IRS-Approved Depository for Precious Metals

Ever pondered the legitimacy of storing your precious metals in an IRS-approved depository? You’re not alone. As an astute investor, it’s crucial to ensure your precious metals are safe, secure, and above all, IRS-compliant.

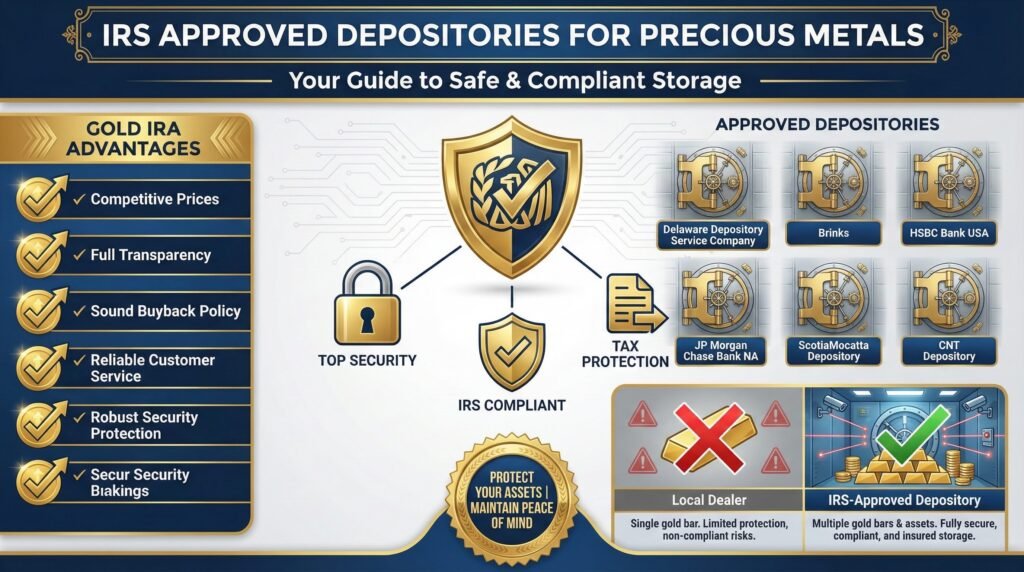

IRS-approved depositories include Delaware Depository Service Company, Brinks, HSBC Bank USA, JP Morgan Chase Bank NA, ScotiaMocatta Depository, and CNT Depository. By choosing an IRS-approved depository, you’re not just opting for top-notch security, but also guarding yourself against potential tax complications.

Whether you’re a veteran investor or just starting, you’ll find this information invaluable in safeguarding your assets and maintaining peace of mind.

Delaware Depository Service Company

As one of the premier storage solutions for precious metals, the Delaware Depository Service Company offers you top-tier security and insurance coverage for your valuable assets.

This institution, approved by the IRS and licensed by the CME Group, serves as an exchange-approved depository for the NYMEX and COMEX markets.

Delaware Depository provides peace of mind by ensuring your assets are well-protected.

With an all-risk insurance coverage worth up to $1 billion, you can rest assured that your precious metals are safe. Even shipments made by express carrier or mail are covered for up to $100,000 per package.

Whether you’re a brokerage firm, a manufacturer, a refiner, an IRA custodian, a coin dealer, a retailer, or a commodity trading house, you can benefit from Delaware Depository’s services. It caters to clients of all sizes, demonstrating its flexibility and commitment to providing top-notch service to all.

Another key advantage of storing your assets with the Delaware Depository is the potential tax benefits. As a client, you can benefit from Delaware’s numerous business tax advantages, which can significantly enhance the value of your investment.

In choosing Delaware Depository, you’re not just selecting a storage facility, but a partner committed to providing a secure environment for your precious assets.

A partner that takes pride in its robust security measures, comprehensive insurance coverage, and commitment to client satisfaction. Ultimately, Delaware Depository isn’t just about storing your assets; it’s about securing your future.

Brinks

When you’re looking to secure your precious metals, Brinks Global Services stands out as a top choice due to its exceptional security measures and reliable storage solutions. Operating with authorized depositories in both New York City and London, Brinks has a global reputation for safety and reliability.

One of the significant advantages of Brinks is the comprehensive liability coverage it provides for all stored valuables.

This offers you an added layer of security and peace of mind, knowing that your precious metals are fully insured. Furthermore, Brinks offers globally accessible inventory management via an online portal. This means you can easily track and manage your assets from anywhere in the world.

Brinks also prioritizes speed and accuracy in the delivery of precious metals to secure storage locations. Here is a breakdown of their services:

-

- Fast Delivery: Brinks ensures quick, efficient transportation of your precious metals to secure storage locations.

- Industry Standard Weighing Practices: You can trust the accuracy of the weight of your assets.

- Third-Party Assays and Inspections: Brinks allows for independent verification of your precious metals, ensuring transparency and trust.

- Controlled Storage Release: Based on your instructions, Brinks will handle the preparation, acceptance, storage, and release of your precious metals.

HSBC Bank USA

Often, you might find yourself considering HSBC Bank USA as a top choice for precious metal storage due to its solid reputation and significant global footprint.

Its position as the world’s largest precious metals custodian and owner of the world’s largest commercial vault certainly makes it a formidable choice.

HSBC’s standing in the precious metals industry is marked by continuous recognition. The bank has been ranked the #1 dealer in silver and gold every year since 2003, according to surveys by Risk and Energy magazine.

This consistent performance underscores the bank’s commitment to offering superior services in precious metal storage and transactions.

An interesting aspect of HSBC Bank USA is its comprehensive global customer service, which is available 24-hours a day.

This means that regardless of your location or time zone, you’ll always have access to professional assistance.

This level of customer service, combined with HSBC’s strong presence on the world’s six leading precious metals exchanges, provides an exceptional level of convenience and accessibility.

Moreover, HSBC’s IRS approval as a precious metals depository further enhances its credibility.

This approval signifies the bank’s adherence to stringent regulations, offering you peace of mind that your precious metals are stored safely and in compliance with all necessary regulations.

JP Morgan Chase Bank NA

If you’re considering HSBC Bank USA for precious metal storage, you should also take a close look at JP Morgan Chase Bank NA, another significant player in the precious metals depository sector.

Although newer to the game, having only been approved as a depository in 2011, JP Morgan has quickly established itself as a valuable player in the industry.

-

- Experience in Precious Metals: With over 30 years of experience in the precious metals industry, JP Morgan has a profound understanding of the market. This extensive experience allows them to provide insightful, knowledgeable guidance and services to their clients.

- Risk Management Solutions: JPMorgan offers risk management solutions for its clients. This service can help you navigate the potential pitfalls and risks associated with storing and investing in precious metals.

- Global Vault Facilities: Their state-of-the-art vault facilities are located in major financial hubs, including New York, London, and Singapore. These locations offer heightened security, ensuring the safe storage of your precious metals.

- Variety of Precious Metals Managed: JP Morgan manages a range of precious metals, including Gold, Silver, Platinum, Palladium, and Rhodium. This gives you flexibility in choosing the type of metal you want to store and invest in.

While JP Morgan currently accounts for less than 10% of the COMEX, its strong capabilities and services make it a strong contender in the precious metals depository sector.

Whether you’re an experienced investor or a novice, JP Morgan Chase Bank NA is a viable option for storing and managing your precious metals.

ScotiaMocatta Depository

Next on your list of potential depositories is the ScotiaMocatta Depository, a key part of Scotiabank, which has long been known as ‘Canada’s gold bank.’

This depository, established in 1997, is a product of the acquisition of Mocatta Bullion & Base from Standard Chartered Bank by Scotia Capital Markets. Not only does ScotiaMocatta have a robust history, but it also has the distinction of being an approved COMEX depository.

ScotiaMocatta offers a wide array of precious metals-related services. You can avail yourself of their coin offerings or participate in their certificate programs.

If you’re interested in leases, consignments, or loans, they’ve got you covered. They even offer rate agreements, providing you with financial flexibility in your investments.

One of ScotiaMocatta’s standout features is its offering of 24-hour global market coverage. This means you’re not limited by time zones or business hours – you can access your investments at any time.

Additionally, they guarantee the global physical delivery of stored metals. This ensures that your assets aren’t just safely stored but are also readily accessible and movable as per your needs.

Choosing ScotiaMocatta as your depository assures you of working with a reputable institution with deep roots in the precious metals market.

With their wide range of services and round-the-clock market coverage, you can confidently secure and manage your valuable assets while ensuring compliance with IRS regulations.

In essence, you’re not only investing in precious metals, but you’re also banking on ScotiaMocatta’s long-standing expertise and reliability.

CNT Depository

Continuing your exploration of IRS-approved depositories, let’s now turn our attention to the CNT Depository.

Based in Bridgewater, Massachusetts, CNT Inc. is a COMEX-approved depository, recognized for being the largest supplier of raw gold to the U.S. government.

Over the past 35 years, the depository has generated over $8 billion in annual revenue. CNT has achieved this through its direct distribution and storage relationships with some of the world’s largest government mints.

The CNT Depository distinguishes itself in several ways:

-

- Security: The depository is a Class III facility, ensuring the highest level of security for your precious metals. This includes 1,400 square feet of segregated vault space and 75 cubic feet of private vault storage.

- Insurance: All metals stored in the CNT depository are 100% insured by Lloyd’s of London. This gives you peace of mind knowing that your assets are protected.

- Space: The facility boasts over 20,000 square feet of fully insured storage. This substantial space allows for the secure storage of a large volume of precious metals.

- Experience and Relationship: With over 35 years of experience in vaulting, CNT has established strong relationships with global government mints. This helps to ensure a reliable supply of precious metals.

Gold IRA Company Partners

As we covered in this article, gold and silver are valuable and, most of all, expensive. Finding a trusted gold IRA company that has an established relationship with the aforementioned precious metals depositories is crucial and alleviates any concerns.

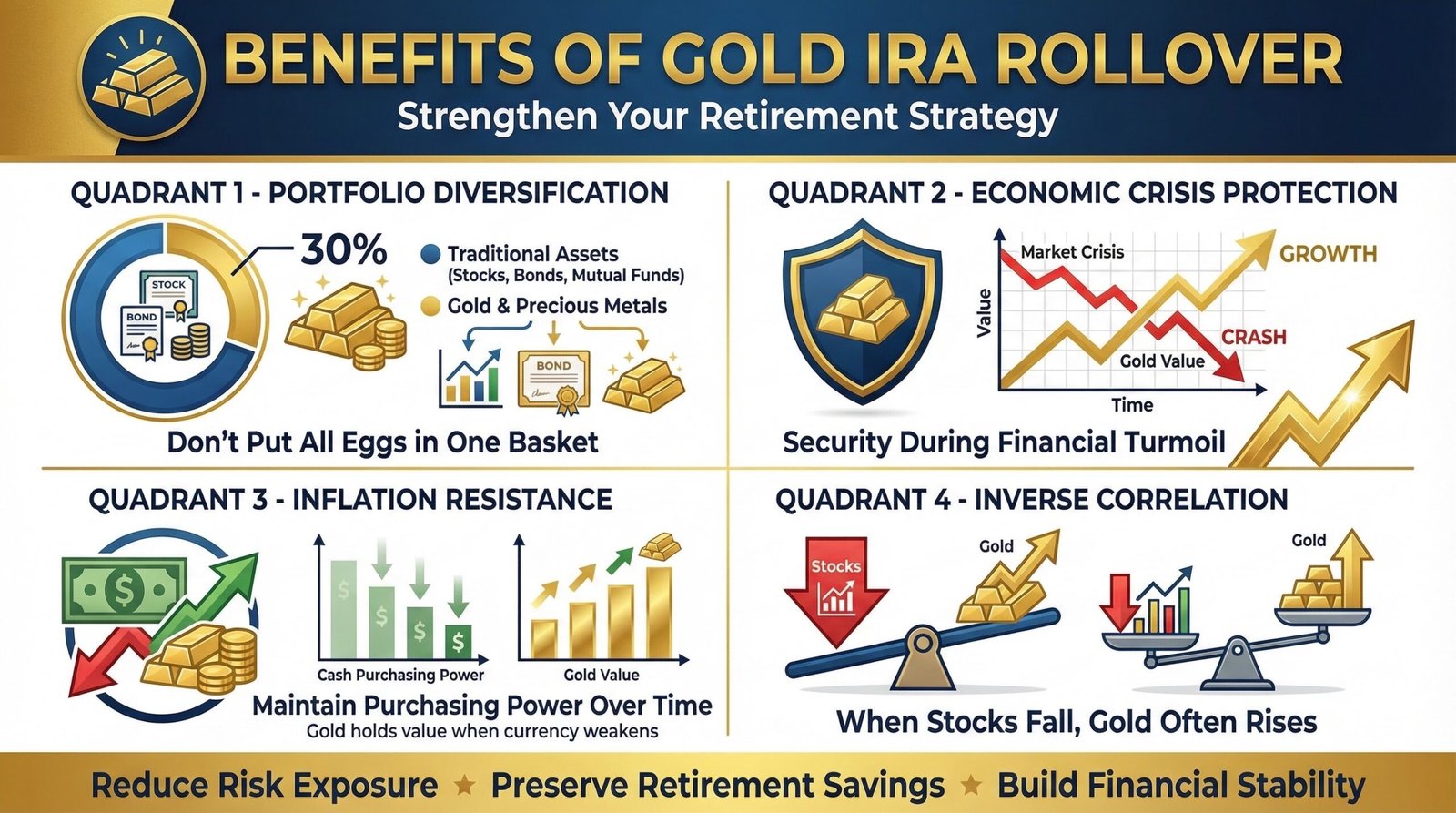

Gold IRAs provide additional advantages to merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one’s unique investing needs.

Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your place of residence is also an option.

We have provided links to these companies at the bottom of this article for your convenience.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Conclusion

So, you’re ready to dip your toes into the golden world of IRA-approved gold? Remember, it’s not just about buying any gold, but quality, .9999 fine gold bars and coins.

Be savvy, understand the nuances of Gold IRAs, and choose eligible products wisely.

With careful planning and investment, you’ll not only diversify your portfolio but also set yourself up for a more secure retirement. Now that’s a golden strategy!

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect and want to take advantage of the best prices, attend a gold educational webinar hosted by Augusta Precious Metals. Click the button below:

Find the right company for You. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com