Can I Take Physical Possession of Gold in My IRA?

Gold IRAs are a popular investment option for those looking to diversify their retirement portfolio. Have you ever wondered if it’s possible to take physical possession of gold in your IRA?

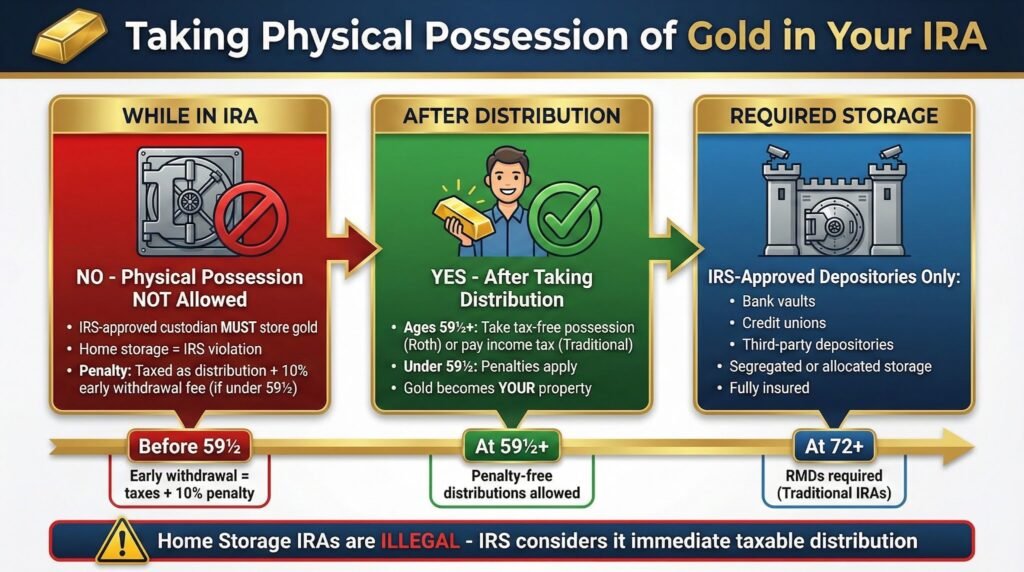

Specific rules within a gold IRA dictate whether you can take physical possession of gold. Broadly, the owner of the IRA cannot take possession of the gold within the account until the age of 59.5 years. This is the standard age of eligibility for distribution. To cover this subject in more depth, we will discuss the following:

-Understanding Gold IRAs

-Taking Physical Possession of Gold in Your IRA

-Alternatives to Taking Physical Possession of Gold in Your IRA

-Factors to Consider Before Taking Physical Possession of Gold in Your IRA

-Frequently Asked Questions

Stay tuned to find out all you need to know about Gold IRAs.

Understanding Gold IRAs

Understanding Gold IRAs is essential for anyone looking to diversify their retirement account portfolio by investing in precious metals like physical gold; these self-directed IRAs provide an alternative to traditional IRAs, Roth IRAs, and SEP IRAs, offering a unique way to hedge against financial uncertainties and market volatility.

What Is a Gold IRA?

A Gold IRA is a self-directed individual retirement account that allows investors to hold physical gold and other precious metals, complying with IRS regulations.

Investors can choose to invest in a variety of precious metals, such as silver, platinum, and palladium, in addition to gold. The flexibility of a Gold IRA allows account holders to diversify their retirement portfolios beyond traditional assets like stocks and bonds.

Self-directed IRAs enable individuals to make their own investment decisions, including choosing which types of precious metals to hold and when to buy or sell them.

How Does a Gold IRA Work?

A Gold IRA works by allowing investors to purchase gold and other precious metals through a custodian who handles the investment and storage in an approved depository.

Once the investor decides to set up a Gold IRA, the first step is to select a reputable custodian who specializes in precious metal IRAs. The custodian plays a vital role in facilitating the purchase of gold on behalf of the investor and ensuring compliance with IRS regulations.

The investor can choose between different storage options, such as segregated or allocated storage, to safeguard their precious metal assets. It’s essential to be aware of the associated fees, which may include annual custodian fees, storage fees, and potentially transaction fees.

Proper management of the investment is crucial to optimizing returns and preserving the value of the precious metals held within the IRA.

Access the Gold IRA calculator below to calculate the potential growth of your Gold IRA investment compared to traditional stock market returns. Adjust assumptions to see how different factors affect your retirement savings.

Taking Physical Possession of Gold in Your IRA

Taking physical possession of gold in your IRA is a complex process that involves navigating IRS regulations and understanding the associated benefits and risks, making it crucial for investors to be thoroughly informed before proceeding.

Is It Possible to Take Physical Possession of Gold in Your IRA?

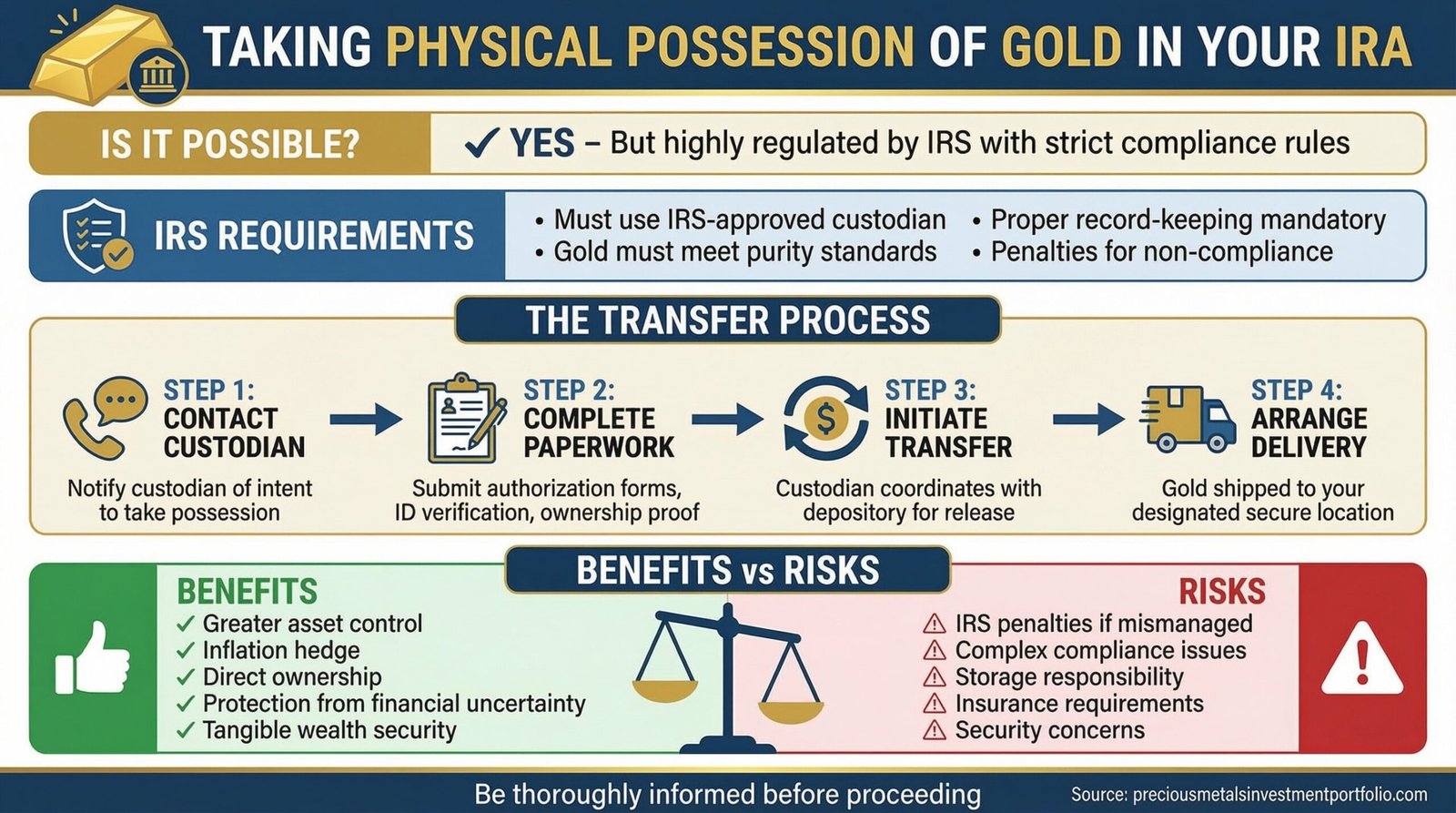

While it is technically possible to take physical possession of gold from your IRA, it is highly regulated by the IRS and involves strict compliance with specific rules.

One of the key regulations set by the IRS is that the gold must be held by a custodian approved by the agency, ensuring proper record-keeping and accountability. The IRS requires that the gold meet specific purity standards to qualify for inclusion in an IRA. This means that not all forms of gold may be eligible for physical possession in your retirement account. It’s crucial to carefully navigate these rules to avoid any penalties or disqualification of your IRA status. The IRS aims to maintain the integrity of retirement accounts while offering some flexibility in investment choices.

What Are the Steps to Take Physical Possession of Gold in Your IRA?

To take physical possession of gold in your IRA, you must coordinate with your custodian, complete the necessary paperwork, and arrange for transfer from the depository to your possession.

Once you have informed your custodian of your desire to take physical possession of gold from your IRA, they will guide you through the required paperwork. This paperwork usually includes specific forms to authorize the transfer of the gold from the depository to your possession. Be sure to carefully review and fill out all the necessary documents to ensure a smooth transfer process.

-Your custodian may also require you to provide identification and other verification documents to verify your identity and ownership of the IRA account.

-After you have completed the paperwork, your custodian will initiate the transfer process with the depository where your gold is stored. The depository will then work with your custodian to arrange the physical delivery of the gold to your designated location.

-It is important to stay in communication with both your custodian and the depository throughout the process to ensure timely and secure delivery of your gold. Once the transfer is complete, you can enjoy the peace of mind that comes with having physical possession of your precious metal assets.

What Are the Benefits of Taking Physical Possession of Gold in Your IRA?

The primary benefits of taking physical possession of gold in your IRA include greater control over your assets and the ability to hedge against financial uncertainty and inflation.

Having physical gold ensures that you have direct ownership and can easily access and manage your investment without relying on intermediaries. This can be particularly reassuring during times of economic volatility or geopolitical instability when financial systems may face disruptions. Physical gold also offers a tangible form of wealth, providing a sense of security that is not dependent on the performance of other assets or markets.

What Are the Risks of Taking Physical Possession of Gold in Your IRA?

Taking physical possession of gold in your IRA involves several risks, including potential penalties and fines from the IRS if not managed correctly.

One major concern of holding physical gold in an IRA is the compliance issues that may arise with IRS regulations. The IRS has strict guidelines on the types of precious metals that can be held in a retirement account, and failure to adhere to these rules can result in severe penalties.

When you take possession of physical gold, you also bear the responsibility of safeguarding the asset. This includes ensuring secure storage, insurance against theft or damage, and protection from unforeseen events that could jeopardize the value of the gold.

Alternatives to Taking Physical Possession of Gold in Your IRA

For those who prefer not to take physical possession of gold in their IRA, several alternatives involve secure storage options managed by custodians and depositories, maintaining the investment benefits without the individual responsibility of safekeeping.

What Are Some Alternatives to Taking Physical Possession of Gold in Your IRA?

Alternatives to taking physical possession of gold in your IRA include using secure depository storage provided by custodians, where your investment is safely managed and insured.

Depository storage facilities offer a secure and convenient way to store your gold investments without the need for physical possession. These facilities are equipped with state-of-the-art security measures such as 24/7 surveillance, alarm systems, and secure vaults.

By entrusting your gold to a custodian, you can benefit from professional management and oversight of your investment. Custodians play a crucial role in ensuring compliance with IRS regulations and maintaining accurate records of your holdings.

What Are the Pros and Cons of Each Alternative?

Each alternative to taking physical possession of gold in your IRA comes with its own set of pros and cons, such as lower risks and higher security with depository storage but potentially higher costs.

When considering depository storage, one key advantage is the enhanced security measures in place to protect your investment.

These facilities are often equipped with state-of-the-art security systems, including alarm systems, surveillance cameras, and on-site guards, providing peace of mind for investors concerned about theft or loss.

One drawback of depository storage is the additional costs involved. Storage fees, insurance premiums, and administrative charges can add up over time, potentially eating into the overall returns on your investment. It’s essential to weigh these expenses against the benefits of heightened security and convenience.

Working with a Reputable Gold IRA Company

In addition to offering competitive prices, transparency, reliable customer service, and security of your precious metals, a trusted gold IRA company understands the many rules and regulations required for compliance, whether you choose to take physical possession of your gold or not. These specialized gold IRA companies eliminate the guesswork, time, and worry.

Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a tax-deferred gold IRA or owning the physical gold in your place of residence, make the choice that best suits your needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Factors to Consider Before Taking Physical Possession of Gold in Your IRA

Before deciding to take physical possession of gold in your IRA, it is critical to evaluate various factors including tax implications, storage and insurance costs, and current market trends for gold to ensure an informed decision.

What Are the Tax Implications of Taking Physical Possession of Gold in Your IRA?

Taking physical possession of gold in your IRA can have significant tax implications, including potential penalties and loss of tax-deferred status, depending on IRS rules and compliance.

When you decide to physically hold gold within your IRA, it is essential to note that the IRS has specific regulations regarding this practice. By taking possession of the gold, you are essentially removing it from the custodian’s control, potentially triggering tax consequences.

In most cases, this act is considered a distribution of assets from the IRA, which might result in taxable income and even early withdrawal penalties if you are not yet eligible.

What Are the Storage and Insurance Costs?

The costs of storage and insurance are crucial factors to consider when taking physical possession of gold in your IRA, as they can add up significantly over time.

When you decide to physically hold gold within your IRA, it is essential to note that the IRS has specific regulations regarding this practice. By taking possession of the gold, you are essentially removing it from the custodian’s control, potentially triggering tax consequences.

In most cases, this act is considered a distribution of assets from the IRA, which might result in taxable income and even early withdrawal penalties if you are not yet eligible. Again, the present standard minimum age for distribution is 59 ½.

What Are the Market Trends for Gold?

Understanding the current market trends for gold is essential for making informed investment decisions, as the value of gold can be influenced by economic factors and market volatility.

The historical performance of gold has shown it to be a reliable store of value during times of economic uncertainty, making it a popular choice for investors seeking a safe haven asset.

-Monitoring global geopolitical events and economic indicators can offer valuable insights into potential movements in the price of gold.

Factors such as inflation, interest rates, and currency fluctuations can significantly impact the value of gold in the market.

Noble Gold Investments provides both gold IRA and private ownership options. Noble Gold’s Royal Survival Packs are a great alternative or addition to a tax-advantaged gold IRA.

Also, Noble Gold provides low investment minimums for beginning investors. Minimums are $2,000 to open an account, $10,000 for direct transfers, and $20,000 for IRA/401k rollovers. Tap the banner below to visit Noble Gold’s official site.

Noble Gold Investments IRA & Royal Survival Packs and Low Fees

Conclusion

So, now you are aware of all the legal ramifications and rules that are involved with taking possession of your gold within your specific IRA as well as alternatives to holding the precious metals as well.

What you decide will be based on your own specific needs. To find the best gold IRA company for your specific needs, see the links we have provided at the end of this article.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Frequently Asked Questions

Can I take physical possession of gold in my IRA?

Yes, it is possible to take physical possession of gold in your IRA. However, certain rules and regulations must be followed to ensure the gold is held within the IRA account and not directly by you.

What are the rules for taking physical possession of gold in my IRA?

According to the IRS, the gold must be held by a custodian or trustee that is approved by the IRS. The gold must also meet purity requirements and must be stored in an approved location, such as a depository or bank.

Can I store the gold in my home or personal safe?

No, the gold must be stored in an approved location by the IRS. This is to ensure the gold remains within the IRA account and is not used for personal purposes.

What types of gold can I hold in my IRA?

The IRS allows for certain types of gold to be held in an IRA, such as American Gold Eagles, Canadian Gold Maple Leafs, and gold bars that meet certain purity requirements. It is important to consult with a financial advisor to determine what types of gold are eligible for IRA investment.

How do I take physical possession of gold in my IRA?

You can request a distribution of the gold from your IRA custodian or trustee. They will then arrange for the gold to be transferred to an approved storage facility where you can take physical possession of it.

What are the tax implications of taking physical possession of gold in my IRA?

If the gold is held within a traditional IRA, any distributions taken will be subject to income tax. If the gold is held within a Roth IRA, qualified distributions will be tax-free. It is important to consult with a tax professional for specific tax advice related to your individual situation.

Find the right gold IRA company for you. Obtain a gold IRA guide and talk to a broker

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com