Why Buy Silver Coins

Investors should consider buying silver coins because they’re affordable and offer a great way to diversify your investment portfolio with a lower capital requirement. Silver coins outperform gold in terms of price acceleration due to their smaller market, but they also benefit from industrial demand that drives their value up. With the gold-silver ratio indicating that silver is significantly cheaper than gold, you’re positioned to make strategic investment moves.

Moreover, silver coins’ high liquidity and historical role as real money provide stability and security, acting as a hedge against economic downturns and fiat currency instability. By integrating silver coins into your investments, you’re embracing an asset known for its long-term value and wealth preservation benefits. Exploring further can unveil deeper insights into optimizing this investment option for your financial strategy.

Easy to Purchase

Buying silver coins is an accessible investment choice, as this precious metal is not only affordable but also widely available in the market. When you’re considering diversifying your investment portfolio, or simply starting in the world of precious metals, silver presents an appealing entry point.

Its affordability means that you can begin investing with a relatively low amount of capital compared to other assets, including gold. This aspect of silver investment is particularly attractive to those who are new to investing in precious metals or have limited funds to allocate towards their investment endeavors.

The ease of purchasing silver coins adds to their appeal. You’ll find that silver is readily available from a variety of sources, including online retailers, coin shops, and precious metals dealers.

This widespread availability ensures that you can shop around to find the best deals and the specific types of silver coins that meet your investment goals. Whether you’re interested in modern bullion coins, like the American Silver Eagle or the Canadian Silver Maple Leaf, or more historical pieces, the market’s diversity offers something for every type of investor.

Moreover, the liquidity of silver coins enhances their attractiveness as an investment. Because they are easily recognized and valued, selling your silver coins when the time is right can be straightforward.

This ease of purchase and subsequent liquidity provide a dual advantage, making silver coins not just an accessible investment but also a flexible one. In sum, the affordability, availability, and liquidity of silver coins make them an excellent choice for anyone looking to enter the precious metals market.

Silver Outperforms Gold

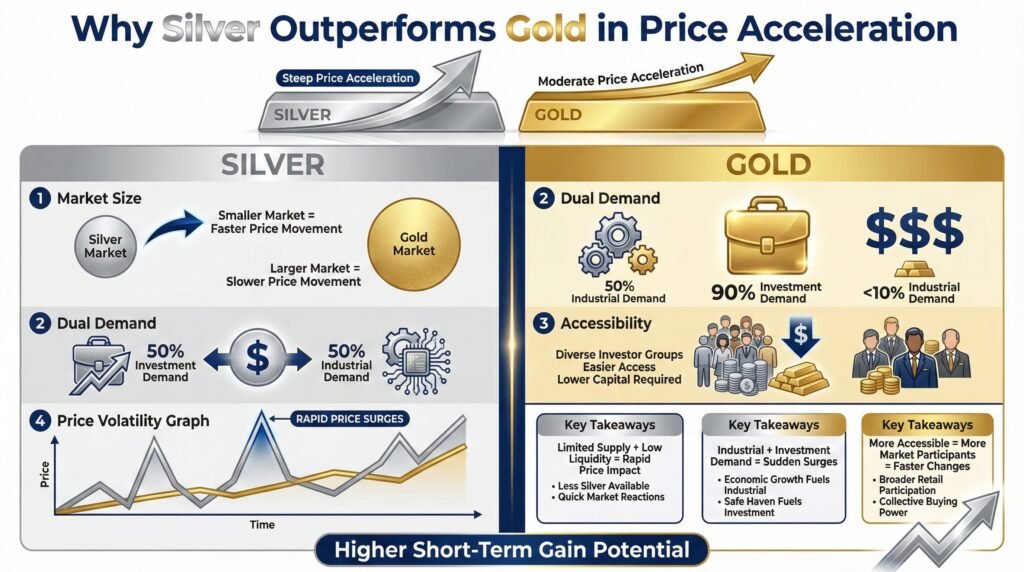

Why does silver often outperform gold in terms of price acceleration? You’re likely aware that both metals are valuable, but when it comes to rapid price increases, silver frequently takes the lead.

This phenomenon can largely be attributed to silver’s smaller market relative to gold. When investors and collectors start buying silver, its price tends to rise at a faster rate because even small increases in demand can significantly impact its market price. This is due to the relatively limited supply and lower market liquidity compared to gold.

Historically, records have shown that silver experiences more substantial jumps in pricing, especially during periods of increased demand. This is because silver, besides being an investment asset, has numerous industrial applications.

Its dual role as both an investment and an industrial commodity means that shifts in economic conditions or technological advancements can create sudden surges in demand, thereby accelerating price increases.

Moreover, the smaller initial investment required for silver compared to gold makes it accessible to a broader range of investors. This accessibility can lead to more rapid changes in silver’s market dynamics, as more participants can cause quicker shifts in demand and supply balances.

In essence, silver’s tendency to outperform gold in terms of price acceleration is a reflection of its unique market characteristics. Its smaller size, coupled with its industrial demand, makes it more susceptible to rapid price changes, providing potentially higher short-term gains for investors.

Understanding these dynamics can be crucial for anyone looking to diversify their investment portfolio with precious metals.

Gold-Silver Ratio

Understanding the gold-silver ratio offers investors crucial insight into the relative value of these two precious metals, which historically fluctuated in a way that can significantly influence investment strategies.

The ratio essentially tells you how many ounces of silver it would take to purchase one ounce of gold. This is a critical metric for those looking to diversify their investment portfolio with precious metals.

Historically, the ratio has seen dramatic shifts. For example, one could have acquired 15 ounces of silver for the price of one ounce of gold.

However, as recently as 2026, the ratio has widened significantly, reaching 50:1. This means that for the price of one ounce of gold, you can now buy 80 ounces of silver. This shift offers a unique perspective on the value and investment potential of silver. Here are three key points to consider:

-

- Flexibility in Investment: The current high ratio means that silver is significantly cheaper relative to gold. This presents an opportunity for investors to buy more silver and potentially trade it for gold as the ratio normalizes, maximizing their investment.

- Historical Variability: The fluctuation of the gold-silver ratio over time suggests that the market’s valuation of these metals is not static. This variability can be leveraged for strategic investment planning.

- Potential for Gain: When the ratio is high, as it is currently, buying silver could be particularly advantageous. If the ratio decreases, the relative value of silver increases, potentially leading to significant gains when exchanged for gold.

Analyzing the gold-silver ratio allows you to make informed decisions, potentially maximizing your returns in the precious metals market.

Easy to Invest and Gift

Silver coins offer an accessible investment option and serve as elegant gifts, reflecting both monetary value and personal thoughtfulness. As a precious metal, silver holds inherent value, making it a stable and secure choice for building or diversifying an investment portfolio.

Its relative affordability compared to other precious metals like gold allows you to start investing with a smaller budget, making it an attractive option for new investors.

When it comes to gifting, silver coins stand out for their exquisite craftsmanship and the wide variety of designs available. From commemorative issues celebrating historical events to pieces featuring artistic renditions of cultural icons, there’s a silver coin to suit any interest or occasion.

This versatility ensures that you can select a gift that not only holds monetary value but also carries a personal significance to the recipient. The act of gifting silver coins is a thoughtful way to mark milestones, express appreciation, or celebrate achievements, adding a layer of emotional value to the tangible worth of the metal.

Moreover, silver coins are easy to purchase and store. Numerous reputable dealers offer a vast selection of products, both in physical stores and online, ensuring that you can buy or gift silver coins with ease.

Their compact size also makes them convenient to store securely at home or in a safe deposit box. This blend of accessibility, aesthetic appeal, and intrinsic value positions silver coins as a standout choice for both investing and gifting, catering to a range of financial goals and personal preferences.

Silver and Gold IRAs

Silver is valuable and can be expensive through certain investment channels. Owning physical silver requires responsible sourcing of grades, purity, condition, best prices, and most of all, security and storage.

A tax-deferred means of investing through a long-established and trusted gold and silver IRA company that can provide competitive prices, price transparency, reliable customer service, and security of your precious metals takes away all of the guesswork.

Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a tax-deferred gold IRA or owning the physical gold in your place of residence, make the choice that best suits your needs.

Click the banner below to visit American Hartford Gold and receive their silver investment guide and begin your silver investing journey today.

Industrial Demand of Silver

Beyond personal investments, the industrial demand for silver significantly shapes its market value and future investment potential. You might already know that silver, like gold, is a popular investment.

However, unlike gold, silver’s demand isn’t driven solely by investors or jewelry enthusiasts. Instead, a substantial portion comes from industries that rely on silver for its unique properties.

Silver’s industrial demand stems from its excellent electrical conductivity, thermal conductivity, and reflectivity. These properties make it an irreplaceable component in various applications. Here’s how:

-

- Electronics and Electricals: Nearly every electronic device contains silver. From smartphones and tablets to desktops and laptops, silver’s excellent electrical conductivity ensures efficient operations. It’s also vital in electrical switches and circuit boards. As the world becomes increasingly digital, the demand for silver in electronics shows no signs of slowing down.

- Solar Panels: The push towards renewable energy sources has significantly increased the demand for silver. Photovoltaic cells in solar panels use silver to conduct electricity, making it an essential material in the fight against climate change. As countries aim to reduce their carbon footprint, the demand for silver in solar panels is expected to rise.

- Medicine: Silver’s antibacterial properties make it valuable in medical applications. It’s used in bandages, dressings, and as a coating on medical devices to prevent infections. As the healthcare sector continues to grow, so does the need for silver.

Understanding the industrial demand for silver clarifies its potential for excellent returns in the future. It’s not just about the current market value; it’s about anticipating where the demand will grow, influenced by technological advancements and environmental initiatives.

Best Silver and Gold IRA for Low Minimum Investment. Click the Banner Below to Get Started

Silver’s Increased Demand

The growing interest in undervalued assets has propelled many investors toward buying silver coins, significantly impacting its demand and supply dynamics. As you delve deeper into this market, you’ll understand that the allure of silver isn’t just its current price but its potential for future appreciation.

This surge in demand comes at a time when the rate of silver mining has notably decreased, creating a fascinating tension between availability and the desire for the metal.

Here are three critical aspects to consider:

-

- Finite Resources: Silver’s availability is inherently limited. The decrease in mining activities means that the silver being extracted from the earth is dwindling. This scarcity principle plays a pivotal role in driving up demand, as investors rush to secure their share before it’s too late.

- Investor Sentiment: The perception of silver as an undervalued asset contributes significantly to its increased demand. Investors are always on the lookout for opportunities to buy low and sell high. Silver coins, with their historical and intrinsic value, present such an opportunity, particularly in times of economic uncertainty.

- Supply Constraints: The lag in mining activities cannot be quickly resolved. It takes considerable time and investment to increase mining output, during which the demand for silver coins may continue to outstrip supply. This imbalance can lead to price increases, making early investments in silver coins more appealing.

Having a means of tracking the price of silver is crucial in order to track the short and long-term progress of your investment.

Calculate the current market value of your silver based on weight, purity, and live market prices. Get instant estimates for selling or buying gold jewelry, coins, or bars.

Access the silver price calculator by clicking the button below and bookmarking it for future use:

Silver Price Calculator

Easy to Sell

Silver coins are often regarded as a highly liquid investment, meaning you can typically sell them quickly and with minimal hassle. Their inherent value and widespread recognition make them a preferred choice for investors looking to maintain a fluid asset portfolio.

When you’re considering liquidating your silver coin investments, there are several factors that underscore their easy sellability.

-

- Hard Asset: Silver coins are tangible assets, unlike stocks or bonds. This physical nature adds a layer of security to your investment since it’s not just a number on a screen but an actual item you can hold. The tangible aspect of silver coins often instills more confidence in both buyers and sellers, facilitating smoother transactions.

- Widespread Availability and Recognition: Silver, being a precious metal with a long history of use in trade and investment, is universally recognized. This global recognition ensures that there’s always a market for silver coins, no matter where you are. The ease of selling silver coins is significantly enhanced by their widespread acceptance among both collectors and investors.

- Buyback Guarantees and Local Selling Options: Some platforms, like CoinBazaar, offer buyback guarantees, providing you with a straightforward option to sell back your coins. In addition, the ability to sell silver coins locally without any significant issues adds another layer of convenience. Whether it’s through a dedicated platform or a local dealer, the options for liquidating your silver coin investment are both varied and accessible.

Best Silver and Gold IRA for Prices and Customer Support. Click the Banner Below to Get Started

Silver is Real Money

Beyond its utility in liquidity, investing in silver coins offers the inherent stability of real money, maintaining value in ways fiat currencies cannot always guarantee. While you might not use silver in daily transactions, its status as “real money” is undeniable.

Unlike fiat currency, which relies on government regulation and economic policies, silver retains intrinsic value. This means that no matter the political climate or economic turmoil, silver will hold its worth.

Fiat currencies are susceptible to devaluation and can suffer from inflation, leading to a decrease in purchasing power over time. This vulnerability is tied to political decisions and economic policies that may not always prioritize the health of the currency.

In stark contrast, silver’s value isn’t dictated by such fluctuating factors. Its worth is recognized globally, transcending national borders and political systems.

Silver’s classification as real money stems from its historical use as a medium of exchange, a unit of account, and a store of value. These fundamental qualities of money are as relevant today as they were centuries ago.

Even in modern times, when silver coins are not commonly circulated for everyday purchases, they continue to serve as a hedge against the instability of fiat currencies.

Investing in silver coins, therefore, isn’t just about owning a piece of precious metal. It’s about securing a form of wealth that can withstand economic downturns and political upheavals.

It’s a tangible asset that you can hold, providing a sense of security that paper money or digital currencies can’t match. In essence, silver coins represent a timeless form of money, offering you a stable store of value for the long term.

Conclusion

In conclusion, investing in silver coins offers a versatile and practical option for diversifying your portfolio. Not only are they easy to purchase and sell, but they also outperform gold in certain market conditions, thanks to the gold-silver ratio.

Their use in industries boosts demand, making them an attractive investment. Additionally, silver coins can serve as memorable gifts and tangible assets representing real money. Whether for investment, industrial use, or personal savings, silver coins present a compelling choice for savvy investors.

If you have 100k in savings to protect and want to take advantage of the best prices, attend a gold educational webinar hosted by Augusta Precious Metals. Click the button below:

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com