💰 Gold Price Calculator

Calculate the current market value of your gold based on weight, purity, and live market prices. Get instant estimates for selling or buying gold jewelry, coins, or bars.

Why Are Gold Prices Rising?

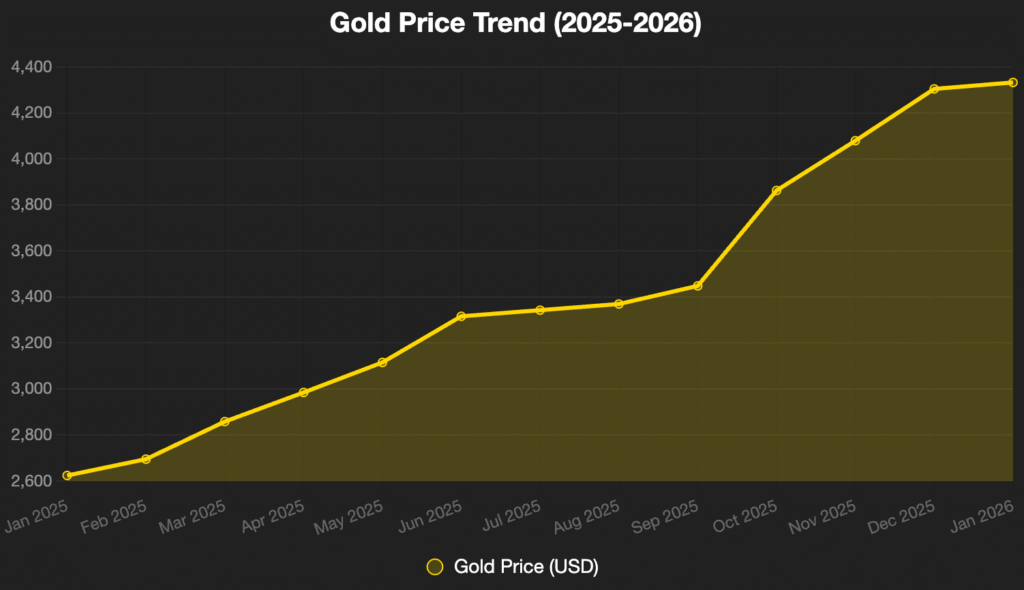

In the early days of 2026, gold continues to captivate investors worldwide, with its spot price hovering around $4,332 per ounce as of January 2.

This marks a staggering 65% increase from the start of 2025, when prices sat at approximately $2,624 per ounce.

The yellow metal’s ascent has been nothing short of remarkable, shattering records and outpacing many traditional assets. But what’s fueling this surge, and is now the time to add gold to your portfolio?

This article explores the key drivers behind gold’s rally and outlines compelling reasons why investing in it could safeguard and grow your wealth in an uncertain economic landscape.

The Meteoric Rise: A Look at the Numbers

Gold’s performance in 2025 was its strongest in decades, with prices climbing over 66% by year-end.

To put this in perspective, the average annual return for gold over the past 15 years has been around 8.9%, but recent years have seen explosive growth: a 12.8% gain in 2023, 26.3% in 2024, and a whopping 66.5% in 2025.

Short-term trends are equally impressive—up 2.67% in the last 30 days and 29.76% over six months.

This upward trajectory isn’t random. Gold prices have historically responded to macroeconomic shifts, and the current environment is ripe for continued appreciation.

Analysts from major institutions like J.P. Morgan and Bank of America project prices could hit $5,000 per ounce by the end of 2026, with some even eyeing $6,000 in the longer term.

To visualize this trend, consider the following chart of monthly average closing prices for gold (XAU/USD) throughout 2025, showing a clear bullish pattern:

This data, derived from forex aggregates, underscores gold’s resilience amid volatility in other markets.

Key Drivers Behind the Price Surge

Several interconnected factors are propelling gold higher, creating a perfect storm for the precious metal.

1. Geopolitical and Economic Uncertainty

In a world plagued by conflicts and trade tensions, gold’s status as a safe-haven asset shines brightly. The ongoing war in Ukraine, escalating Middle East tensions, and U.S.-China trade frictions have driven demand for haven investments.

Investors flock to gold during times of instability because it retains value when fiat currencies falter. As one analyst noted, “In a world fraught with geopolitical and economic uncertainty, gold’s safe-haven reputation thrived this year as it had not since the high-inflation era of the late 1970s.”

Moreover, domestic policy uncertainties in the U.S., including fiscal pressures and midterm elections, add to the mix.

2. Central Bank Buying and Currency Debasement

Central banks have been voracious buyers, adding hundreds of tons to reserves in 2025 alone.

This trend stems from de-dollarization efforts, where nations like China and Russia diversify away from U.S. Treasuries into gold to hedge against dollar depreciation. A weaker U.S. dollar—down over 6% in 2025—makes gold more affordable for foreign buyers, amplifying demand.

Quantitative easing (QE) and rising U.S. deficits are also key. As one expert put it, “The balance sheet expansion is outright monetary debasement, and there’s nothing better for precious metals than that.”

Gold acts as a hedge against currency debasement, preserving purchasing power when governments print money.

3. Monetary Policy and Interest Rates

The Federal Reserve’s rate cuts in 2025, with more expected in 2026, lower the opportunity cost of holding non-yielding gold.

Lower rates weaken the dollar and make gold more attractive compared to bonds or savings accounts. If economic data softens, prompting aggressive cuts, gold could surge 15-30% this year.

4. Investor Demand and Portfolio Reallocation

Exchange-traded funds (ETFs) saw billions in inflows as investors sought diversification. Gold’s low correlation with stocks and bonds makes it an ideal portfolio stabilizer.

In 2025, 84% of gold ETF investors reported positive impacts on their returns. Structural shifts, like high-net-worth individuals doubling allocations, signal sustained demand.

Tax-Advantaged Gold IRAs

As gold prices soar to around $4,330 per ounce in early 2026, following a remarkable 65% surge in 2025, many investors are turning to Gold Individual Retirement Accounts (IRAs) to secure their retirement savings.

A Gold IRA is a self-directed retirement account that allows you to hold physical precious metals like gold, silver, platinum, and palladium, rather than traditional stocks or bonds.

One of the primary advantages is tax benefits. Gold IRAs offer the same tax advantages as traditional or Roth IRAs: tax-deferred growth in a traditional Gold IRA or tax-free withdrawals in a Roth version. This allows your investment to compound without immediate tax burdens, preserving more wealth for retirement.

Another key benefit is diversification. Gold often moves independently of stocks and bonds, reducing overall portfolio risk. In times of market volatility or economic uncertainty, physical gold acts as a tangible asset that historically retains value, providing stability when paper assets falter.

Gold IRAs also serve as a strong hedge against inflation. As currencies lose purchasing power due to rising prices or monetary debasement, gold has proven to maintain or increase its value over the long term, protecting your retirement nest egg from erosion.

Additionally, with easy rollover options from existing 401(k)s or IRAs, adding physical gold is straightforward while keeping tax advantages intact. Experts recommend allocating 5-20% of your portfolio to precious metals for optimal balance.

In an era of geopolitical tensions and persistent inflation concerns, a Gold IRA combines the security of physical assets with retirement tax perks, making it a compelling choice for long-term wealth preservation.

Click the button below receive a free gold IRA company integrity checklist from Augusta Precious Metals and start protecting your retirement wealth today.

Conclusion: A Golden Opportunity

Gold’s rise is rooted in timeless fundamentals: uncertainty, debasement, and demand. As 2026 unfolds with potential rate cuts, geopolitical strife, and economic headwinds, prices are poised to climb further.

Investing now could protect your wealth from inflation, diversify your holdings, and capture upside potential.

Whether through ETFs or physical bars, gold remains a beacon of stability in turbulent times. With projections pointing to new highs, the question isn’t if you should invest—it’s how much.