How Much Do I Need to Start Investing in Gold?

Considering investing in gold but unsure where to start?

We explore the world of gold investing, from reasons to add this precious metal to your portfolio to different ways to start investing in gold.

We also discuss factors to consider before diving into gold investments and associated risks.

How much you need to start investing in gold will greatly depend on your investment goals, age, risk tolerance, preferred gold investment vehicle, and more. To gain a better understanding of:

-What Is Gold Investing?

-Why Should I Invest in Gold?

-How Much Money Do I Need to Start Investing in Gold?

-What Are the Different Ways to Invest in Gold?

-What Factors Should I Consider Before Investing in Gold?

-What Are the Risks of Investing in Gold?

-How Can I Start Investing in Gold?

If curious about gold investing and want to learn more, keep reading!

What Is Gold Investing?

Gold investing refers to the process of allocating funds into various gold-related assets, such as physical bullion, coins, and other gold-backed securities, to diversify one’s investment portfolio and mitigate risks associated with economic volatility and inflation.

Why Should I Invest in Gold?

Investing in gold offers a range of benefits, including acting as a hedge against inflation, providing a safe haven asset during economic downturns, and helping to diversify an investment portfolio to mitigate risks.

Hedge Against Inflation

Gold is often considered a reliable hedge against inflation because its value tends to rise when the cost of living increases.

Historically, gold has been prized for its ability to retain purchasing power during times of economic uncertainty.

During inflationary periods, when fiat currencies may lose value rapidly, gold has demonstrated its resilience by maintaining its worth. For instance, in the 1970s, when inflation surged, the price of gold soared, providing a safe haven for investors seeking protection against the eroding value of paper money.

Safe Haven Asset

Gold is known as a safe-haven asset because it tends to retain or increase in value during times of political unrest and economic downturns.

One of the key reasons why investors turn to gold during turbulent times is its reputation as a reliable store of value. Unlike currencies, which can depreciate rapidly in times of crisis, gold historically holds its worth.

For example, during the 2008 financial crisis, while stock markets plummeted, the price of gold surged, proving its resilience as an investment. Similarly, in times of geopolitical uncertainty, such as during conflicts or trade wars, gold has shown its ability to act as a hedge against inflation and market volatility.

Diversification

Incorporating gold into your investment portfolio can help diversify your assets, thereby reducing overall risks and potentially enhancing returns.

Diversification in investment strategy is crucial for mitigating risks and maximizing returns. One of the key benefits of diversifying with gold is its low correlation with traditional asset classes such as stocks and bonds.

This low correlation means that gold often moves independently of other investments, acting as a hedge during economic downturns. For example, during the 2008 financial crisis, the price of gold surged while stock markets plummeted.

This unique characteristic of gold can help protect your portfolio from volatility and provide stability in times of market turbulence.

How Much Money Do I Need to Start Investing in Gold?

The amount of money needed to start investing in gold can vary widely depending on the type of gold investment you choose, such as physical gold, ETFs, or gold stocks, as each option has different costs, fees, and storage requirements.

Physical Gold

Investing in physical gold, such as bullion and coins, typically requires an initial outlay for the gold itself, along with additional costs for storage and insurance.

Regarding physical gold, there are various forms that investors can consider. For example, bullion refers to gold bars or ingots of various sizes, usually produced by government mints or private refineries.

On the other hand, coins like the South African Krugerrand or the U.S. American Eagle are popular options for those looking to invest in gold. These coins are not only valuable for their gold content but also carry a numismatic premium due to their collectible status.

Gold ETFs

Gold ETFs, like SPDR Gold Shares ETF, offer a cost-effective and liquid means of investing in gold without the need for physical storage.

Investing in gold ETFs involves purchasing shares that represent ownership of the underlying gold assets, typically held by a trust. These ETFs are traded on major stock exchanges, providing investors with an easy way to gain exposure to the price of gold without directly owning physical gold.

One of the key benefits of gold ETFs is their lower costs compared to buying and storing physical gold. Gold ETFs offer high liquidity, allowing investors to buy and sell shares easily during market hours.

Some popular gold ETFs apart from SPDR Gold Shares ETF include iShares Gold Trust, Aberdeen Standard Physical Gold Shares ETF, and VanEck Merk Gold Trust.

When considering gold ETFs, investors should pay attention to the expense ratios, which represent the annual fees charged by the fund to manage its operations.

Lower expense ratios are favorable as they can help maximize returns over time. For example, SPDR Gold Shares ETF (GLD) has an expense ratio of 0.40%, iShares Gold Trust (IAU) has an expense ratio of 0.25%, and Aberdeen Standard Physical Gold Shares ETF (SGOL) has an expense ratio of 0.17%. These figures highlight the importance of comparing expense ratios when choosing a gold ETF for investment purposes.

Gold Stocks

Investing in gold stocks, which involves buying shares of mining companies like Newmont Corp. and Barrick Gold Corp., can provide exposure to gold prices along with potential dividends.

One key advantage of investing in gold stocks is the opportunity to benefit from a rising gold price, as the stock prices of gold mining companies tend to move in tandem with the price of gold.

Some gold mining companies also offer investors a regular stream of dividend income, providing an additional incentive for holding onto these stocks for the long term.

It is important to consider the risks involved, such as market volatility. Gold prices can be influenced by various factors, including economic conditions, geopolitical events, and investor sentiment, leading to fluctuations in stock prices.

Investing in individual mining companies comes with company-specific risks, such as operational challenges, production costs, and regulatory issues that can impact the company’s financial performance and stock valuation.

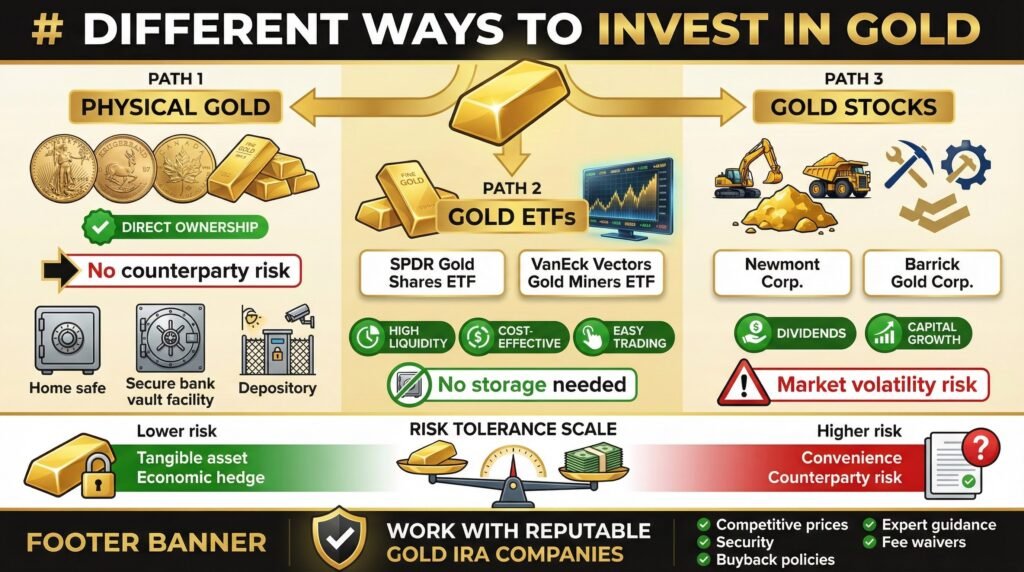

What Are the Different Ways to Invest in Gold?

There are several ways to invest in gold, each with its own set of benefits and considerations, including physical gold, gold ETFs, mutual funds, futures, and options, which offer various levels of exposure, risk, and liquidity.

Physical Gold

Investing in physical gold involves purchasing bullion or coins, which requires safe storage solutions and offers the advantage of direct ownership.

When individuals opt to invest in physical gold, they often find themselves navigating a world of different options in terms of the types of gold they can acquire.

For instance, some may choose to purchase popular coins such as the American Eagle, South African Krugerrand, or Canadian Maple Leaf, while others may prefer investing in bars of pure gold. These decisions involve considerations such as liquidity, purity, and potential resale value.

Once the gold is acquired, the major concern for investors lies in the safe storage of their precious metals. While some opt for home safes or secure storage facilities, others choose to utilize the services of vault companies or depositories for added security as we will discuss shortly.

Gold ETFs

Gold ETFs, such as SPDR Gold Shares ETF and VanEck Vectors Gold Miners ETF, offer an efficient way to gain exposure to gold prices with high liquidity and ease of trading.

Investing in these gold ETFs provides several advantages over physical gold ownership. They offer a cost-effective way to invest in gold without the need for storing and securing physical bullion.

Additionally, ETFs like the ones mentioned have demonstrated strong performance historically, closely tracking the price of gold. Investors can benefit from the transparency and flexibility of ETFs in terms of trading frequency and diversification.

It is also important to consider the expense ratios of these funds, with lower ratios typically indicating better value for investors.

Gold Stocks

Investing in gold stocks involves purchasing shares of mining companies like Newmont Corp. and Barrick Gold Corp., which can provide dividends and capital growth potential.

Gold prices play a significant role in determining the performance of mining company stocks, as these stocks are directly linked to the price of gold in the market.

When gold prices rise, the profitability of mining companies tends to increase, leading to a potential rise in the value of their stocks. This presents investors with an opportunity for not only capital gains but also the possibility of receiving dividends from these companies.

It’s important to note that investing in gold stocks also comes with certain risks. The volatility of the gold market can impact the stock prices of mining companies, making them susceptible to market fluctuations.

Factors such as geopolitical instability, environmental regulations, and operational challenges within the mining industry can pose risks to the overall performance of these stocks.

Therefore, while gold stocks have the potential for high returns, investors should carefully consider these risks before making investment decisions.

Risk Tolerance

Investors with high-risk tolerance levels often lean towards paper gold products such as stocks and etfs as it provides convenience and liquidity compared to physically holding gold, which may require storage and insurance costs. However, there is a greater counterparty risk of default.

Also, certain paper gold contracts, like unallocated gold forwards or futures contracts, may not have the equivalent amount of physical gold backing each contract.

If the open interest of the various gold contracts stood for delivery, would that specific contract have the tangible gold to fulfill this request? This is where due diligence on the part of the individual investor is critical

On the other hand, those with a lower risk tolerance may prefer the tangible asset of physical gold as a hedge against economic uncertainties, quick access to the actual asset itself, and the elimination of third-party counterparty risk. Physical gold ownership does not rely on someone else’s promise.

To surmount the possible storage and security costs of owning physical gold, a credible gold investment company can provide this expertise and peace of mind.

Working with a Reputable Gold Investment Company

When embarking on the path of gold investing, working with a trusted and reputable gold investment company can alleviate a great deal of the guesswork, time, and possible financial setbacks. Leveraging the institutional knowledge of these companies will provide you with the ability to maximize your gold investment.

Gold IRA companies, more specifically, can provide additional benefits beyond merely buying physical gold from a local dealer.

These companies offer competitive prices, sound buyback policies, transparency, reliable customer service, and robust security of your precious metals. This option alleviates the worry of holding and securing the gold within your own home.

Dependent on the volume of physical gold you intend to own, it is usually advised that you do not put all your wealth in one place. Also, many gold IRA companies will waive certain fees depending on the investment minimum.

Finding the right gold IRA will also depend on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs whether you prefer a gold IRA or owning the physical gold in your place of residence. See our gold IRA reviews for more information so you can make the right choice.

Furthermore, if you are looking for a gold investment company that provides the benefits of a gold IRA as well as private ownership, Noble Gold Investments is a great option. In addition to gold IRAs, Noble Gold provides Royal Survival Packs.

With an array of packages ranging from $10,000 to $500,000 plus, Noble Gold will ensure safe delivery of your gold to your home. This provides you with immediate access to tangible and peace of mind.

Click the banners below to go to the official gold company site and find the right option for you.

What Factors Should I Consider Before Investing in Gold?

Before investing in gold, it’s important to consider several factors such as current market conditions, your specific purpose for the investment, and your overall personal financial situation.

Market Conditions

Understanding current market conditions, including trends in gold prices and overall market volatility, is crucial before making an investment in gold.

One key aspect to consider is the impact of external factors on gold prices. Economic indicators like inflation rates, interest rates, and GDP growth play a significant role in shaping the value of gold.

Geopolitical events such as political instability, trade tensions, and global conflicts can cause fluctuations in the market.

By closely monitoring these variables and analyzing their potential impact, investors can gain valuable insights to make informed decisions when entering or exiting the gold market.

Purpose of Investment

Defining the purpose of your gold investment, whether it’s for hedging against inflation, diversifying your portfolio, or seeking profit, helps guide your investment strategy.

For instance, if your primary goal is to hedge against inflation, selecting physical gold in the form of coins or bars can provide a tangible asset that typically retains its value over time.

On the other hand, if you aim to diversify your portfolio, investing in gold exchange-traded funds (ETFs) could offer a convenient way to gain exposure to the precious metal without the need for storage.

For those looking to profit from gold price movements, trading gold futures or options might be a more suitable approach due to the potential for higher returns, albeit with increased risks.

Personal Financial Situation

Your personal financial situation, including your risk tolerance, liquidity needs, and overall asset allocation, should play a significant role in deciding how much to invest in gold.

Assessing your financial situation involves evaluating your income, expenses, debts, and savings. Understand your risk tolerance by considering how comfortable you are with market fluctuations and potential losses.

It’s important to strike a balance with asset allocation, spreading investments across different classes such as stocks, bonds, and commodities like gold.

Consider costs associated with investing in gold, such as storage fees or transaction charges, and factor these into your decision-making. Ensure you maintain adequate liquidity for emergency expenses by not overcommitting to illiquid assets like physical gold.

What Are the Risks of Investing in Gold?

While investing in gold can offer several benefits, it’s also important to be aware of the associated risks, including price volatility, counterparty risk, and liquidity risk.

Volatility

Gold prices can be highly volatile, which means that the value of your investment may fluctuate significantly over short periods of time.

This volatility in gold prices can be attributed to various factors, such as geopolitical tensions, economic uncertainty, inflation rates, and currency fluctuations. For example, during times of political instability or economic downturns, investors tend to flock to gold as a safe-haven asset, driving up its price.

On the other hand, improved economic conditions or a strengthening dollar can lead to a decrease in gold prices.

When gold prices experience such fluctuations, it can have a direct impact on your investment portfolio. If you have a significant allocation to gold, sudden price drops can erode your portfolio’s overall value.

To mitigate these effects, diversification is key. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce the risk associated with gold price volatility.

Setting clear investment goals and maintaining a long-term perspective can help you weather short-term fluctuations in gold prices.

Avoiding emotional reactions to price swings and sticking to your investment strategy can prevent impulsive decisions that may harm your portfolio in the long run.

Counterparty Risk

Counterparty risk arises when investing in gold-related financial products such as ETFs, futures, and options, as it involves reliance on another party to fulfill their contractual obligations.

When an investor engages in gold derivatives or trades gold-based financial instruments, they are exposed to the possibility that the counterparty may default on their obligations.

This can lead to financial losses or disruptions in the investment process. For instance, if a gold ETF fails to deliver the physical gold as promised, the investor faces the risk of not realizing the intended returns.

To mitigate counterparty risk in gold investments, investors can diversify their holdings across different counterparties. By spreading their exposure, investors can reduce the impact of any single counterparty’s default.

Conducting thorough due diligence on the financial health and reliability of the counterparties before entering into any agreements is crucial.

Liquidity Risk

Liquidity risk refers to the potential difficulty in selling your gold assets quickly without significantly affecting their market price, especially in times of economic stress.

During periods of high market volatility, liquidity risk becomes a crucial consideration for investors holding physical gold, as it may not be as readily convertible to cash as other financial assets.

To mitigate this risk, one strategy is to focus on investing in highly tradable gold assets such as gold exchange-traded funds (ETFs) or gold futures contracts, which offer greater liquidity and ease of sale.

Another approach is to maintain a diversified portfolio that includes a mix of highly liquid assets alongside gold holdings, providing flexibility and ensuring access to funds when needed.

How Can I Start Investing in Gold?

Starting to invest in gold involves understanding the different types of gold investments available, assessing your financial goals and risk tolerance, and following guidelines that cater specifically to beginners.

Before diving into the world of gold investing, it is important to educate yourself on the various forms in which you can invest in gold.

Common options include physical gold like coins and bars, gold exchange-traded funds (ETFs), gold mining stocks, and gold futures. Each type of investment comes with its own set of risks and potential returns, so it’s crucial to choose wisely based on your financial objectives and comfort level with risk.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Click the button below:

Conclusion

So now you know the numerous variables when considering how much you will need to start investing in gold.

There is a myriad of gold investing options that provide their own set of advantages and disadvantages.

Your present, individual investing goals will determine what path to take. To get started in the process of gold investing, see the links at the end of this article to access the free investing guides from the best gold IRA companies.

Best of luck to you in your gold investing journey.

Frequently Asked Questions

How Much Do I Need to Start Investing in Gold?

The amount you need to start investing in gold depends on your personal financial goals and risk tolerance. However, experts recommend starting with at least $5,000 to have a diversified portfolio.

What Are the Benefits of Investing in Gold?

Gold is considered a safe-haven asset and can act as a hedge against inflation and economic uncertainty. It also has a long history of retaining its value, making it a valuable addition to any investment portfolio.

Can I Start Investing in Gold with a Small Amount of Money?

Yes, you can start investing in gold with a small amount of money. There are various options available such as buying fractional shares of gold or investing in gold exchange-traded funds (ETFs).

How Do I Determine the Right Amount to Invest in Gold?

It is recommended to consult with a financial advisor to determine the right amount to invest in gold based on your individual financial situation and goals. They can also provide guidance on when to increase or decrease your investment in gold.

Are There Any Risks Involved in Investing in Gold?

As with any investment, there are risks involved in investing in gold. The value of gold can fluctuate, and there may be storage and transaction fees. It is important to do your research and understand the potential risks before investing in gold.

Is It Better to Invest in Physical Gold or Gold Stocks?

There are pros and cons to both investing in physical gold and gold stocks. Physical gold provides a tangible asset, but it may come with storage and insurance costs. Gold stocks offer the potential for greater returns, but they also carry higher risks. It is important to carefully consider your options and consult with a financial advisor before making a decision.

Find the right gold IRA conpany for you. Obtain a gold IRA guide and talk to a broker

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com