Gold Retirement Account Rollover

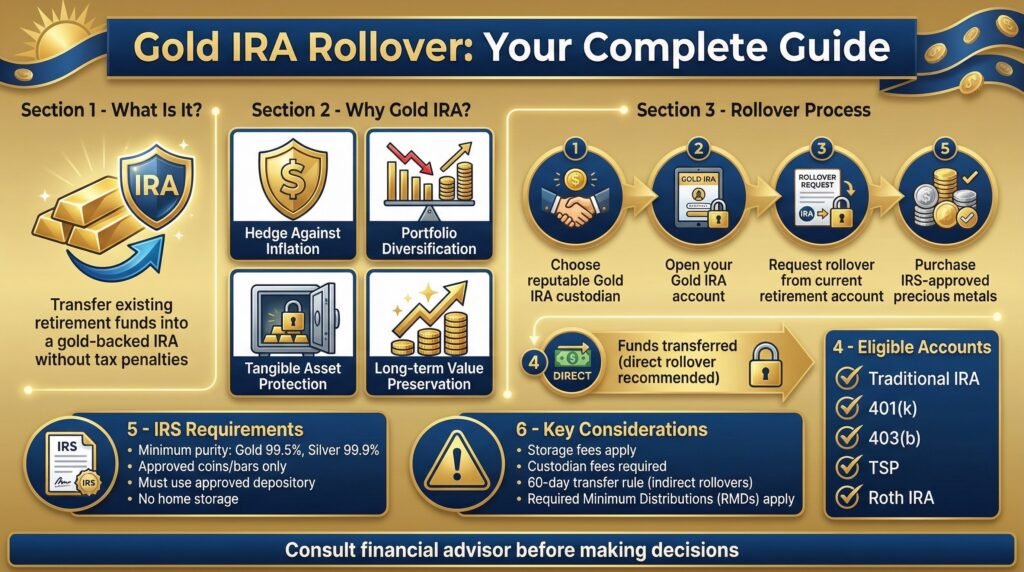

A Gold Retirement Account Rollover, or a Gold IRA rollover, refers to moving your funds from a traditional IRA or 401(k) to a self-directed IRA investing in physical gold or other approved precious metals.

Done correctly, it can bolster your portfolio’s security, diversifying it against economic turmoil. However, you must also keep in mind the associated costs, such as storage, insurance, and custodian fees, which can affect your return on investment.

Consulting a financial advisor and carefully examining how gold fits into your broader investment strategy is essential. If you’re contemplating a Gold IRA rollover, delving further will equip you with the necessary details to make an informed decision.

Understanding Gold IRA Rollover

In the midst of current market trends and economic indicators, you might be evaluating diversification strategies for your retirement savings.

One strategy to reflect upon is a gold Individual Retirement Account (IRA) rollover. It’s a type of self-directed IRA that permits investment in physical gold, as well as other approved precious metals.

Implementing a gold IRA rollover involves moving funds from your traditional IRA or 401(k) to a gold IRA.

You have two options for this: a direct rollover or an indirect one. In a direct rollover, the institution transfers the funds directly into your new gold IRA. In an indirect rollover, you withdraw the funds from your current account and deposit them into the new one within 60 days to avoid tax penalties.

When choosing a gold IRA rollover, it’s important to understand the costs involved. These can include storage and insurance fees for the physical gold, custodian fees, and premiums for the gold itself. These charges can impact your overall return on investment, so it’s vital to take them into account in your decision-making process.

Lastly, make sure you find a reputable gold IRA custodian. Look for one with a solid track record, fair fees, and positive customer reviews.

Remember, they’ll be handling the paperwork, ensuring compliance with IRS regulations, and storing your physical gold, so it’s significant that they’re trustworthy and reliable.

Benefits of Gold IRA Rollover

Having explored the concept and setup of a gold IRA rollover, let’s now explore the potential advantages it can bring to your retirement savings strategy.

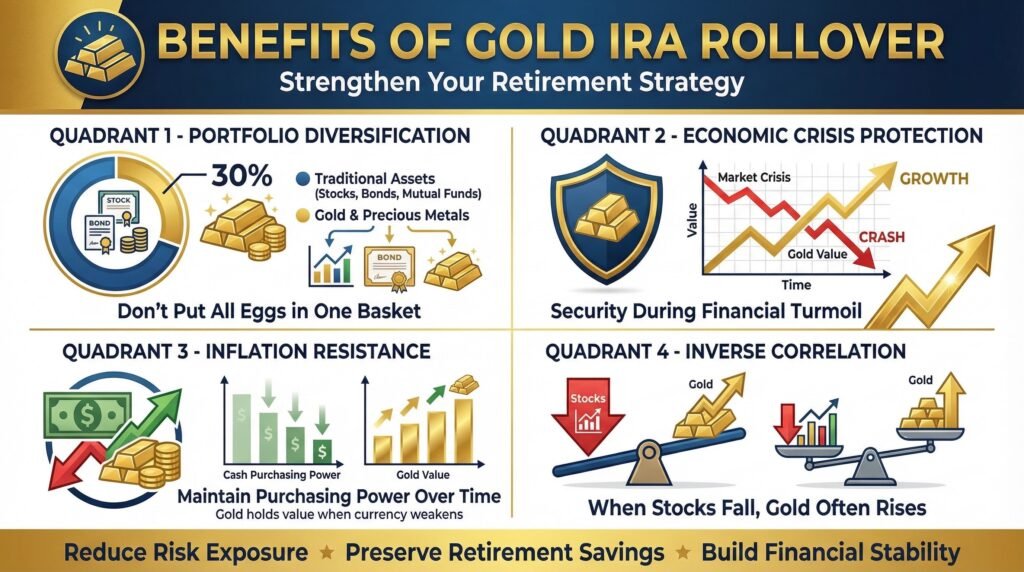

A gold IRA rollover can be a significant step towards diversifying your retirement portfolio, which is a primary benefit of this strategy.

By including gold and other precious metals in your portfolio, you’re not just relying on traditional stocks, bonds, or mutual funds. One of the most appealing advantages of a gold IRA rollover is the security it can provide during periods of economic turmoil.

Gold has historically held its value or even increased in value during financial crises. This stability can be a reassuring factor when the markets are unpredictable.

Another benefit of a gold IRA rollover is its resistance to inflation. Unlike cash or other assets, gold’s value doesn’t diminish with inflation.

This can be a crucial attribute in maintaining the purchasing power of your retirement savings over time. With geopolitical instability and market volatility becoming increasingly common, the stability of gold can be a valuable safeguard.

Additionally, gold’s negative correlation with other assets like stocks is an advantage. When stocks go down, gold often goes up. This means a gold IRA rollover can potentially reduce your risk exposure and help maintain your retirement savings even during underperforming markets.

Considerations Before Rollover

Before you decide to roll over your traditional IRA or 401(k) into a gold IRA, it’s vital to understand the specifics. A gold IRA rollover isn’t a decision to be made lightly. It’s important to weigh the benefits and drawbacks, considering the impact on your retirement savings and your overall financial plan.

Firstly, consider the costs involved. Unlike traditional retirement accounts, gold IRAs come with additional fees. These include storage and insurance costs for the physical gold you’ll hold in your account.

You’ll also need to factor in custodian fees and any premium you might pay for the gold itself. These expenses can add up and will directly impact your bottom line.

Next, consider how a gold IRA fits into your broader investment strategy. Gold can be an excellent hedge against inflation and market volatility, but it’s not without risks. The price of gold can fluctuate, just like any other investment. If you’re overly reliant on gold for your retirement savings, a significant drop in gold prices could hurt your financial security.

Lastly, it’s important to consult with a financial advisor before making any major investment decisions. An advisor can help you assess your financial situation, consider your retirement goals, and determine if a gold IRA rollover is the right move for you.

Steps to Set Up Gold IRA

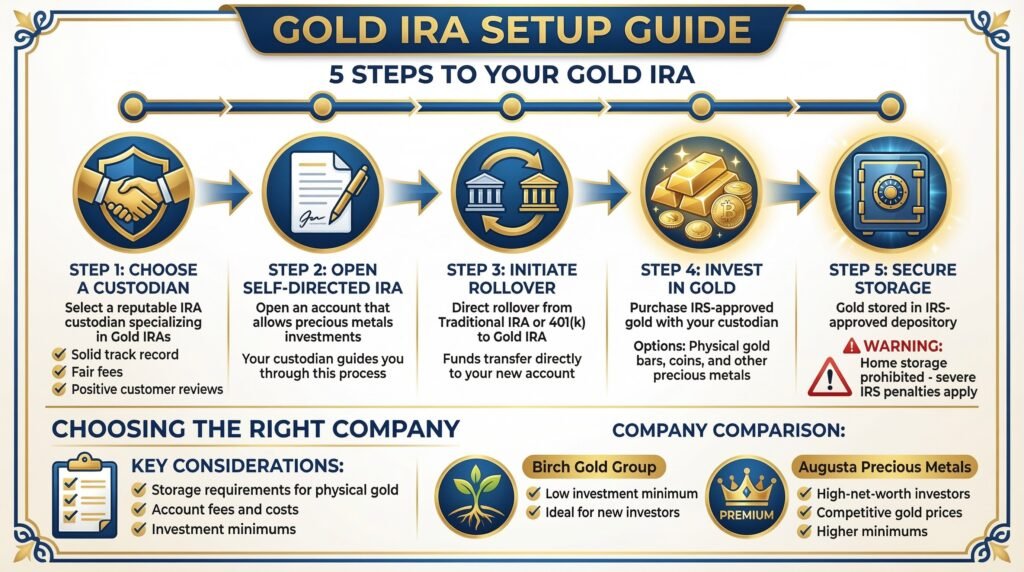

Setting up a gold IRA rollover involves a few crucial steps. Here, I’ll walk you through the process. It’s not as intimidating as it may seem, and it can provide a substantial boost to your retirement savings.

Firstly, you’ll need to choose a reputable IRA custodian specializing in gold IRAs. It’s important to choose someone reputable, with a solid track record, fair fees, and positive customer feedback. Research thoroughly before making a decision. After all, this custodian will be handling your retirement savings.

Once you’ve chosen a custodian, you must open a self-directed IRA. This is an account that allows you to make investments in a variety of assets, including precious metals like gold. Your custodian will guide you through the process.

Next, you’ll initiate a rollover from your traditional IRA or 401(k). The funds will be transferred directly to your new self-directed gold IRA. This is known as a direct rollover, and it’s generally the most straightforward method.

Once the funds are in your new gold IRA, you can start investing in gold. You’ll have the option to invest in physical gold, like bars and coins. Work with your custodian to purchase IRS-approved gold or other precious metals.

The gold must be stored in an approved depository. Home storage is not allowed for Gold IRAs, and attempting to do so could result in severe penalties from the IRS.

Benefits of Choosing a Reputable Gold IRA Company

It is crucial to remember that investing in a Gold IRA involves unique considerations. These include understanding the storage requirements of physical gold and the fees associated with these accounts.

Finding the right gold IRA company for your individual needs is critical. For example, if you require a low investment minimum to start a gold IRA company, Birch Gold Group would be a great choice to consider.

However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive gold prices, then Augusta Precious Metals would be a good fit.

Decide based on your individual needs. See the links at the bottom of this article to each of these top-rated and reputable gold IRA companies and access their free gold IRA kit.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Gold IRA Rollover: The Bottom Line

Now that we’ve gone through the steps of setting up a gold IRA rollover, let’s take a look at the bigger picture. A gold IRA rollover isn’t just a decision you make on a whim. It’s a strategic move that, when done right, can add a layer of security to your retirement nest egg.

One of the primary benefits of a gold IRA rollover is the diversification it offers. If you’re like most investors, your portfolio is heavily weighted toward traditional assets like stocks and bonds.

By adding gold to the mix, you’re not only spreading your risk but also creating a hedge against inflation and market volatility.

But, there’s a flip side. Rolling over into a gold IRA comes with its own set of costs – storage fees, insurance fees, custodian fees, and the premium for physical gold.

All these can eat into your retirement savings if you’re not careful. That’s why it’s essential to understand these costs and their impact on your bottom line.

So, is a gold IRA rollover right for you? Well, that depends on your financial situation, your risk tolerance, and your retirement goals.

It could be a valuable addition to your investment strategy if you’re looking for a tangible asset that has stood the test of time. But like any other investment decision, it should be made with careful consideration and ideally, with the guidance of a financial advisor.

When it comes to your retirement, there’s no one-size-fits-all solution. A gold IRA rollover is just one of the many options you have. The bottom line is, do your homework, weigh the pros and cons, and make the decision that’s best for you.

Financial Calculators

Find out whether gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement calculators and perform real-time calculations as you read our articles.

Click the buttons below to access these calculators, bookmark them for future use, and start protecting your wealth today.

Conclusion

In summary, a Gold IRA rollover can be a strategic move to diversify your retirement portfolio. It offers a safety net against market uncertainties and inflation. However, it’s vital to weigh the costs and regulations involved.

Setting up a Gold IRA can be straightforward with the right guidance. Remember, your retirement savings are an important part of your future, so make every decision count. Stay informed, stay secure!

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Find the right gold IRA conpany for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com