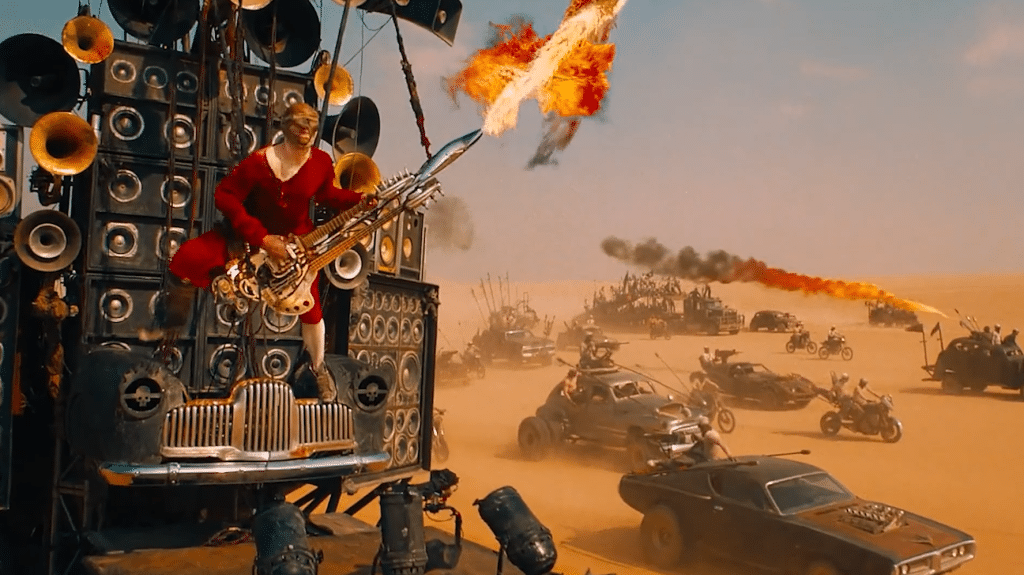

To begin, we are not talking about a Mad Max, cannibal marauder-populated, resource-shorted wasteland that takes place after Tyler Durden blows up the major banking centers, sending the world into a financial tailspin. Pardon my Generation X references. That being said, let’s begin.

When preparing for survival scenarios, selecting the right type of gold is essential, with top options including the Gold CombiBar, the PAMP Gold Bar, and the Gold American Eagle, each offering unique benefits concerning purity, versatility, and investment potential.

The Gold CombiBar is a standout for its versatility. Minted by Valcambi Swiss, it’s 0.9999 pure gold. But what sets it apart is its design – 20 breakable 1-gram tabs.

This unique feature gives you flexibility in situations where you need smaller denominations of gold, making it perfectly suited for survival circumstances.

Next, the PAMP Gold Bar is a budget-friendly choice and offers the same purity of 0.9999. Produced by PAMP Suisse, it comes with Veriscan authenticity, assuring you of its quality and reliability. It’s an excellent entry point for those new to investing in gold.

Lastly, the Gold American Eagle is a top-tier choice for those seeking an investment as well as a survival asset. Minted by the US Mint, it’s 0.9999 pure and weighs 1 troy ounce.

Its recognition and liquidity make it an ideal choice for those looking to diversify their investment portfolio while preparing for any survival scenario.

Factors to Consider When Choosing Gold

Making the right gold investment requires careful consideration of several key factors such as spot premium, denomination, versatility, size and weight, and recognition. Let’s break down these factors to make certain you’re well-equipped to make an informed decision.

Spot premium, the price you pay over the gold’s spot price, is an essential element to take into account. While you may be tempted to go for the cheapest option, you should be aware that a lower spot premium might mean lower purity or smaller denominations – compromising your investment’s value.

Denomination is another significant factor. Owning a mix of bullion denominations – ounces, half ounces, quarter ounces, and tenth ounces – can be beneficial. This strategy ensures you have flexibility for smaller transactions, should you need to barter or sell part of your investment.

Versatility plays an important role as well. For survival situations, having different types of gold bars, coins, or rounds increases your options for barter and trade. Versatile gold forms are more likely to be accepted in various scenarios, giving you an advantage when liquidity is paramount.

What is the most trusted place to buy gold and silver?

Noble Gold Investments offers a range of Royal Survival Packs priced from $10,000 to $500,000 plus. Delivered to your door and stored in your home, you have ultimate control over your gold investments. Peace of mind.

Click the banner below to visit Noble Gold Group’s official site to explore the company’s many options for direct purchases as well as tax-advantaged gold IRAs.

It is also suggested not to keep all of your wealth in one location unless you can adequately defend it. If you cannot, it is suggested that a portion be kept in a trusted, safe, and secure custodian, immune to breaches.

Gold IRA companies that utilize a secured vault and storage facility, such as a Brinks or Delaware depository, are an advantage.

Size, Weight, and Recognition

Understanding the importance of size, weight, and recognition in your gold investments is a critical part of your survival strategy. The physical dimensions of gold, such as its size and weight, greatly impact its portability and storage.

You need to ponder if your gold investment can be easily moved or stored securely. Larger bars may offer a greater value, but they’re harder to transport and store discreetly. Smaller denominations like coins or gram bars, on the other hand, are more manageable and practical for everyday use.

Weight is another key factor. The heavier the gold, the more difficult it is to handle and transport. Investing in lighter units can make it easier for you to carry your gold, especially in a survival situation where mobility is crucial.

Recognition, as well, is essential. Gold investments should be easily identifiable and widely recognized. This ensures that they can be readily traded or sold when necessary.

Gold coins minted by the government, for instance, are easily recognizable and widely accepted. They also come with a guarantee of their weight and purity. On the other hand, gold bars require verification of their weight and purity, which can complicate transactions.

Noble Gold provides Royal Survival pacts for quick access to gold and silver. Particularly, in the event of a catastrophic economic collapse and national emergency.

Contrary to popular belief, precious metals are still considered legal tender and can be exchanged for goods and services.

Gold IRA Custodians for Diversified Protection

When considering the counterparty risks of a volatile economic environment, owning physical gold becomes a far more attractive and secure investment path.

A long-established and trusted gold IRA company can provide competitive prices, transparency, reliable customer service, and security of your precious metals.

Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs, whether you prefer a gold IRA or owning the physical gold in your place of residence.

To learn more about how gold investing can protect your long-term wealth and the advantages of tax-deferred gold IRAs, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Using Gold for Survival

In a survival situation, you’ll find gold to be an invaluable asset for maintaining financial stability and facilitating barter transactions.

As a universally recognized form of value, gold enables you to trade for essential goods and services when standard currency systems fail or become unstable.

Gold’s durability and portability make it an ideal ‘hard currency’ for survival scenarios. It’s not susceptible to decay, and its small size and weight relative to its value allow for easy transport.

Additionally, gold’s divisibility into smaller units facilitates transactions with varying aspects.

However, capitalizing on gold’s survival benefits requires strategic planning. You’ll want to diversify your gold holdings with consideration for denomination and form.

This allows you to make precise transactions and increases your trading options. Smaller gold coins and bullion bars are recommended for this purpose.

Moreover, gold serves as an effective hedge against inflation and economic uncertainty. Its value tends to rise when confidence in traditional currency wanes, providing you with a measure of financial stability even during turbulent times.

Gold Investing Research and References

To make the most informed decisions about gold investment and survival planning, it’s vital to engage in thorough research and refer to trustworthy sources.

You’ll need to explore academic papers, historical references, and economic reviews for insights. It’s not sufficient to rely on hearsay or conjecture; you must base your decisions on concrete facts and proven data.

Use reputable studies and scholarly resources to guide your decisions. Trustworthy studies offer a wealth of knowledge about the intricacies of gold and silver investments, including their historical performance, their potential in times of economic instability, and their role in investment diversification.

These studies can help you understand the nuances of investing in precious metals and can guide you in making informed decisions about your survival planning.

Conferences and seminars can also be valuable sources of information. These events often feature experts in the field who share their insights and experiences.

They can provide you with a broader perspective on gold and silver investments, as well as practical tips and strategies for survival planning.

If you have 100k of savings to protect and want to take advantage of the best gold prices and lifetime customer support, click the banner below to join a free gold and silver web conference hosted by Augusta Precious Metals. Secure your place today:

Conclusion

Ultimately, investing in gold and silver for survival isn’t just about securing wealth, it’s about preparing for uncertainty. Consider factors like size, weight, and recognition when choosing your precious metals.

Always back your decisions with sound research. Remember, the goal is to sustain your standard of living during crises. Armed with this knowledge, you’re now ready to make informed choices about gold and silver ownership for survival.

Find the right gold IRA company for you. Obtain a free guide and talk to a broker

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com