Silver Price Predictions for Next 5 Years – Silver Price Forecast

Silver has long been a metal of intrigue, valued for its beauty, industrial applications, and as a hedge against economic uncertainty. As we look ahead to the next five years, understanding the potential trajectory of silver prices can offer valuable insights for investors and enthusiasts alike.

Expert silver price predictions for the next 5 years extend into the $70 range with a series of corrections occurring along the way. As of January 2026, silver is trading at approximately $90 per ounce, marking a significant rise from previous years.

Various factors, including increased industrial demand and economic policies, have influenced this upward trend. Notably, silver has outperformed gold in recent months, highlighting its growing appeal among investors.

Factors Influencing Silver Prices

Several key elements are poised to impact silver prices in the coming years:

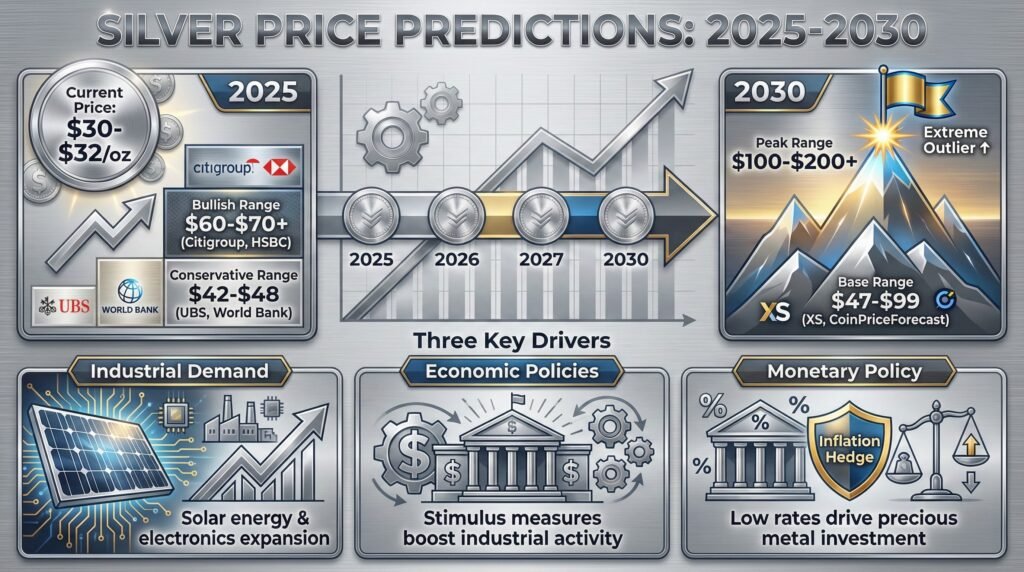

- Industrial Demand: Silver’s unique properties make it essential in various industries, particularly in electronics and renewable energy sectors. The expansion of solar energy projects, especially in countries like China, has significantly boosted silver demand. With governments pushing for clean energy transitions, silver’s role in photovoltaic cells continues to expand, reinforcing its position as a high-demand commodity.

- Economic Policies and Stimulus Measures: Government initiatives, such as China’s substantial stimulus efforts, have bolstered industrial activities, indirectly supporting silver prices. These measures can lead to increased manufacturing and infrastructure development, both of which utilize silver extensively. Additionally, financial policies in the United States and Europe focusing on economic recovery after the recent downturn have increased investments in industrial and technological sectors that use silver.

- Monetary Policies and Inflation: Central banks’ monetary policies, including interest rate adjustments, influence precious metals’ attractiveness as investment assets. Periods of low interest rates and higher inflation often drive investors toward silver as a store of value. Inflationary pressures due to increased government spending, supply chain disruptions, and energy price fluctuations make silver an appealing hedge against devaluation.

Silver Price Predictions for the Next Five Years

Forecasting commodity prices involves analyzing current trends, economic indicators, and expert insights. Here’s a year-by-year breakdown of projected silver prices up to 2030:

- Presently, 2026: Although the present silver price in the range of $80 – 90 per ounce. However, predictions suggest a potential rise to approximately $42-$48 (UBS, World Bank) to $60-$70+ (Citigroup, HSBC). Increased investment in renewable energy, especially in Asia and North America, is expected to drive demand.

- 2030: Some analysts see prices in the $47-$99 range (XS, CoinPriceForecast), while more aggressive views project $100-$200+, with some extreme outliers suggesting even higher figures, say Robert Kiyosaki.

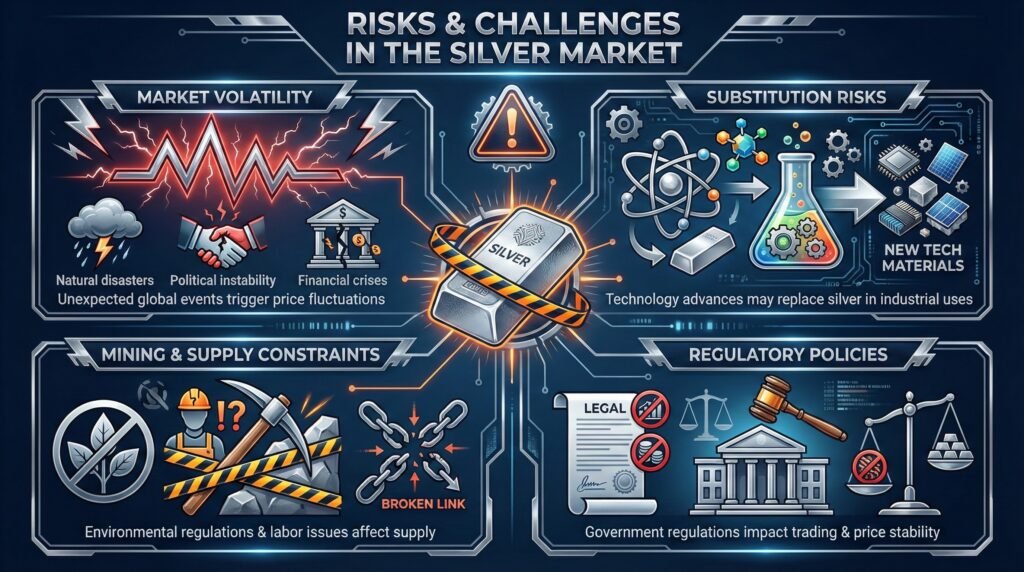

Risks and Challenges in the Silver Market

While the outlook for silver appears positive, certain risks and challenges could impact its price trajectory:

- Market Volatility: The silver market is historically volatile, and unexpected global events, such as political instability, natural disasters, or financial crises, can lead to price fluctuations.

- Substitution Risks: Advances in technology may lead to the discovery of alternative materials that could replace silver in certain industrial applications, potentially reducing demand.

- Mining and Supply Constraints: Although silver is abundant, mining challenges such as stricter environmental regulations and labor issues may affect supply levels, creating uncertainty in pricing.

- Regulatory Policies: Government regulations on commodities trading and industrial use of silver may affect price stability and investor sentiment.

Best Silver and Gold IRA for Low Minimum Investment.

Click the Banner Below to Receive National Gold Group’s Free Gold IRA Guide.

Investment Opportunities in Silver

For those considering capitalizing on the anticipated rise in silver prices, several investment avenues are available:

- Physical Silver: Purchasing silver bullion, coins, or bars offers direct ownership. Investors should consider secure storage options and insurance to protect their holdings.

- Exchange-Traded Funds, ETFs: Investing in silver-focused ETFs allows exposure to silver prices without the need to handle physical metal. However, these silver investment instruments present greater counterparty risk of default.

- Mining Stocks: Investing in companies that mine silver can offer leveraged exposure to silver price movements. Companies like First Majestic Silver Corp and Pan American Silver Corp are among the key players in this sector. However, silver mining stocks are notorious for high volatility and require active management.

- Futures and Options: Investors with a high-risk tolerance may consider silver futures and options contracts. These derivative instruments allow traders to speculate on future silver prices, providing both profit opportunities and exposure to price volatility.

Tax-advantaged Silver IRAs

Silver IRA companies, more specifically, provide a tax-advantaged way of buying and owning silver without the stress of dealing with local or online vendors or the need for security and storage in your own home. These companies can provide access to competitive prices, price transparency, a reasonable buyback policy, reliable customer service, and security of your precious metals.

Finding the right silver and right gold IRA company for your individual needs is critical. For example, if you require a low investment minimum to start a silver IRA, Birch Gold Group or American Hartford Gold would be two choices to consider.

However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive silver prices as well as lifetime customer support, then Augusta Precious Metals would be a good fit.

For a highly personalized experience, National Gold Group is a family-owned gold and silver IRA company that offers a low minimum investment, no-fee buyback policy, and great educational resources for their clients.

Furthermore, Noble Gold Investments provides gold and silver IRAs as well as private investment options for home storage. See the links in the video description to find the right gold and silver IRA company that best serves your needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ free gold and silver IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Conclusion

The silver market is poised for notable growth in the next five years, driven by industrial demand, economic policies, and investment interest. Staying informed about market trends and understanding the factors influencing silver prices can help investors make strategic decisions.

Whether you’re a seasoned investor or new to the precious metals market, exploring the various avenues to participate in silver’s potential ascent could be a worthwhile consideration.

With silver’s applications expanding across industries and its role as a safe-haven asset strengthening, its future looks promising. Investors who strategically position themselves in silver markets now may reap significant benefits in the coming years.

Obtain a gold IRA guide and talk to a broker

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com