Gold IRA vs Traditional IRA

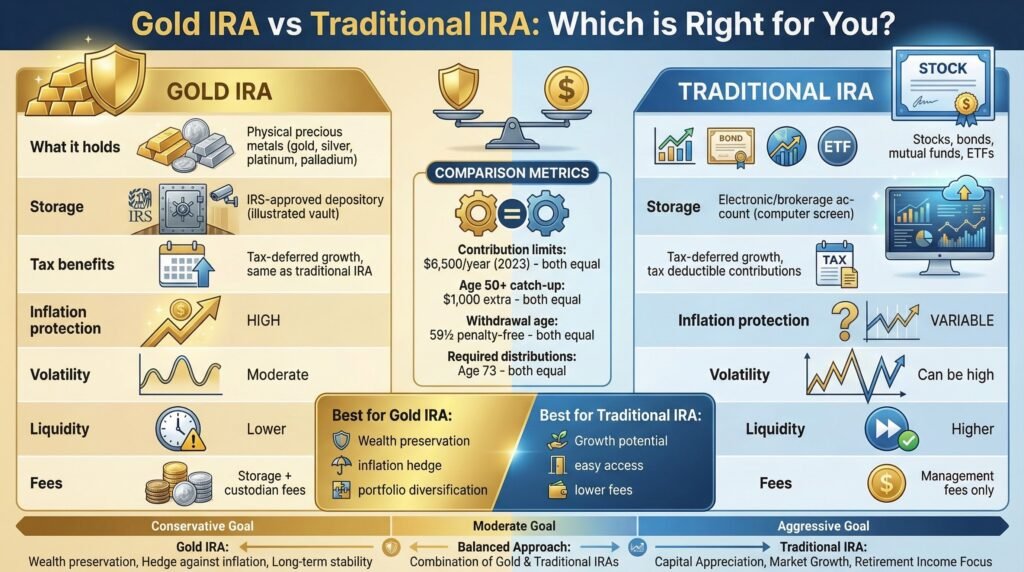

A Gold IRA and a Traditional IRA each have unique benefits and challenges you should consider.

Traditional IRAs offer a wide range of investment options and tax deductions, but they’re also subject to market volatility. On the other hand, a Gold IRA lets you invest in physical gold and other precious metals, sheltering your retirement savings from market fluctuations.

While you’d typically pay a one-time setup fee and yearly costs for a Gold IRA, these often total less than fees associated with Traditional IRAs. Taxes and penalties for early withdrawal apply to both types.

Delving deeper will reveal finer details and help you make an informed choice.

Understanding Traditional IRAs

Often, investors gravitate towards Traditional IRAs due to their familiarity and widespread use. Let me explain why. First, the tax benefits are hard to ignore.

Contributions made to a Traditional IRA are tax-deductible, which means you get to reduce your taxable income now and pay taxes later when you withdraw the funds in retirement.

Yet, it’s not just the tax perks that appeal to investors. There’s also the simplicity and ease of investing in a Traditional IRA.

You can invest in a wide range of assets, from stocks and bonds to mutual funds and exchange-traded funds. Plus, most brokers offer Traditional IRAs, so you’re not short on choices when it comes to finding a provider.

But here’s where it gets interesting. While the flexibility is great, it also means that your investments are subject to market volatility.

Remember, stocks can go up and down, and there’s always a risk that you could lose your investment. With a Traditional IRA, you’re fundamentally putting your faith in the market.

It’s also worth noting that while you have a degree of control over your investments, you’re often guided by the advice of financial advisors. Some people are comfortable with this, but others prefer having more direct control over their assets.

Lastly, don’t forget about the fees. Between management fees, transaction fees, and potential early withdrawal penalties, the costs can add up. So, while Traditional IRAs have their benefits, it’s vital to understand their intricacies before diving in.

Exploring Gold IRAs

While you may be familiar with Traditional IRAs, it’s also important to contemplate Gold IRAs when planning for retirement.

Let’s explore how gold IRAs work. Unlike traditional IRAs that limit you to paper-backed assets like stocks, bonds, and ETFs, Gold IRAs allow you to diversify your portfolio by investing in tangible assets such as gold, silver, and platinum.

Your investment goals will dictate the suitability of each IRA type. Both accounts offer tax-deferred benefits and have the potential for compounded growth. However, the key difference lies in the control and management of your investments.

With a Gold IRA, you have direct ownership of physical gold vs paper gold assets, giving you greater control compared to traditional IRAs, where asset managers typically handle your investments.

Working with a Precious Metals Advisor can enhance your decision-making, especially if you’re new to investing in tangible assets. They can guide you through the setup process, which generally involves a one-time setup fee and annual costs.

While there are misconceptions about the affordability of traditional IRAs, you may find that Gold IRAs often have lower overall costs due to their transparent fee structures. Each gold IRA company will also promote possible waiver of precious metals IRA fees with certain offers.

When it comes to risk and security, traditional IRAs expose your wealth to market volatility and manipulation. Gold IRAs, on the other hand, provide tangible assets, offering greater security.

The physical storage of assets in Gold IRAs reduces your exposure to external threats, making it a generally more stable investment option. Depending on the gold IRA company you choose, each works with specific IRS-approved depositories and IRA custodians.

To learn more right now, tap the banner below to be taken to the Augusta Precious Metals official site to receive a free gold IRA company integrity checklist.

Investment Risks and Returns

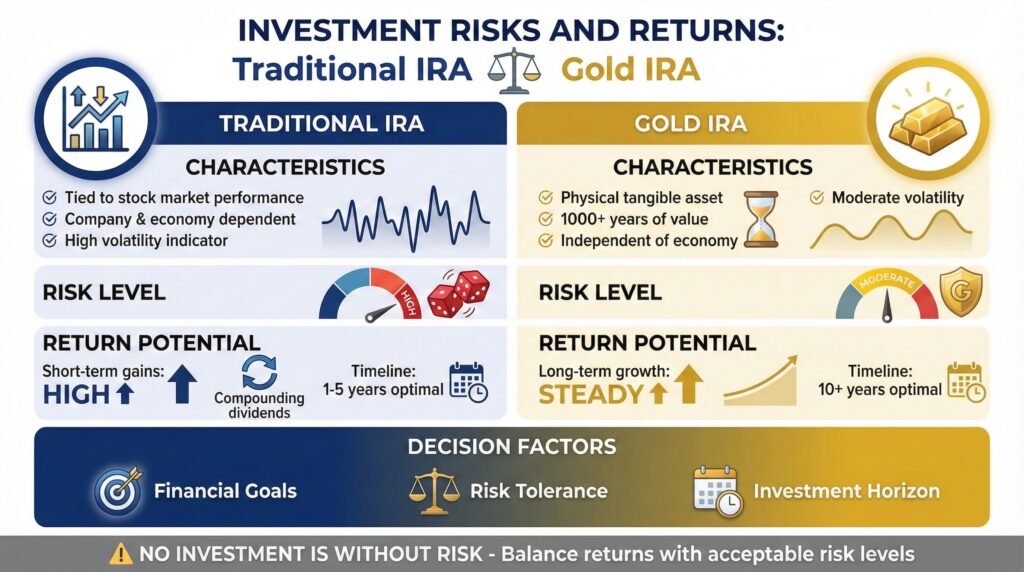

Maneuvering the investment landscape requires a keen understanding of both risks and returns. Investing in a traditional IRA exposes your wealth to the volatility and unpredictability of the stock market.

This means your returns could be substantial, but the risks are equally high. You’re gambling on the performance of companies and the economy as a whole, which I can tell you, is never a sure thing.

Now, let’s switch gears to a gold IRA. When you invest in a gold IRA, you’re investing in an asset that has maintained its value for thousands of years.

Gold is a physical asset that doesn’t rely on a company’s performance or economic trends to hold its value. This can provide a more stable return over time. However, the price of gold can fluctuate, so there’s still a level of risk involved.

It’s also important to understand the return potential of both IRA types. Traditional IRAs generally have a higher potential for short-term gains due to the compounding effect of reinvested dividends and capital gains.

However, a gold IRA can offer steady, long-term growth as the value of precious metals typically increases over time.

In the end, remember that no investment is without risk. It’s about balancing the potential returns with the level of risk you’re willing to take.

Whether a traditional IRA or a gold IRA is right for you, depends on your financial goals, risk tolerance, and investment horizon. Always weigh the risks and returns, and make the decision that suits you best.

Tax Considerations Compared

Despite the complexity, understanding tax implications is essential when comparing traditional and gold IRAs. Let’s explore this topic to better understand how these considerations can impact your retirement planning.

With a traditional IRA, contributions are often tax-deductible, meaning you can lower your taxable income for the year you contribute.

However, when you start to withdraw funds in retirement, these distributions are taxed as regular income. So, if you’re in a higher tax bracket when you retire, you could end up paying more taxes.

On the other hand, gold IRAs, a type of self-directed IRA, have the same upfront tax benefits as traditional IRAs, with contributions potentially deductible.

However, the real difference comes with the type of asset you’re investing in. You’re purchasing physical gold, not a paper-backed asset.

Here’s where it gets tricky: though gold itself doesn’t generate income like dividends or interest, it could appreciate in value, and this appreciation isn’t taxed until you take a distribution.

Additionally, the IRS considers precious metals collectibles, so long-term capital gains are taxed at a maximum rate of 28%, which could be higher than your regular tax rate. Being versed in the various rules, regulations, and tax implications can help minimize and sometimes eliminate these pitfalls.

Additionally, if you take an early distribution from either type of IRA before age 59 ½, you’re likely hit with a 10% penalty on top of the taxes. Knowing the gold IRA withdrawal rules are crucial for avoiding any tax penalties.

Furthermore, many gold IRA companies provide partial 401(k) rollover options to a gold IRA. Finding the right gold IRA company for your individual needs is critical.

For example, if you require a low investment minimum to start a gold IRA company, Birch Gold Group or American Hartford Gold would be two choices to consider. However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive gold prices, then Augusta Precious Metals would be a good fit. Furthermore, Noble Gold Investments provides a gold IRA as well as private investment options for home storage. Decide based on your individual needs. See the links at the bottom of this article to each of these top-rated and reputable gold IRA companies and access their free gold IRA kit.

Retirement Planning Strategies

Taking into account the tax considerations of both traditional and gold IRAs, it’s clear that steering through retirement planning isn’t a walk in the park. It’s a journey of strategic decision-making, where every step matters.

The first step is understanding your retirement accounts. Both traditional and gold IRAs offer tax-deferred growth, but their investment scope differs.

While traditional IRAs are limited to paper-backed assets like stocks, bonds, and ETFs, gold IRAs allow direct investment in physical assets such as gold, silver, and platinum. Your investment goals should guide your choice between these two.

Control and management are another vital aspect of retirement planning. In a gold IRA, you directly own and control your assets, which isn’t always the case with traditional IRAs that are typically managed by asset managers.

Partnering with a Precious Metals Advisor can further enhance your decision-making abilities.

Don’t overlook the costs associated with these IRAs. While hidden management and transaction fees can inflate the cost of traditional IRAs, gold IRAs generally have a one-time setup fee and predictable annual costs.

It’s a common misconception that traditional IRAs are more affordable, but a gold IRA’s transparent fee structure can be more beneficial.

Finally, consider risk and security. Traditional IRAs expose your wealth to market volatility, but gold IRAs, backed by tangible assets, offer greater stability. Remember, no investment is risk-free, but the physical storage of assets in gold IRAs can reduce exposure to external threats.

Navigating retirement planning is complex, but understanding these strategies can guide you towards a secure future.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

Click the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

Conclusion

Choosing between a Gold IRA and a Traditional IRA comes down to your personal risk tolerance, investment goals, and tax considerations. Both offer unique benefits and potential drawbacks.

Diversifying your portfolio by including various types of investments is always a wise move. But remember, the best retirement plan is always one that aligns with your individual financial situation and retirement goals.

So, do your homework, consult with a financial advisor, and make the choice that’s right for you.

If you have 100k in retirement savings to protect, click the banner below to take advantage of a free gold investment webinar hosted by Augusta Precious Metals.

Find the right gold IRA conpany for you. Obtain a gold IRA guide and talk to a broker

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com