Monetary Metals Gold Lease

Monetary Metals’ Gold Lease is an innovative gold investment product that lets you earn a real yield by leasing your gold to businesses. This strategy offers a consistent income and risk mitigation without selling your precious metals. Starting at 10 ounces of gold, you can participate in their various leases and earn income paid in ounces. To gain a better grasp of how the Monetary Metals gold lease works, we cover:

-Understanding Gold Lease Basics

-Role of Monetary Metals

-Initiating a Gold Lease

-Exploring Additional Resources

-Insights on Monetary Metals Lease Model

Monetary Metals conducts a thorough vetting of businesses, offering greater transparency for your investment. You’ll receive monthly or quarterly gold interest, adding to your earnings. Delving further reveals how this unique model could revolutionize your financial strategy.

Understanding Gold Lease Basics

Exploring the fundamentals of gold leasing, it’s important to highlight that this investment strategy enables you to earn gold by leasing it to businesses through a system designed for interest income and risk reduction. Basically, you’re not just sitting on your gold assets; you’re making them work for you.

To understand how this plays out, let’s consider the nitty-gritty of the process. In a typical gold leasing scenario, businesses buy their gold inventory and hedge the price risk.

This approach is a strategic move to avoid the risks associated with gold price volatility, which can have a notable impact on profit margins. By choosing to lease gold, these businesses are freeing themselves from the costs and risks tied to shorting futures contracts.

From your perspective as an investor, this opens up opportunities for earning interest. You can participate in specific gold leases, and in return, you receive monthly or quarterly gold interest payments.

Role of Monetary Metals

While setting up your gold lease account, Monetary Metals plays a pivotal role in bringing your investment to life, serving as the facilitator that matches you with suitable gold-using businesses.

This process is not haphazard; Monetary Metals conducts rigorous due diligence on businesses before considering them for gold leases. They work exclusively with companies that use gold productively and hold physical gold as work-in-progress or as inventory.

Monetary Metals charges a fixed fee to these businesses to lease your metal. They present potential lease terms and their due diligence results for your review, providing a transparent and efficient means of investing. This isn’t about taking wild chances; it’s about calculated decisions based on thorough research.

In a gold lease, your ounces earn interest at a fixed rate specified for each lease. Monetary Metals’ role doesn’t end after the lease initiation. They continue to oversee the lease, ensuring that businesses fulfill their obligations and that you receive your gold interest.

Putting gold into leases is a way of earning passive income, paid in ounces. Monetary Metals simplifies this experience, providing a robust and secure platform for gold leasing. The process is not only user-friendly but also profitable, thanks to their careful selection of businesses and diligent management of the lease terms.

Their proactive role offers you passive income opportunities on your metals, adding value to your precious metal holdings. Monetary Metals truly is the cornerstone of successful gold leasing.

Initiating a Gold Lease

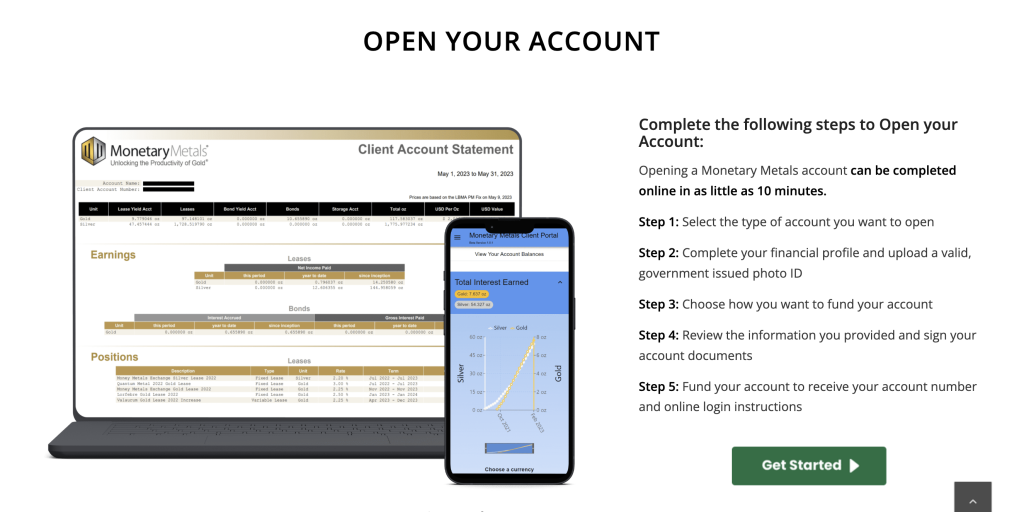

Initiating a gold lease with Monetary Metals is a straightforward process, often beginning with opening an account containing a minimum of 10 ounces of gold. This first step is crucial as it sets the foundation for your future transactions.

Once you’ve got your account set up, it’s time for the preliminary round. In this phase, you’ll be presented with a selection of businesses that are in need of gold. These businesses are thoroughly evaluated by Monetary Metals for their financial stability and reliability, so you can feel confident in your choices.

Next, you will have ounces that are in your Lease Yield account automatically allocated across their various open leases. Then, the gold lease generates monthly or quarterly gold interest for you at their specified interest rate. You are able to opt out of any lease that you would not like your metal to be allocated to.

The entire process is managed and facilitated by Monetary Metals, making it both simple and efficient. They handle heavy lifting, including conducting thorough due diligence on the businesses and managing the logistics of the gold lease.

To learn more and get started with earning interest on your gold, visit Monetary Metals’ official site by clicking the banner.

Exploring Additional Resources

To further enhance your understanding and take full advantage of the gold leasing process with Monetary Metals, a wealth of additional resources awaits your perusal. You’re encouraged to explore these resources, which include detailed information on the funded deals available on the Monetary Metals website.

Here you’ll find invaluable insights into the performance of past leases, aiding in your assessment of potential future investment opportunities.

Understanding the nuances between True Gold Leases and conventional bullion bank leases is vital. By exploring these differences, you’ll gain a deeper comprehension of how Monetary Metals’ unique model works to your advantage.

This knowledge, coupled with an up-to-date list of upcoming lease opportunities, will empower you to make informed decisions and position yourself advantageously in the gold leasing market.

Additionally, the Gold Yield Marketplace™ is an essential resource for you to explore. It offers a transparent platform where gold lease options are openly available, giving you the power to choose the leases that best fit your financial goals.

It’s a dynamic environment where you can engage with offers in real-time, ensuring you’re always at the forefront of the latest opportunities.

Insights on Monetary Metals Lease Model

Diving into the Monetary Metals lease model reveals a disruptive approach that enables you to lease your gold to businesses, and in return, you earn passive income paid in ounces. This innovative model lets you benefit from your gold holdings, rather than bear the costs of storage.

Delving deeper into the model, let’s break down its unique aspects:

-

- Gold Leasing: You lease your gold to businesses requiring it for their operations. It’s not just about storage; you’re actively using your gold to generate income.

- Earn a Return.: You earn a fixed return on your leased gold. This return is paid in ounces, adding to your existing gold reserves.

- Risk Mitigation: Monetary Metals conducts rigorous due diligence before matching investors with businesses. This means that you’re leasing your gold to credible businesses, reducing risk.

- Ease of Process: With a minimum of 10 ounces of gold, you can open an account and start your gold lease journey. Monetary Metals’ Relationship Managers are there to guide you every step of the way.

In essence, the Monetary Metals lease model creates a win-win situation, benefiting both gold owners and businesses.

You’re not just holding gold; you’re growing it. With this model, you have the opportunity to contribute to the gold industry while also expanding your wealth. It’s a golden opportunity indeed.

Click the button below to visit Monetary Metals official site and get started on your gold investing journey, as well as earn a competitive interest rate on your gold.

Conclusion

Monetary Metals’ Gold Lease program offers a unique strategy to maximize your gold assets. You’re not just safeguarding your investment against market volatility, but also earning steady returns.

You’re in control, determining your allocations and watching your gold work for you. This isn’t just a new way to invest in gold; it’s a game-changer. Explore the world of gold leasing and make your gold truly productive.

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com