Gold Coin Prices

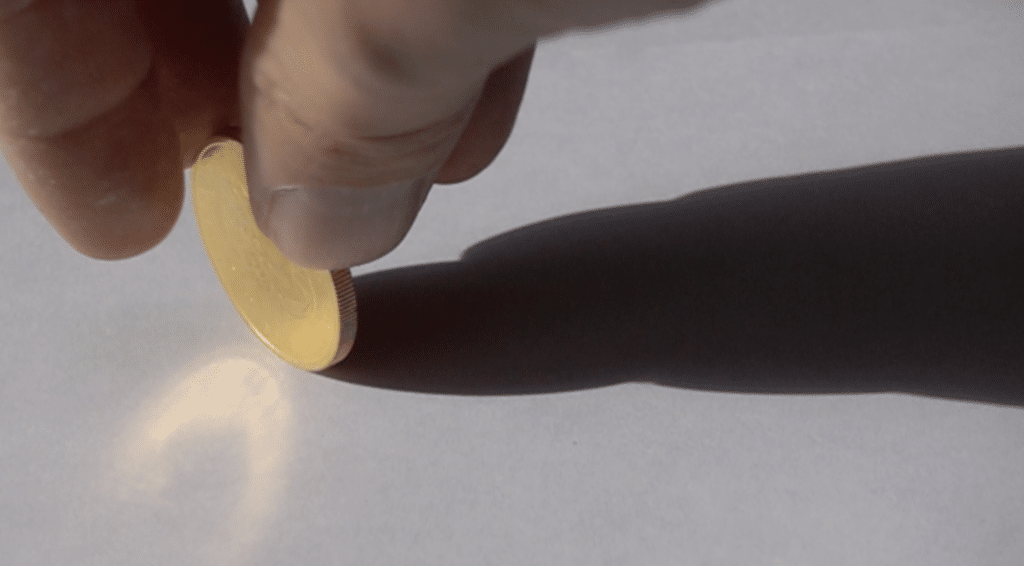

“All that glitters isn’t gold,” as the old saying goes, but in the case of gold coins, the glitter might very well be the sound of profit clinking in your pocket.

You’re aware of gold’s enduring allure as a timeless investment, but have you ever considered the potential of gold coins? From investment-grade bullion to vintage and circulated coins, there’s a wealth of opportunities waiting for you.

But how do you determine their worth, and what factors influence the prices? That’s the golden question, isn’t it? Let’s explore together.

Grade, weight, collectability, and origin are the main determining factors of gold coin prices. To gain a greater understanding of the many valuation aspects that affect the price of gold coins, we will discuss:

-Investment Grade Gold Bullion Coins

-Assortment of Gold Coin Weights

-Vintage Gold Coins

-U.S. Circulated Gold Coins

-Foreign Circulated Gold Coins

Investment Grade Gold Bullion Coins

Diving into the realm of Investment Grade Gold Bullion Coins, you’ll discover a multitude of options and factors to consider, from the premium over spot price to the coin’s purity and mintage, all of which play a pivotal role in determining the coin’s potential as a solid gold investment.

To get the best bang for your buck, it’s crucial to find the lowest premium over spot price. Use comparison tools to seek out the cheapest Gold Eagles, Austria Gold Philharmonics, Canada Gold Maple Leafs, or Gold Krugerrands.

Gold coins are more than just shiny baubles. They’re recognized worldwide as a robust investment and a reliable store of value.

The purity and mintage of these coins are well-known, which solidifies their standing in the market and keeps dealer premiums within a reasonable range.

In the vast sea of modern investment-grade gold coins, you might find the decision-making process overwhelming due to the myriad of choices.

Take note, newly minted modern coins tend to bear higher production and distribution costs than their vintage or secondary market counterparts.

For instance, the Gold Maple Leaf and the Perth Kangaroo, minted with .9999 pure gold, contrast with the American Eagle, minted with a 22 karat alloy constituting 90% gold.

The edges of the coins add another layer to their identity. While most have a reeded or inscribed edge, some modern coins, like the Gold Philharmonic boast a smooth edge.

Also, legal tender face value is generally inscribed on newly minted gold coins, anchoring their value in the backing of their respective governments.

Gold IRAs provide a means of owning gold while securing the best prices.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist:

Assortment of Gold Coin Weights

When you delve into the assortment of gold coin weights, you’ll quickly realize the wide variety of sizes available, from the well-known 1 oz gold coin to fractional sizes, offering a range of affordable options for gold ownership.

The troy ounce, a unit of measure historically used in the precious metals industry, is an integral part of this spectrum. You’ll find the majority of sovereign mints across the globe still adhere to this standard, making it a universal language for gold investors.

Fractional gold coins, while smaller in size, are no less valuable. Investment-grade fractional gold bullion coins are available in 1/2 oz, 1/4 oz, and 1/10 oz sizes from most government mints.

These options provide flexibility, allowing you to invest in precious metals at a level that suits your budget and investment strategy.

Remember, the smaller the coin, the higher the premium over the spot price of gold. This is simply because the production costs for smaller coins are higher per unit of weight.

So, while fractional gold coins offer affordability, they also come with a slightly higher price tag in relation to their weight.

Predictably, the 1 oz gold coin remains the most popular choice among investors. Its size and weight make it a convenient and universally accepted form of gold ownership.

However, the availability of fractional sizes allows you to diversify your investment, reduce risk, and better manage your gold portfolio.

As the gold market continues to evolve, the assortment of gold coin weights will continue to offer you an array of investment choices.

Click the banner below to see the large array of coins to invest in by visiting Augusta Precious Metals’ official site. Invest in gold in a tax-advantaged way through a gold IRA.

Vintage Gold Coins

Shifting your focus to vintage gold coins, you’ll find that these historical treasures offer a unique opportunity to diversify your precious metals investment while connecting you to the rich history of global commerce.

These coins, most commonly minted with alloys of .900 purity (22k) or greater, serve as a testament to the enduring value of gold.

Their allure lies not only in their metallic worth but also in the unique market dynamics of numismatics, allowing you to benefit from both gold price fluctuations and collectors’ demand.

The beauty of vintage gold coins lies in their proven reputation as a store of intrinsic value, a status they’ve held for hundreds of years.

They’re more than just monetary instruments; they’re historical artifacts, nostalgic reminders of eras when hard money was the only currency that mattered.

You’ll find great examples in low-premium gold coins like Mexican Gold Pesos, Gold 20 Francs, Gold Sovereigns, and Pre-1933 US Mint Gold Coins, which often have lower dealer premiums compared to modern gold coins.

U.S. Circulated Gold Coins

You’re about to embark on a journey through the world of U.S.-circulated gold coins, a deeply fascinating and often lucrative aspect of gold investment. Each coin’s face value is a mere fraction of its true gold worth, creating a potential goldmine for savvy investors.

Consider the 1849-1854 Liberty Gold Dollar Type 1, with a face value of $1 but a gold value of $98.29. Its successors, the Type 2 and Type 3, circulated from 1854 to 1889, also boast a gold worth of $98.29. That’s nearly a hundredfold increase from the original face value! It’s clear that the gold content, rather than the face value, is the real treasure in these coins.

Turning to the larger denominations, the Liberty Quarter Eagle, in circulation from 1840 to 1907, and the Indian Quarter Eagle, which followed from 1908 to 1929, both have a face value of $2.50. Yet, their gold values are a whopping $245.77. That’s nearly a hundred times their face value!

Given these figures, it’s reasonable to predict a lucrative market for these circulated gold coins. Their intrinsic gold value, coupled with their historical significance, makes them desirable to both collectors and investors. It’s also worth noting that these coins’ values are tied to the price of gold, which can fluctuate.

Foreign Circulated Gold Coins

Diving into the realm of foreign circulated gold coins, it’s intriguing to note that they, much like their U.S. counterparts, hold significantly more value in gold than their face value would suggest.

For example, the British Sovereign, minted between 1817 and 2007, has a face value of one pound but a gold value of $477.57. That’s an immense disparity, isn’t it?

Similarly, the French Angel Franc, minted from 1871 to 1898, and the French Rooster Franc, minted between 1901 and 1914, both have a face value of 20 francs compared to a gold value of $377.99.

The Swiss Helvetia Franc, minted from 1897 to 1947, also shares this face and gold value. What these figures reveal is the substantial inherent worth of these coins due to their gold content.

Now, consider the potential market for these coins. Think about the gold gram values. A 1-gram gold bar is valued at $65.33, a 2.5-gram bar at $163.34, a 5-gram bar at $326.69, and a 10-gram bar at a whopping $653.38.

As the weight increases, so does the value, and these foreign circulated gold coins often weigh several grams.

Given these values, it’s easy to predict a strong market for foreign circulated gold coins. Whether for investment, collection, or a hedge against inflation, these coins offer immense value. As a savvy investor or collector, keep an eye on these coins.

Their underlying gold value, coupled with their historical and numismatic significance, makes them an attractive asset.

Conclusion

In analyzing your gold coin investment, you’ll find a diverse range of options. From investment-grade bullion to foreign circulated coins, each offers unique value. You might lean towards vintage coins for their historic allure or opt for U.S. circulated coins for their domestic familiarity.

Whatever your choice, anticipate fluctuations in gold prices that could impact your investment. Stay savvy, keep informed, and you’ll navigate this precious metal market with confidence and foresight.

Also, bear in mind that the gold coins will cost more than the spot price for various reasons.

Working with a trusted gold investment company can secure the best prices and help you avoid high premiums. See the links below to our four chosen gold IRA companies that provide a means of owning gold and providing security for peace of mind.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com